Litecoin Price Prediction: LTC to mark new 2023 low as whales’ inactivity hits a three-year high

- Litecoin price is close to falling below $60, leaving it only 2.4% away from establishing new year-to-date lows.

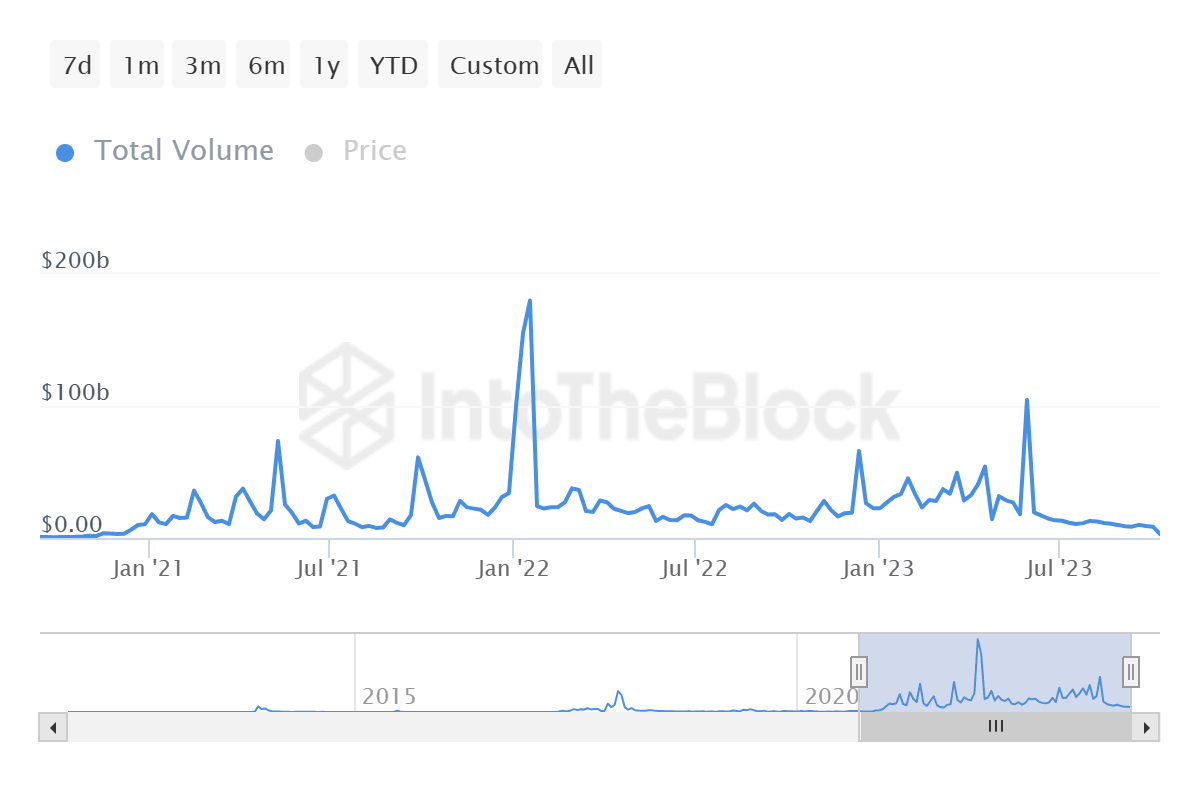

- Litecoin whale transaction volume is averaging at $3 billion on a weekly basis, the lowest since November 2020.

