Litecoin price recovery of 10% crash likely as Grayscale paves way to convert LTC trust into ETF

- Litecoin price witnessed a near 20% crash on Wednesday, bringing the altcoin below the $70 mark.

- Grayscale, long ago, noted that the company would be capable of converting its trusts into ETFs if SEC approves GBTC conversion.

- The SEC approving the Grayscale spot Bitcoin ETF would also level the playing field for spot and futures ETFs.

Litecoin could be joining the spot ETF race later, if not sooner, not because Grayscale wants to, but because it can. That has been the stance of the asset manager’s CEO, and now that it has cleared the roadblocks witnessed at the hands of the SEC during their attempt at converting the Grayscale Bitcoin Trust (GBTC) into a spot ETF, it might be possible.

Spot Litecoin ETF possible

Nearly two years ago, Grayscale Chief Executive Officer (CEO) Michael Sonnenshein stated that the approval of GBTC would one day pave the way for the firm to move to convert its trusts into exchange-traded funds eventually. The asset manager has come a long way since then, as within the next five days, the Securities and Exchange Commission (SEC) will be announcing its decision on the GBTC to spot ETF conversion filing.

The January 8-10 window will witness over a dozen similar applications being approved, delayed, or rejected, which will dictate the crypto market conditions for the next couple of weeks. This would also set a precedent for other similar products, making it far easier for Grayscale and additional fund managers to apply for spot crypto ETFs. Even before the spot BTC ETF decision was announced, some of the top asset managers in the country flocked to file for a spot in Ethereum ETF.

This makes Litecoin a much more likely asset to receive similar treatment, given it has been one of the most consistent performers. Furthermore, Grayscale Litecoin Trust (LTCN) is also an SEC reporting company, making it eligible for the same.

However, it might face some resistance in the form of demand since the performance of the altcoin has not been stellar.

Litecoin price recovery

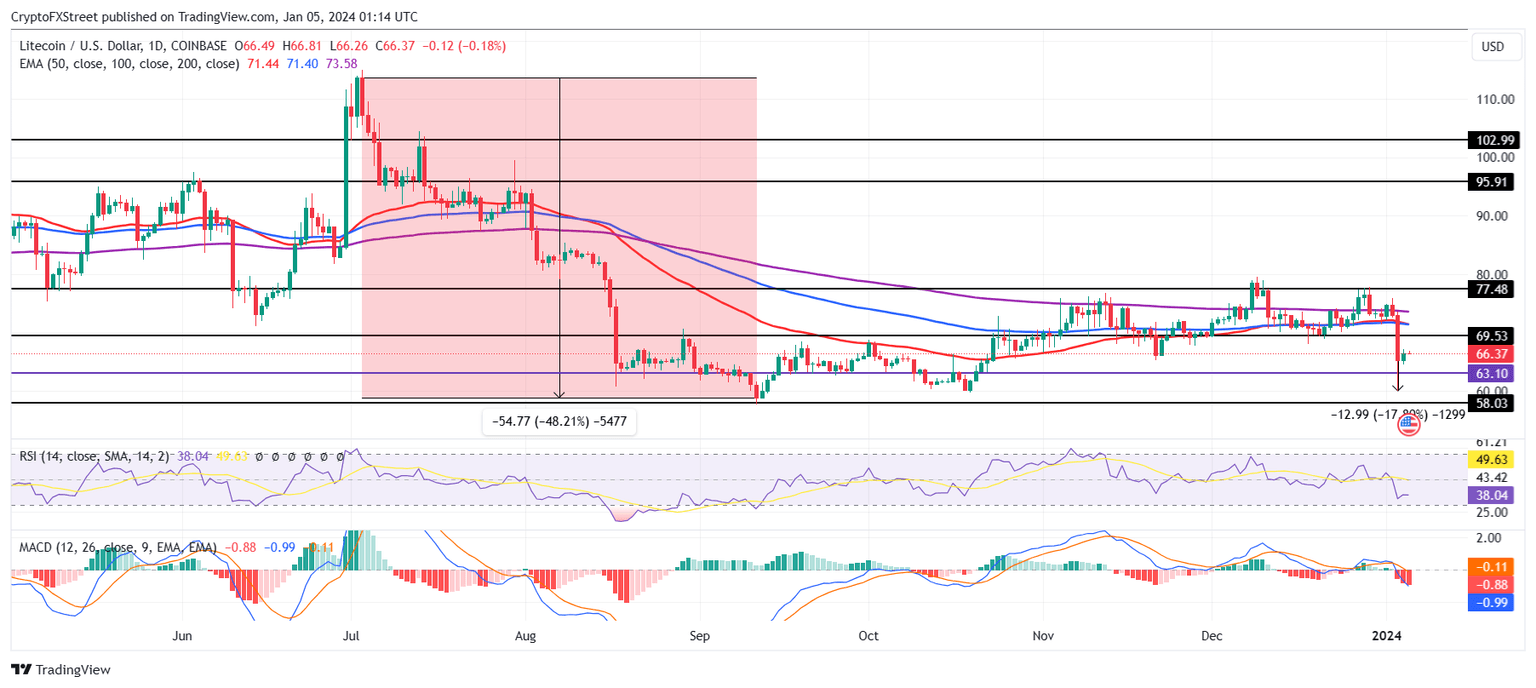

Litecoin price crashed by a little over 10% on Wednesday following the Matrixport FUD but that did nothing to the bearishness witnessed by the asset in 2023. Over the past 12 months, LTC noted no major growth even as many of the other top cryptocurrencies, including Bitcoin, shot up by more than 100%.

