Litecoin Price Prediction: A redemptive rise to $120

- Litecoin price has breached a descending trend line with impulsive-looking price action.

- The 200-week moving average is currently priced at $100.

- Invalidation of the bullish thesis is a breach below $51.

Litecoin price is showing bullish short-term technicals. Key levels have been identified.

Litecoin price on its way back to $120

Litecoin price could be setting up for a powerful move in the coming weeks. Since August's final days, LTC has presented two alternative scenarios with entirely different outcomes. A bullish vs. bearish scenario was issued last week, which identified the ideal market behavior Litecoin price would need to display to be bullish in the short term.

On Tuesday, September 13, the bullish scenario was validated as the LTC price successfully breached a descending trend line. An impulsive-looking rally has accompanied the trend line breach since the early September liquidation. If the technicals are correct, Litecoin price could unfold a much larger countertrend rally.

LTC USDT

The 200-week moving average is currently positioned at $100 and could be an area of interest for high-cap traders to aim. The key level has not yet witnessed a retracement since losing the support of the Litecoin price in May 2022. Furthermore, Fibonacci Retracement levels of the entire decline from the all-time highs to the current lows also show strong FIB clusters between the $100-$120 area.

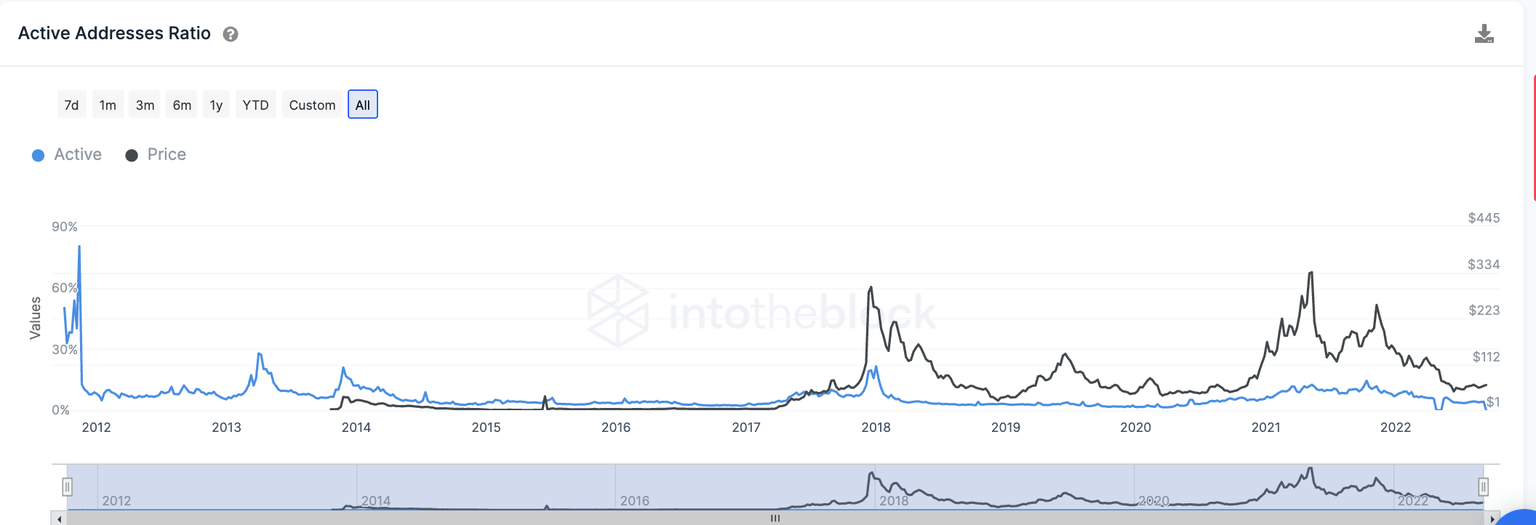

Lastly, the IntoTheBlocks' Daily Active Addresses Ratio Indicator shows a reading near the 2017 lows prior to Litecoin infamous 10X rally. In theory, the indicator hints that Litecoin investors are holding their positions, uninterested in selling at current market value.

When combined, Litecoin price may take sleeping bulls by surprise. Invalidation of the bullish thesis is a break below the August 27 swing low at $51. If the bears breach this level, the LTC price could fall to $30, resulting in a 55% decrease from the current Litecoin price.

In the following video, our analysts deep dive into the price action of Litecoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.