Litecoin Price Prediction: The beginning of the end

- Litecoin price hovers above two descending channels.

- A closing candle below $50 could begin the start of a fatal drop toward $10.

- Invalidation of the bearish thesis remains a breach above.

Litecoin price continues to display bearish signals. Key levels have been identified.

Litecoin price likely to fall

Litecoin price shows concerning price action during the final trading weekend in August. Earlier this month, a midterm thesis was issued noting the strong possibility of a grand super cycle decline underway with LTC targets at $10. The technicals maintain the midterm bearish bias and could potentially induce the cataclysmic demise if market conditions persist.

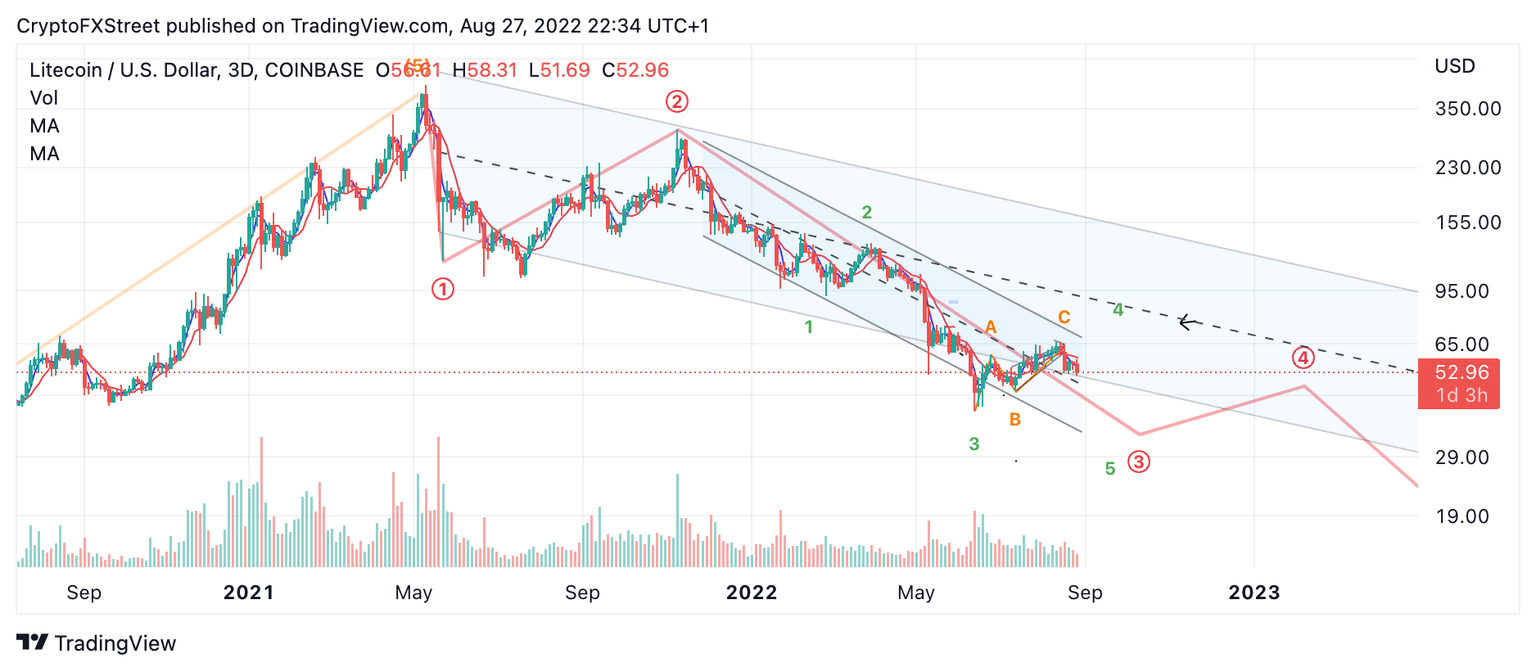

Litecoin price currently auctions at $52.75. The “silver to Bitcoin’s gold” token hovers just above two descending trend channels. The first trend is the shorter Elliot wave count, which currently provides support. The second trend is the midterm trend which has played a rejective role on the LTC price dating back to 2021 May 10, 2021, when the LTC fell from $430 in a free-fall fashion.

If the wave count and trends are marked correctly, a final close below the $50 price level could prompt high cap bears to re-enter the market confidently. A five-wave impulse could unfold in the short term targeting $32, while the midterm thesis suggests the anticipated decline of $10 would be underway. The volume profile indicator confounds this idea as bulls have yet to provide substantial buying support amidst the decline.

Invalidation of the bearish thesis remains a breach above $140. If the bulls can hurdle this price level, a market bottom could be in place.

In the following video, our analysts deep dive into the price action of Litecoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.