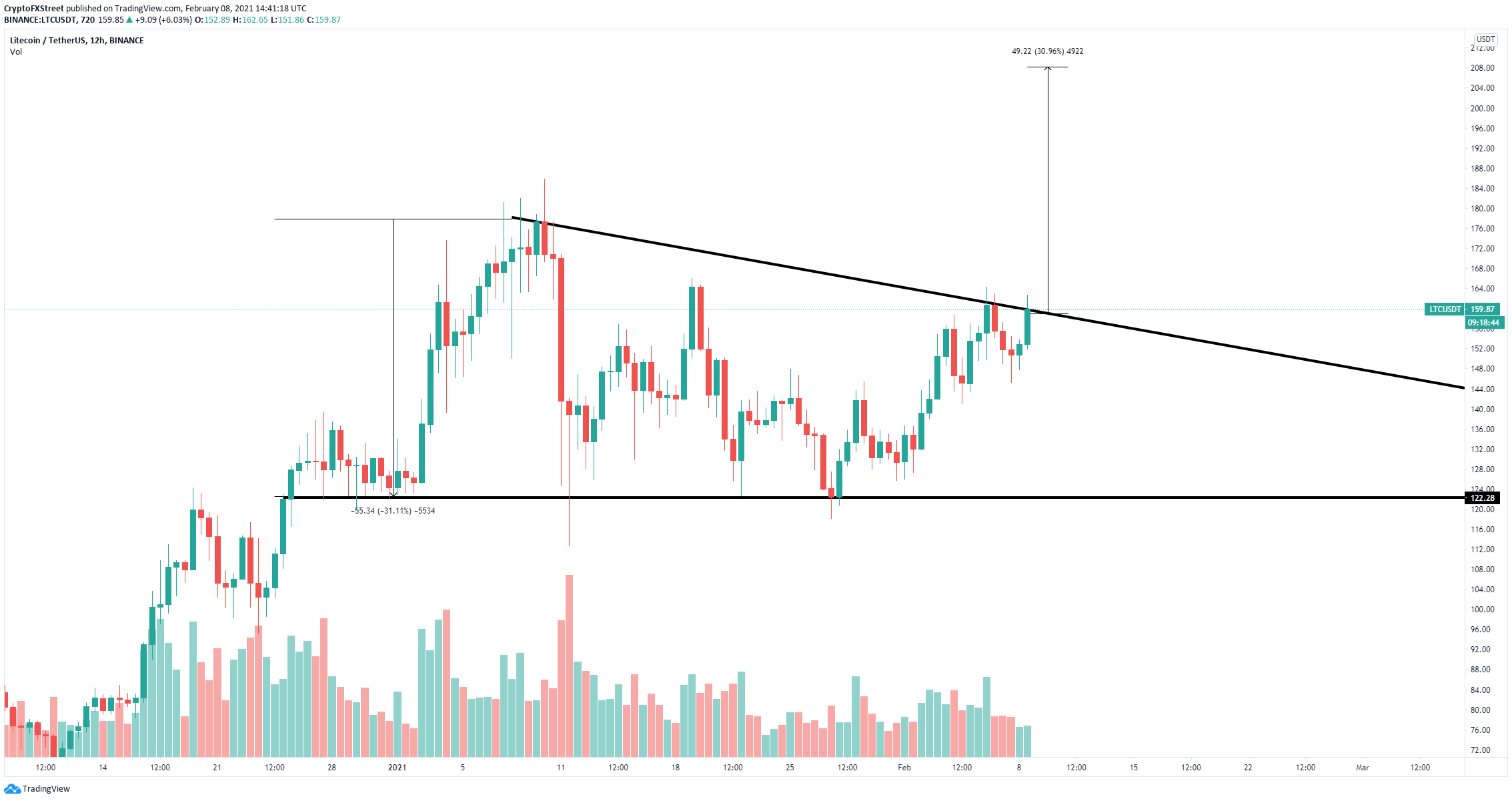

- Litecoin price is trading inside a descending triangle pattern on the 12-hour chart.

- Climbing above $160 decisively can quickly drive LTC towards $200.

- LTC faces really weak resistance on the way up as bulls hold the momentum.

Litecoin price had a significant 7% surge in the past several hours thanks to Bitcoin’s new all-time high at $45,000 after Tesla announced the purchase of $1.5 billion worth of Bitcoin and potentially other digital assets in the future.

Litecoin price can jump to $200 if this level drops

On the 12-hour chart, Litecoin has established a descending triangle pattern with a resistance level located at $160. Breaking above this point will drive Litecoin price above $200 to a price target of around $208.

