Litecoin Price Prediction: LTC looks to dip below $60 as technicals turn bearish – Confluence Detector

- The parabolic SAR in the 12-hour chart has flipped from bullish to bearish.

- The whales are looking to sell their holdings.

Litecoin bounced up from $53 on November 4 to $64.25 on November 7. However, the price has since been on a downtrend and looks to be on course for charting a series of lower highs and lows. Let’s look do some technical and on-chain analysis to predict LTC’s future price movement.

Technicals turn bearish

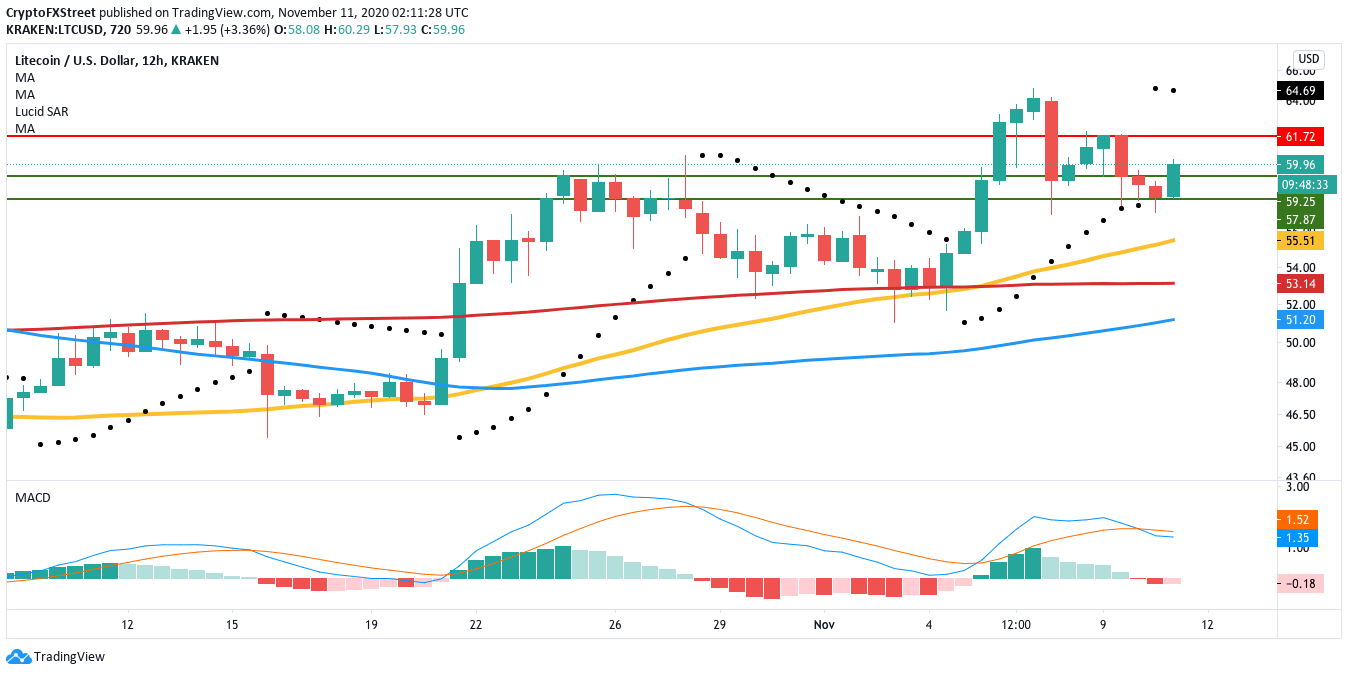

Litecoin dropped from $64.25 on November 7 to $58 on November 10. This fall prompted the parabolic SAR to flip from bullish to bearish. While the latest candlestick has jumped to $59.65, the overall market momentum remains bearish, as indicated by the MACD.

LTC/USD 12-hour chart

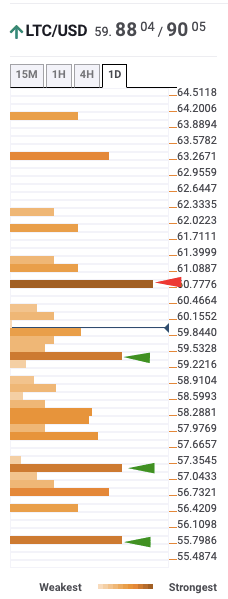

The upside is capped off at the $61 resistance barrier, which is a solid level, as seen in the daily confluence detector. The support walls protect the downside at $59.25, $57.85 and the 50-bar SMA ($55.50). A break below these walls will take the price down to the 200-bar SMA ($53.15) and 100-bar SMA ($51.20). These levels look strong enough to absorb any residual selling pressure.

LTC confluence detector

Santiment’s holders distribution helps us see how the whales have been behaving. The number of tokens holding 1,000 to 10,000 tokens dipped from 3,750 on October 5 to 3,649 at the time of writing. Similarly, the number of addresses holding 10,000 to 100,000 tokens dropped from 408 to 405 in the last 24 hours.

LTC holders distribution

Litecoin is presently going through major price action. The support walls protect the downside at $59.25, $57.85 and the 50-bar SMA ($55.50). These walls should be strong enough to absorb a tremendous amount of selling pressure.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

%20%5B07.42.21%2C%2011%20Nov%2C%202020%5D-637406640385589492.png&w=1536&q=95)