Litecoin Price Prediction: LTC targets new yearly highs at $320

- Litecoin price breakout from bull flag on the 12-hour chart

- The digital asset faces no significant resistance ahead, according to on-chain metrics.

- The cryptocurrency market turns extremely bullish again ahead of Coinbase IPO.

Litecoin (LTC) price has been trading inside a robust uptrend since March 25 and just hit a new 2020-high at $270. On-chain metrics show practically no resistance ahead as the digital asset targets $320.

Litecoin price breaks out of key pattern

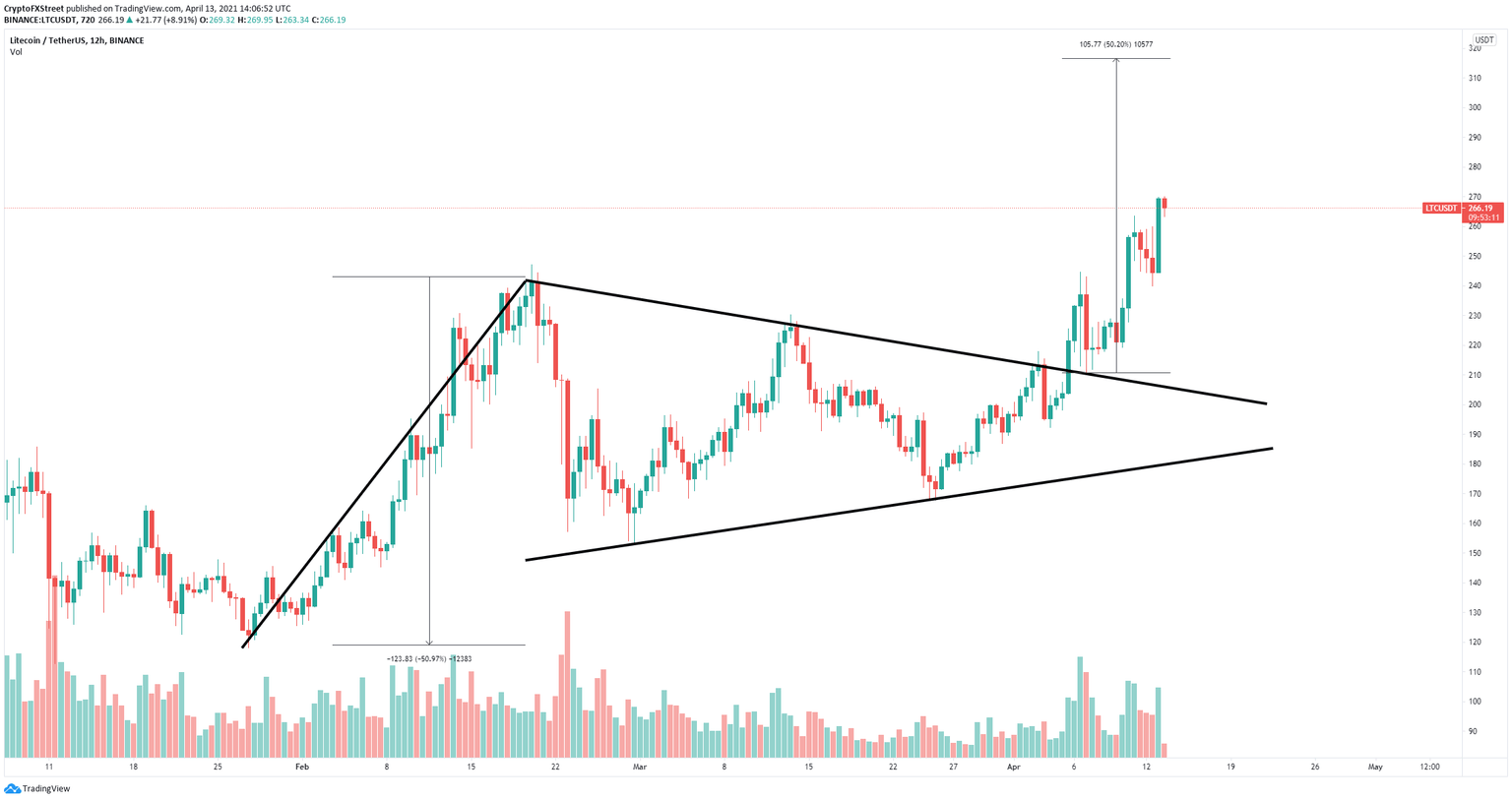

On the 12-hour chart, Litecoin broke out from a bull flag with our price target of $320. This target is calculated using the height of the pole as a reference point. On April 5, Litecoin cracked the upper resistance trendline of the flag and had a significant continuation.

LTC/USD 12-hour chart

The In/Out of the Money Around Price (IOMAP) chart shows basically no significant resistance ahead. The most important area is located between $300 and $308, where 16,700 addresses purchased over 200,000 LTC.

LTC IOMAP chart

However, there is also weak support from the current price of $268 down to $251, which means LTC could see a correction before the next leg up. In the past week, the number of whales has decreased notably.

LTC Holders Distribution

Since April 6, the number of whales holding between 100,000 and 1,000,000 LTC decreased from 118 down to 112, which means large holders are taking profits.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B16.10.38%2C%252013%2520Apr%2C%25202021%5D.png&w=1536&q=95)