Litecoin Price Prediction: LTC bulls target $190 next

- Litecoin price is faced with tough headwinds as the bulls hope to conquer $190.

- The 200 four-hour SMA has acted as stiff resistance for LTC since mid-September.

- Only a break above $174.50 would see Litecoin price tag the upper boundary of the governing technical pattern.

Litecoin price has one last obstacle in its path before it can aim higher at $190. The strength of the resistance ahead may hinder a potential LTC rally if the altcoin fails to slice above a key technical indicator.

Litecoin price at pivotal point

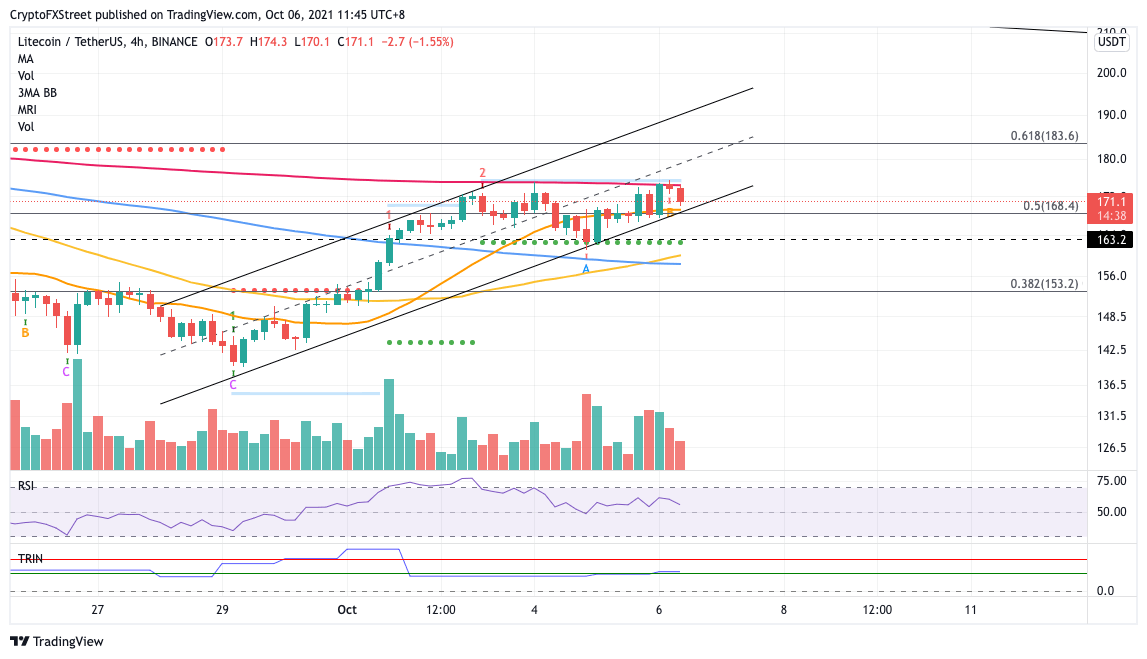

Litecoin price is swaying within an ascending parallel channel on the 4-hour chart as it continues to trend higher. LTC is now faced with the one last, tough hurdle that has restricted the altcoin from further growth since September 19.

If the governing technical pattern is robust, Litecoin price would aim to tag the upper boundary of the parallel channel at $190. However, it has a sturdy roadblock to tackle before the bullish target can be realized.

The 200 four-hour Simple Moving Average (SMA) is acting as stiff resistance for Litecoin price at $174.50, coinciding with the breakout line given by the Momentum Reversal Indicator (MRI). Only if the bulls are able to break above this level would LTC rally toward the topside trend line of the prevailing chart pattern.

Following the aforementioned resistance level, Litecoin price could face further headwinds at the 61.8% Fibonacci retracement level at $183.60.

The Arms Index (TRIN) indicator, which gauges overall market sentiment, suggests that there are more buyers in the market than sellers. However, buying pressure must also increase in order for the bulls to reach the optimistic target.

LTC/USDT 4-hour chart

On the flip side, should the bears take charge, Litecoin price would discover immediate support at the 20 four-hour SMA, which corresponds to the lower boundary of the parallel channel as well as the 50% Fibonacci retracement level at $168.40. This area should act as a strong foothold for LTC unless further selling pressure emerges.

If a spike in sell orders unfolds, Litecoin price may fall further toward $163.20, where the support line given by the MRI sits. If LTC continues to suffer from the strength of the bears, the altcoin could drop toward the 50 and 100 four-hour SMAs at $160.30 and $158.30, respectively.

Additional support will emerge at the 38.2% Fibonacci retracement level at $153.20 if the market continues to weaken.

Like this article? Help us with some feedback by answering this survey:

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.