LTC/USD 12-hour chart

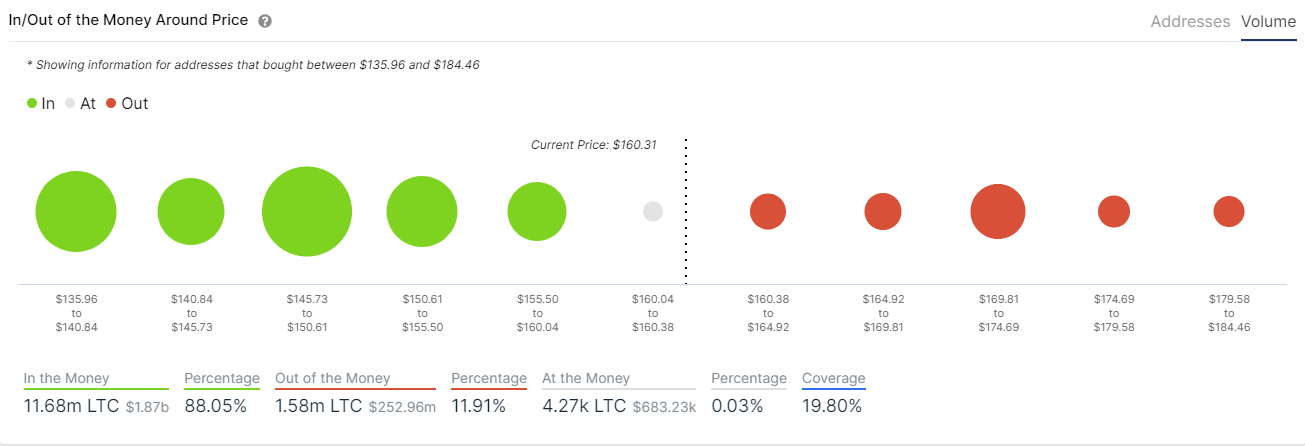

The In/Out of the Money Around Price (IOMAP) chart shows that bulls have far better odds than bears as the resistance above is extremely weak while there is a lot of support on the way down.

LTC IOMAP chart

The IOMAP model indicates that the strongest resistance area is located between $170 and $174 which means that LTC should spike to $200 if this range is broken.

LTC Holders Distribution chart

Unfortunately, it seems that the number of whales holding between 100,000 and 1,000,000 LTC ($16,000,000 and $160,000,000) has significantly declined in the past week from a peak of 116 on January 31 to 111 currently which indicates large holders have been selling and taking profits.

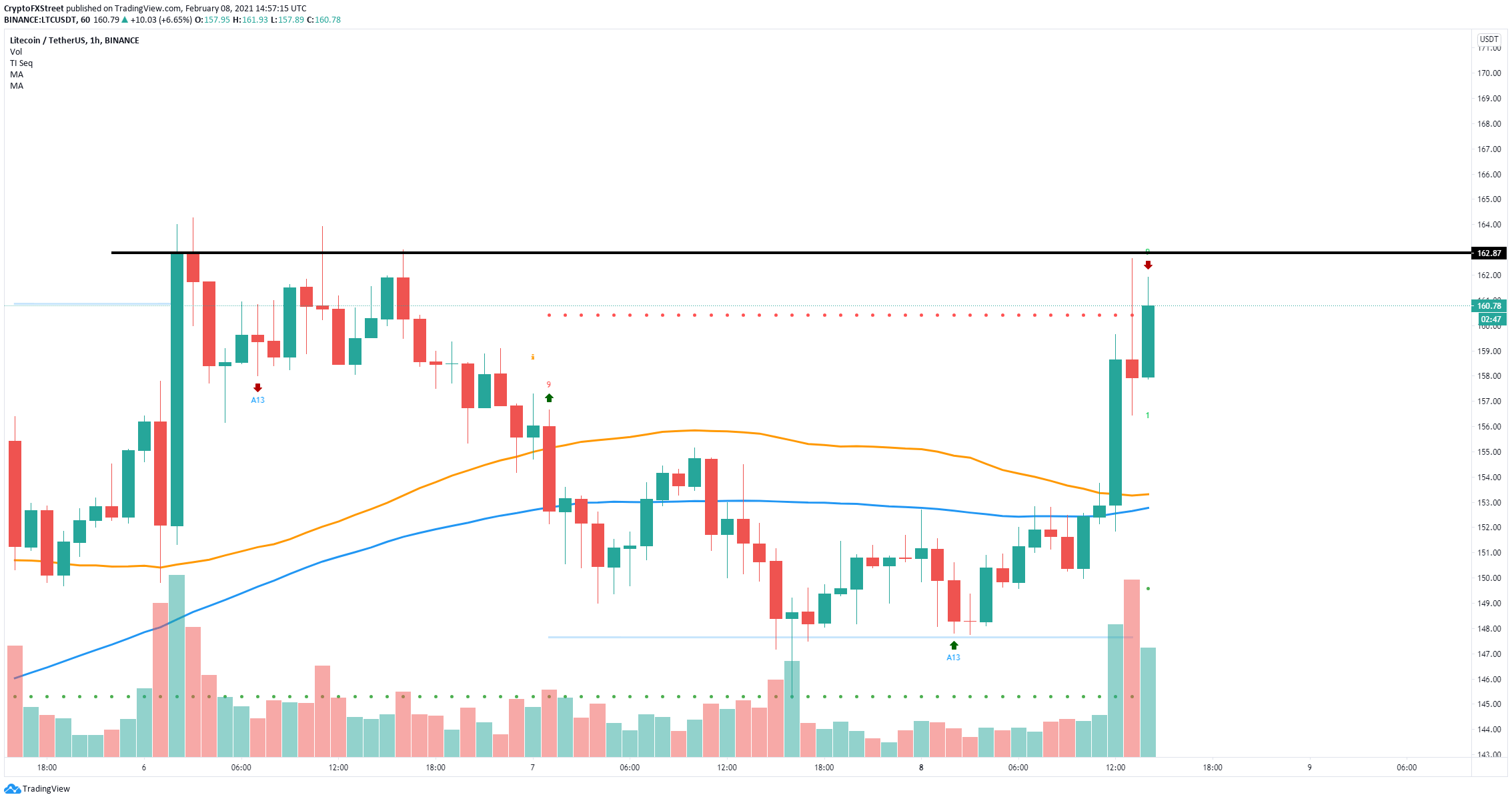

LTC/USD 1-hour chart

On the 1-hour chart, the TD Sequential indicator has presented a sell signal right at the top of another significant resistance level at $163. Validation of this call could push Litecoin price down towards $153 where both the 50-SMA and the 100-SMA converge.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[15.58.44,%2008%20Feb,%202021]-637483931306044982.png)