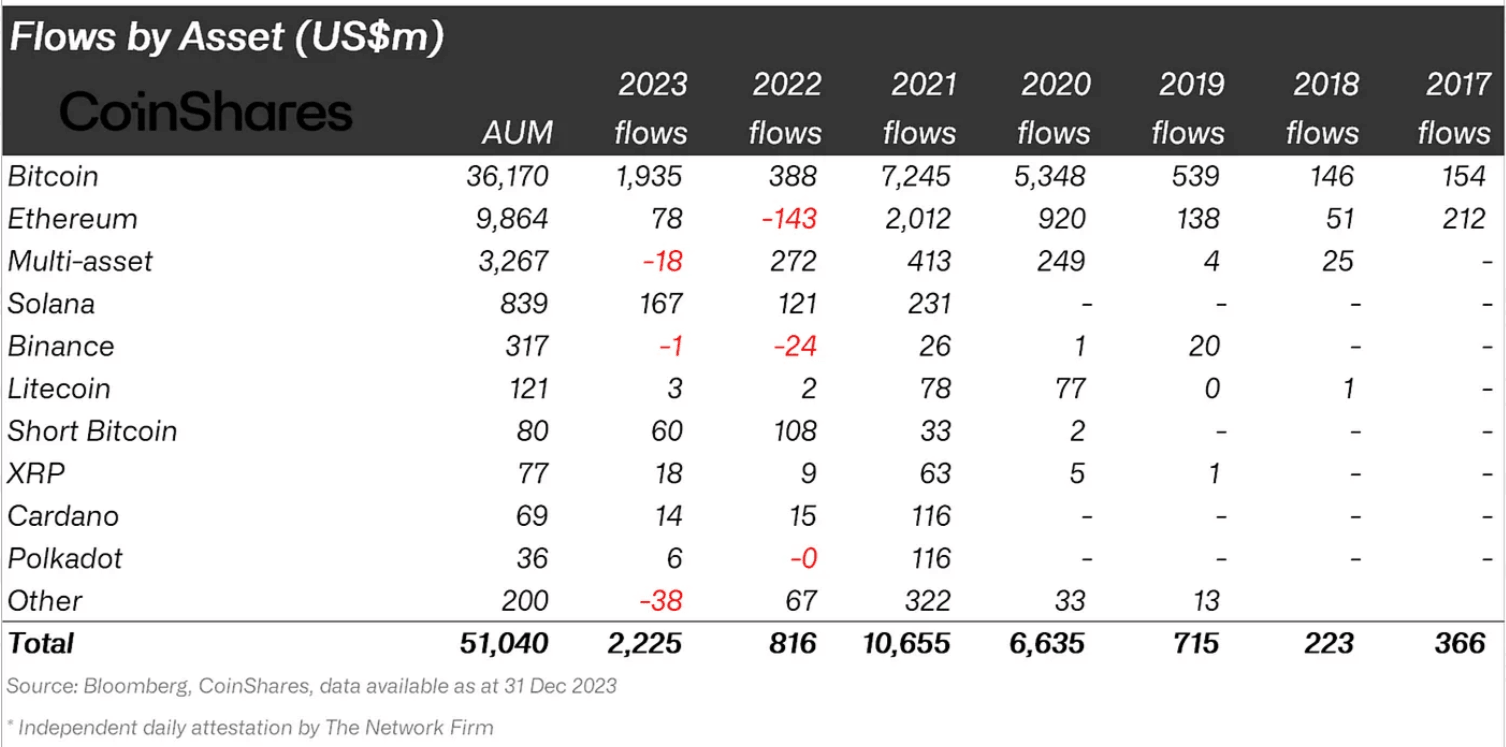

This makes LTC a difficult asset to serve to institutional investors who have shown more interest in alternative assets such as Solana, Cardano and Ripple (XRP). The yearly inflows show institutions poured in merely $3 million into LTC while SOL, ADA, and XRP received $167 million, $14 million, and $18 million, respectively.

Institutional inflows

Nevertheless, the Litecoin community is known to thrive on speculation, which would be beneficial to the altcoin in recovering its recent losses of nearly 18% from Wednesday. Litecoin price crashed by 10% to close at $66, and in order to recover, it would need to climb back to $70 and above.

LTC/USD 1-day chart

But if this speculative recovery fails, further drawdown would bring LTC below $60, invalidating the bullish thesis and sending the altcoin to $58.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.