- Litecoin price shows a massive spike in buying pressure, pushing it closer to pre-crash levels.

- The supply barrier extending from $296.75 to $317.09 is the only hurdle preventing LTC’s 65% upswing to $439.41.

- A breakdown of the demand zone’s upper trend line at $217.97 will invalidate the bullish outlook.

Litecoin price shows a resurgence of buyers, which has pushed it past some resistance levels. A continuation of this bullish momentum could see LTC retest a critical barrier.

Litecoin price primed for upswing

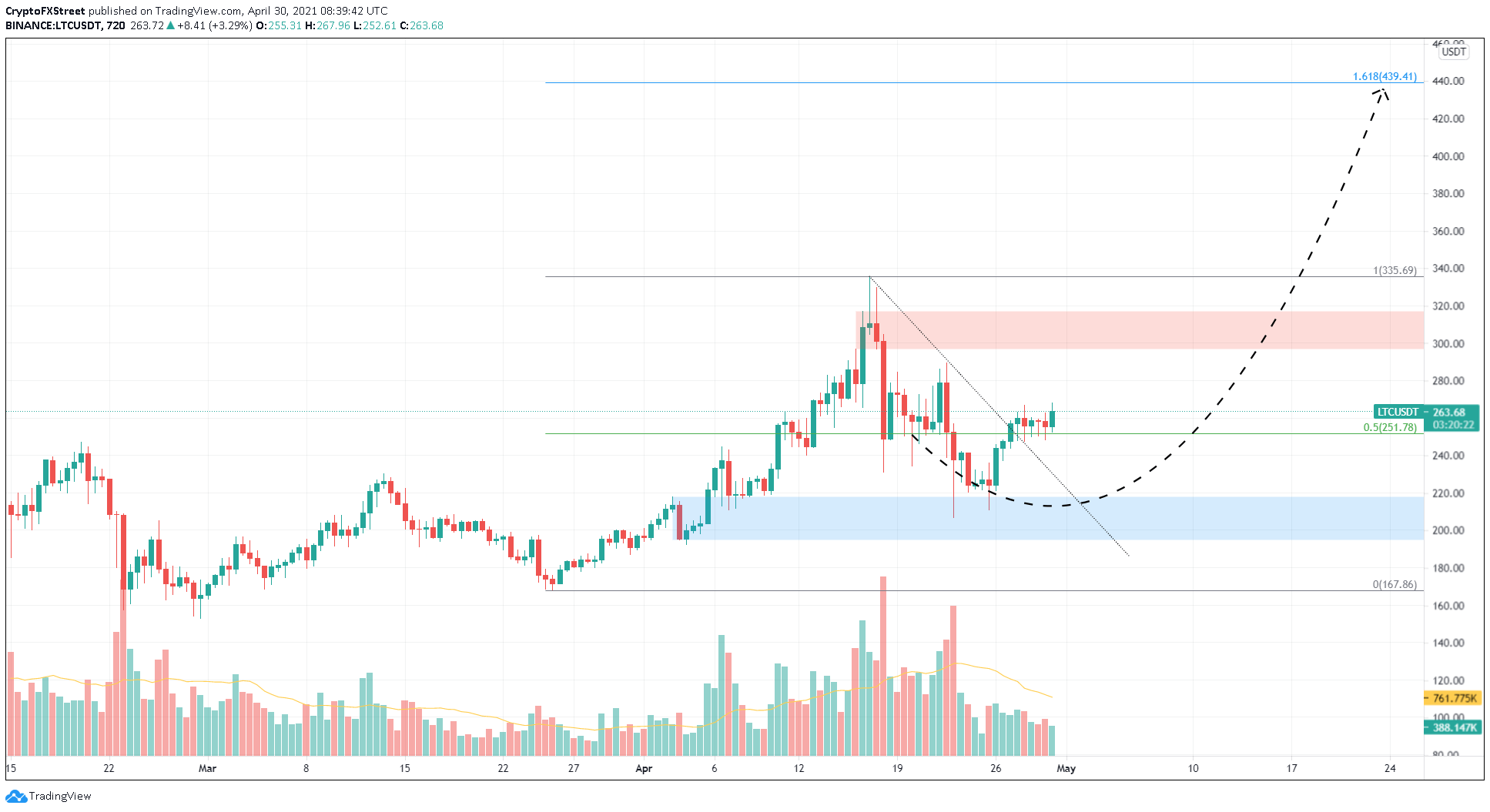

On the 12-hour chart, Litecoin price has sliced through a sloping resistance level indicating the start of a new uptrend. If the buyers continue to maintain their momentum, LTC could surge 12% to retest the immediate supply zone that stretches from $297.06 to $317.09.

A potential spike in bullish pressure that slices through the upper layer of this resistance area will trigger a retest of the local top at $335.69 and a potential swing to the 161.8% Fibonacci retracement level at $439.41.

LTC/USDT 12-hour chart

Regardless of the bullish momentum, if Litecoin price slices through the 50% Fibonacci retracement level at $251.78, it would question the upswing narrative mentioned above.

Sustained trading below this area could lead to bullish exhaustion pushing LTC to the demand zone’s upper boundary at $217.97

If the sellers manage to pierce this barrier, it will invalidate the optimistic scenario and invoke sideways movement or correction.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

President Trump's memecoin leads crypto unlock with incoming supply pressure of over $320 million

Official Trump, launched by President Trump, will unlock over $320 million worth of its tokens to team members next week despite the dominant risk-off sentiment across the crypto market.

Bitcoin and crypto market sees recovery as Fed official says agency ready to stabilize market if necessary

Bitcoin rallied 5% on Friday, trading just below $84,000 following Susan Collins, head of the Boston Federal Reserve, hinting that the agency could stabilize markets with "various tools" if needed.

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin holding steady at $82,584, Ethereum at $1,569, and Ripple maintaining its position above $2.00.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Crypto traders are digesting US President Donald Trump’s Liberation Day announcements last week, the tariff truce declared on Wednesday and the worsening situation with China, as the industry wraps one of its worst weeks in terms of price swings.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.