- Litecoin prepares for lift-off as it slices through a critical resistance at $170.

- LTC's recent price action resembles a W-shaped recovery and is primed for a 20% surge soon.

- On-chain transactional data shows little-to-no resistance ahead.

Litecoin price has seen incredible gains of over 350% since late September 2020. With the entire market in a bull run, this rally could push LTC towards the next resistance level at $220.

Litecoin price poised to enter $300 territory

Litecoin established a strong bull trend as the price closed above the critical resistance level at $170 on February 9. At the time of writing, LTC was trading at $190, a level last seen almost 1,000 days ago.

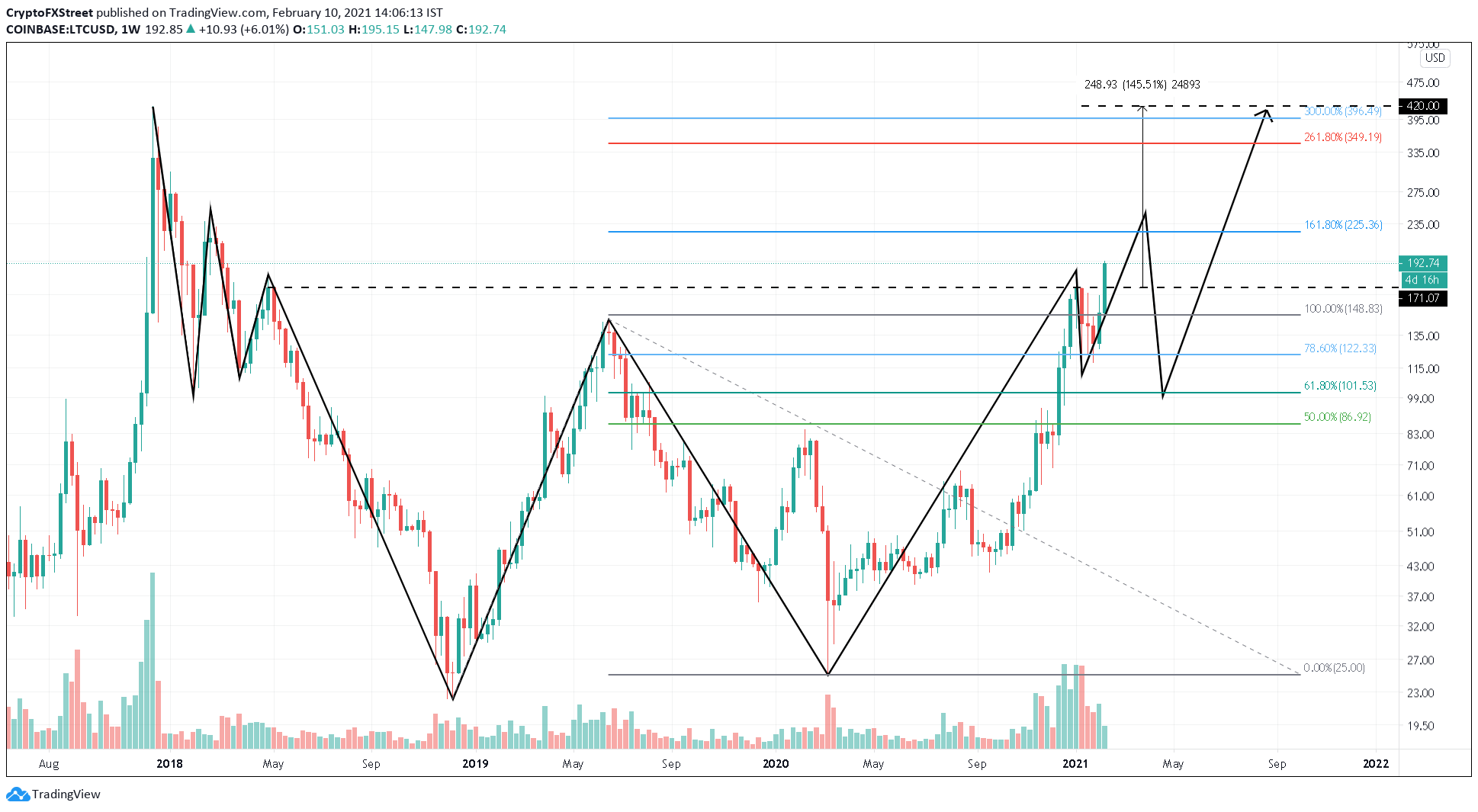

The W-shaped recovery seen on the 1-week chart shows that the next target is $225. Considering the bullish momentum in the broader market, this 20% rise should be a walk in the park for LTC.

