Litecoin Price Prediction: LTC at risk of significant downfall as whales go into selling frenzy

- The number of LTC whales has sharply dropped in the last two weeks.

- The digital asset is barely holding itself above a crucial support level.

- Litecoin seems to favor a bearish move down to $220.

Litecoin price is facing significant selling pressure as large holders are selling their positions. This could quickly drive LTC down to new lows if a crucial support level fails to hold.

Litecoin price might not be able to hold critical support point

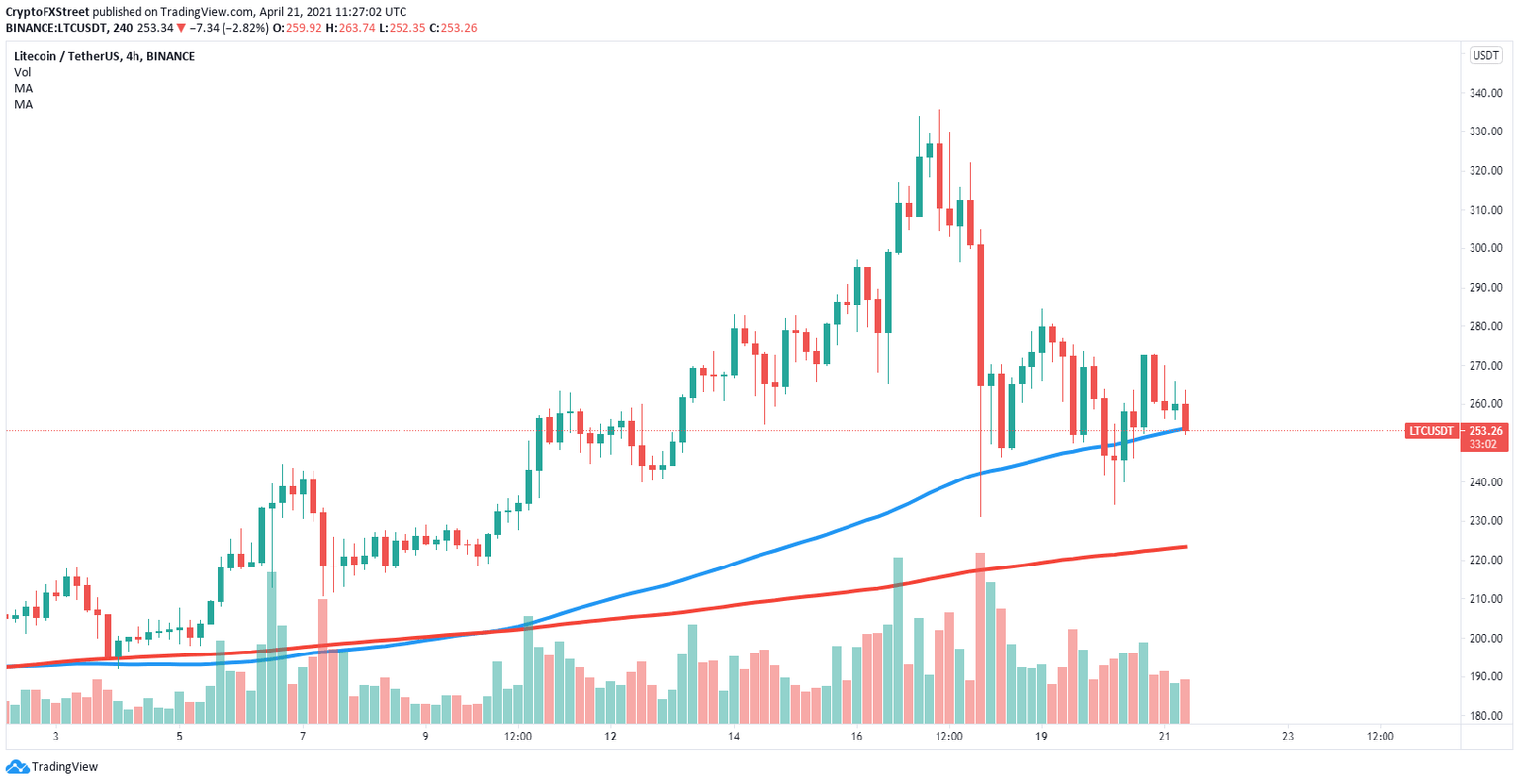

On the 4-hour chart, Litecoin price is trading above the 100 SMA by just a few cents. A 4-hour candlestick close below this support level will most likely drive Litecoin down to the 200 SMA at $220.

LTC/USD 4-hour chart

This seems like the most likely scenario because the number of whales holding between 100,000 and 1,000,000 coins has sharply dropped from 118 on April 6 to 108 currently, which indicates they have been selling and adding even more selling pressure to the digital asset.