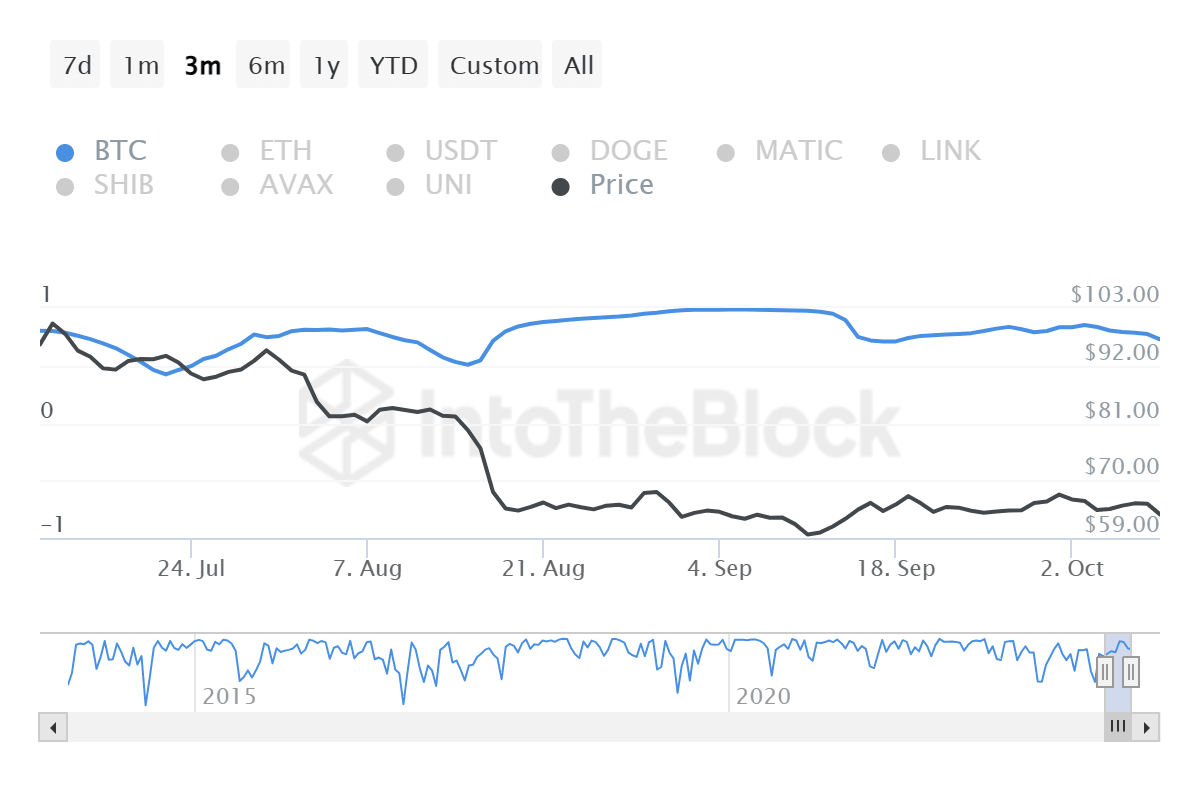

- Sharing a 0.73 correlation with Bitcoin, LTC is largely dependent on BTC to drive its recovery.

Litecoin price has been, is presently and will likely continue to follow the lead of Bitcoin. But beyond the high correlation it shares with the asset, it is also vulnerable to a decline owing to the lack of action from its whale addresses.

Litecoin price nearing new lows

Litecoin price at the time of writing is trading at $61, standing about 2.4% above the current year-to-date low of $58. The cryptocurrency is likely set to fall through this level and mark a new 2023 low, potentially testing the support line at $58.

The Relative Strength Index (RSI), which indicates the momentum building up in the case of LTC, is leaning bearish and could result in further decline, given the indicator is already below the neutral line of 50.0.

LTC/USD 1-day chart

But in the event that LTC bounces off the $58 support and climbs back to reclaim the support line of $63, it would have an opportunity to breach the 50-day Exponential Moving Average (EMA), which it failed to do at the beginning of the month.

Whale activity suggests recovery might be slow

Litecoin shares a pretty strong correlation with Bitcoin. Over the past couple of weeks, this correlation has hovered around 0.73, which makes LTC’s price action vulnerable to volatility in BTC.

Litecoin correlation with Bitcoin

However, beyond the broader market cues, the lack of recovery observed in September in the case of Litecoin price is due to the declining whale activity. Even though the whale addresses (addresses conducting transactions worth more than $100,000) only control 11% of the entire circulating supply, their buying and selling still triggers the market.

Similarly, the LTC market remains liquid when these addresses conduct transactions, and likewise, the lack of it causes distress in the price action. At the time of writing, their weekly average transaction volume has hit $3.01 billion, which is the lowest since November 2020.

Litecoin whale transaction volume

This could trigger caution among investors, reducing transactions and on-chain activity, which will make recovery slower for Litecoin price.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.