LTC/USD 1-week chart

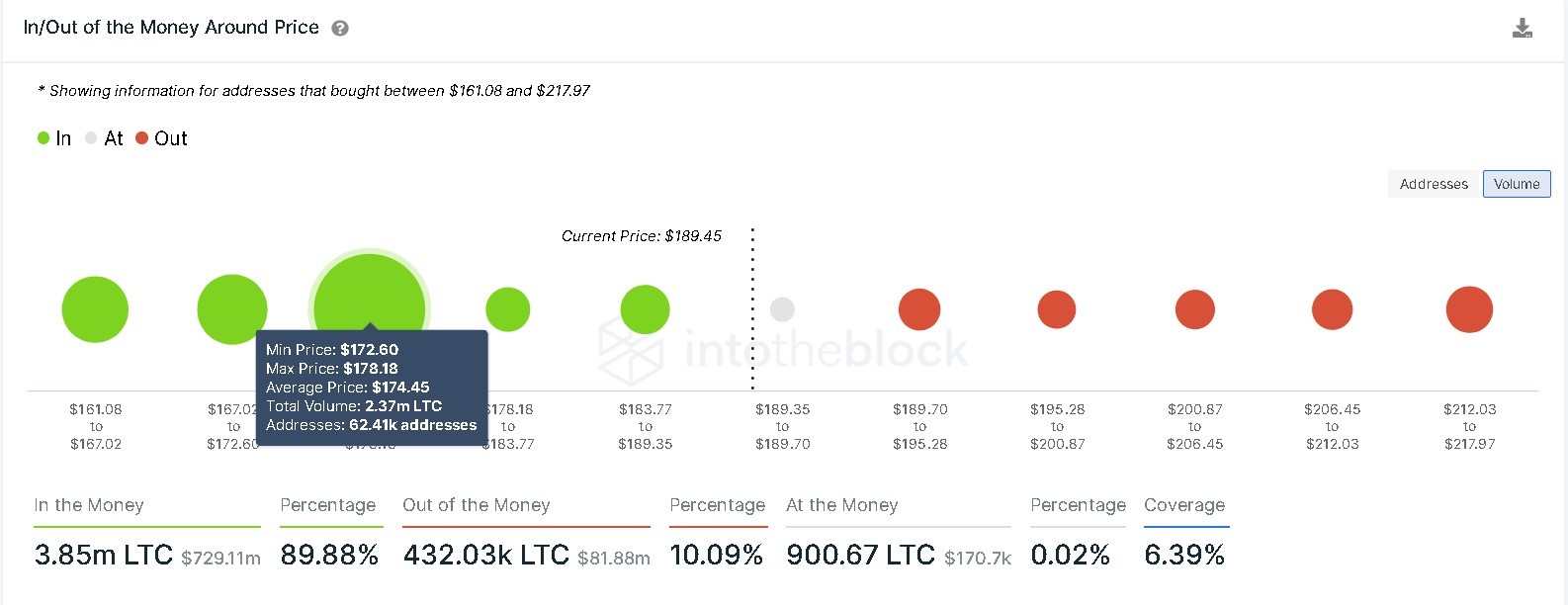

The IntoTheBlock's In/Out of the Money Around Price (IOMAP) model shows a small cluster of investors around the $190 resistance level, where roughly 91,200 addresses purchased nearly 11,000 LTC. Hence, a surge towards $220 seems attainable.

On the other hand, Litecoin sits on top of a stable support level at $175, where 62,400 addresses purchased 2.37 million LTC. Hence, any downward price action will be supported by these investors who may buy more LTC to prevent seeing their investments go underwater.

Litecoin IOMAP chart

However, an unforeseen event causing investors to panic sell could generate enough selling pressure to breach the $175 support level. Under such circumstances, Litecoin could pull back to the demand barrier at $150.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Axiom’s volume surpasses $100M as meme trading platform war escalates on Solana

Axiom meme coin trading volume hit $101 million for the first time, surpassing other platforms on Solana. Axiom accounts for 30% of the ecosystem’s trading users, followed by Photon and Bullx at 24% each.

Bitcoin aiming for $95,000 as Global M2 money supply surges

Bitcoin (BTC) price edges higher and trades slightly above $85,500 at the time of writing on Tuesday after recovering nearly 7% the previous week. The rising Global M2 money supply could be a favorable signal for both Gold and Bitcoin.

Top 3 gainers Brett, Story and Virtuals Protocol sparkle as Bitcoin eyes $90,000

Cryptocurrencies have sustained a buoyant outlook since last week as US President Donald Trump’s tariff war was paused for 90 days, except for China, propping global markets for lifeline relief rallies.

Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.