LTC Supply Distribution

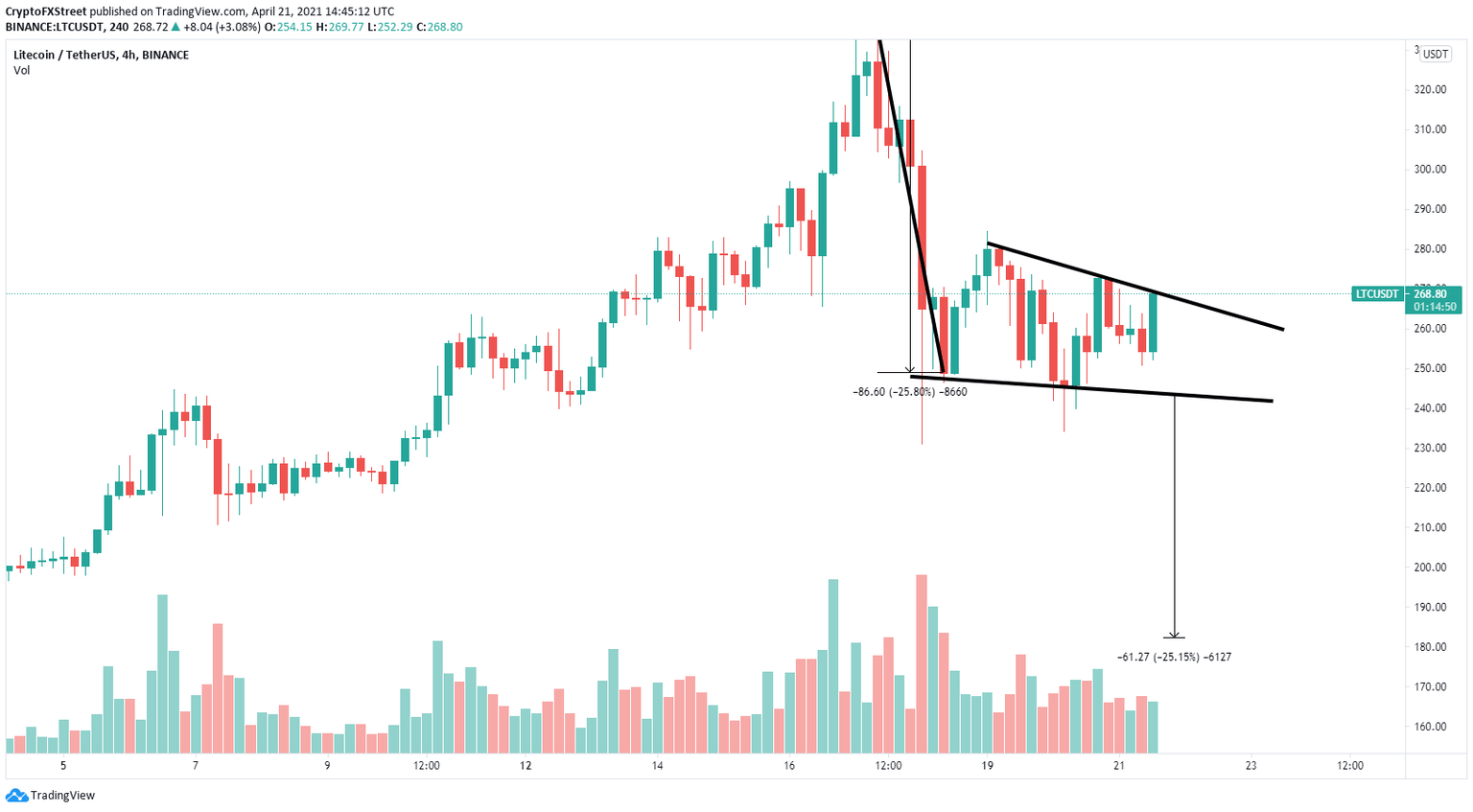

Additionally, on the 4-hour chart, there is also a bearish flag forming which also adds pressure to the digital asset and has a breakdown price target at $180.

LTC/USD 4-hour chart

However, the number of active addresses in the past 24 hours also hit its highest point since January 2018, indicating that investors are heavily interested in the digital asset and want to buy at current prices.

LTC Network Growth

If LTC bulls can hold the 100 SMA support on the 4-hour chart, Litecoin price could see a rebound toward $270 and $285, two previous highs in the last three days.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.30.23%2C%252021%2520Apr%2C%25202021%5D-637546132881737216.png&w=1536&q=95)

%2520%5B15.31.41%2C%252021%2520Apr%2C%25202021%5D-637546133013742478.png&w=1536&q=95)