Litecoin Price Prediction: LTC bears eye 20% decline amid mounting pressure

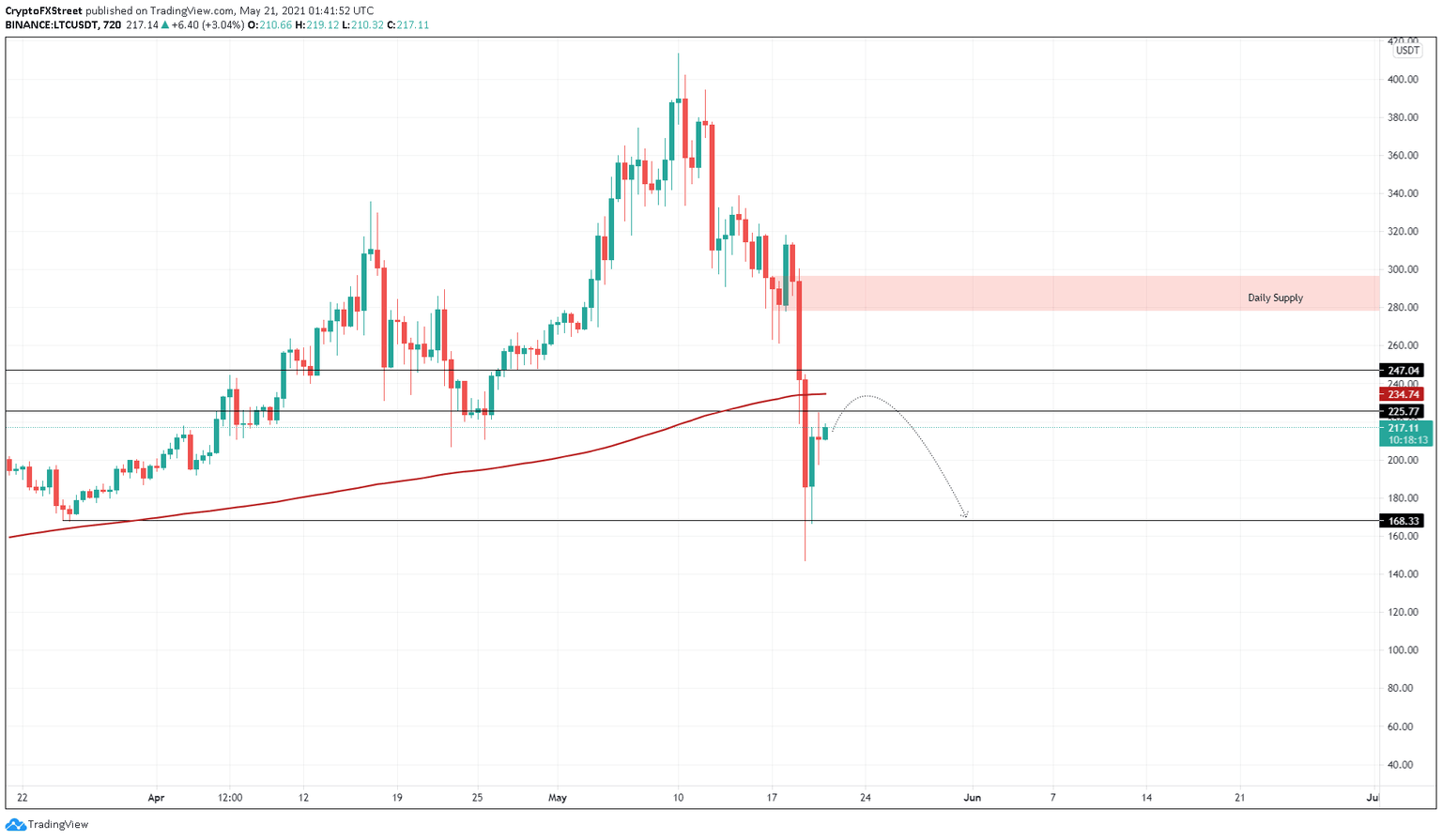

- Litecoin price is heading toward two critical resistance levels, $225.17 and the 200 twelve-hour SMA at $234.74.

- Rejection at any of these barriers will lead to a downtrend that could extend up to 25%.

- A decisive close above $247.04 will invalidate the bearish thesis and kick-start an upswing.

Litecoin price has seen a sharp recovery after Wednesday’s massive sell-off. However, this uptrend will face significant overhead barriers that could prevent it from climbing higher.

Litecoin price slows down its ascent

Litecoin price has surged roughly 45% from its swing low created on May 19 at $147. However, this stellar recovery will face multiple resistance barriers that will prevent its move higher or slow down the pace of its upswing.

The immediate supply level at $225.77 will be crucial, and the first ceiling where LTC is likely to reverse. A few ticks above $225.77 is the 200 twelve-hour SMA at $234.74, the second significant area of interest where the buying pressure is likely to dampen or extinguish.

Investors can expect a reversal at these levels that could push Litecoin price down by 17% to the first support barrier at $185.22.

While the level mentioned above isn’t significant, LTC will mostly find a firm foothold around $168.33, a swing low created on March 25 before the altcoin began its bull rally.

LTC/USDT 12-hour chart

While this bearish scenario seems plausible, it is based on the assumption that Litecoin price will face heavy selling pressure around $225.77 or $234.74. Therefore, if the buyers push past these levels and produce a decisive 12-hour candlestick close above $247.04, it will invalidate the bearish thesis detailed above.

Under these circumstances, market participants could expect LTC to rally 12% to tag the lower boundary of the supply zone stretching from $278.32 to $296.34.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.