Litecoin Price Prediction: Bullish cues underpin rally towards $130

- Litecoin prices have risen 100% since November 10.

- LTC shows potential for a 30% rally toward $130.

- Invalidation of the uptrend could occur from a breach of the $90 swing low.

Litecoin price continues to display bullish price action going into the first week of February. If market conditions persist, the bulls may be able to induce an additional 30% rally.

Litecoin price is ready to rise

Litecoin price is currently trading in the $100 region amid its uptrend stance. Since the November 9 liquidation, which briefly brought LTC into sub-$50 price levels, the bulls have recovered 100% of the lost funds.

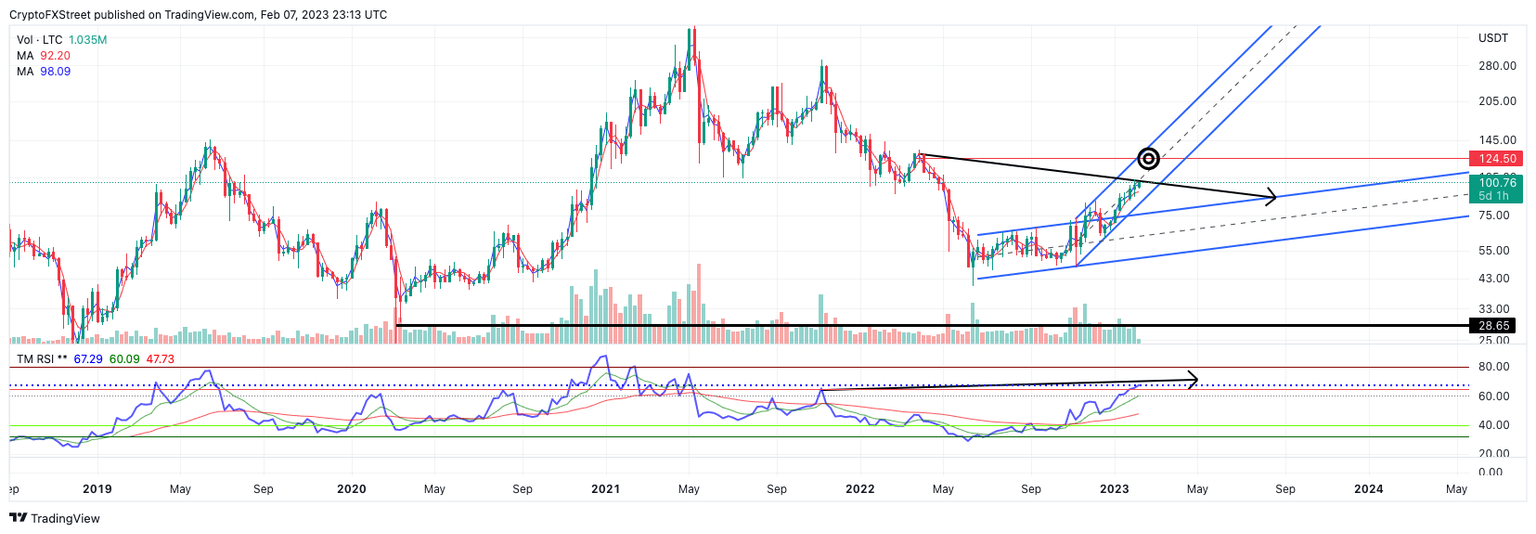

Litecoin price currently auctions at $101. The Relative Strength Index (an indicator used to gauge momentum) on the weekly time frame shows a peculiar situation as LTC price rallies towards overbought conditions. There is a bearish divergence between the current price and the previous swing point in May of 2022 when Litecoin price traded at $128.70.

This price zone creates a significant amount of confluence. The bulls will either challenge the $130 price zone, or the bears using the swing point as a safety stop will enjoy a fruitful return if the uptrend fails. However, as the uptrend angle looks entirely upright, it would be ill-advised to place a short until more congestion signs are displayed. The earliest evidence of a change in trend would be a breach below the $90 swing low.

LTC/USDT 1-Week Chart

Thus, this thesis maintains a bullish outlook, with Litecoin targeting the $130 price level in the coming weeks. If the $90 swing low is breached at any time, the uptrend potential will become void. The bears would likely induce a decline targeting a previously breached ascending trend line position at $78. Litecoin's price would decline by 22% under the bearish scenario.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.