Litecoin price must hold critical support to avoid crash to $100

- Litecoin price action is precarious as it flirts with final support zones that would threaten a deep sell-off.

- $180 represents the most vital area of support for Litecoin, which it must hold.

- Recent whipsaws in Litecoin’s movement make upside potential difficult.

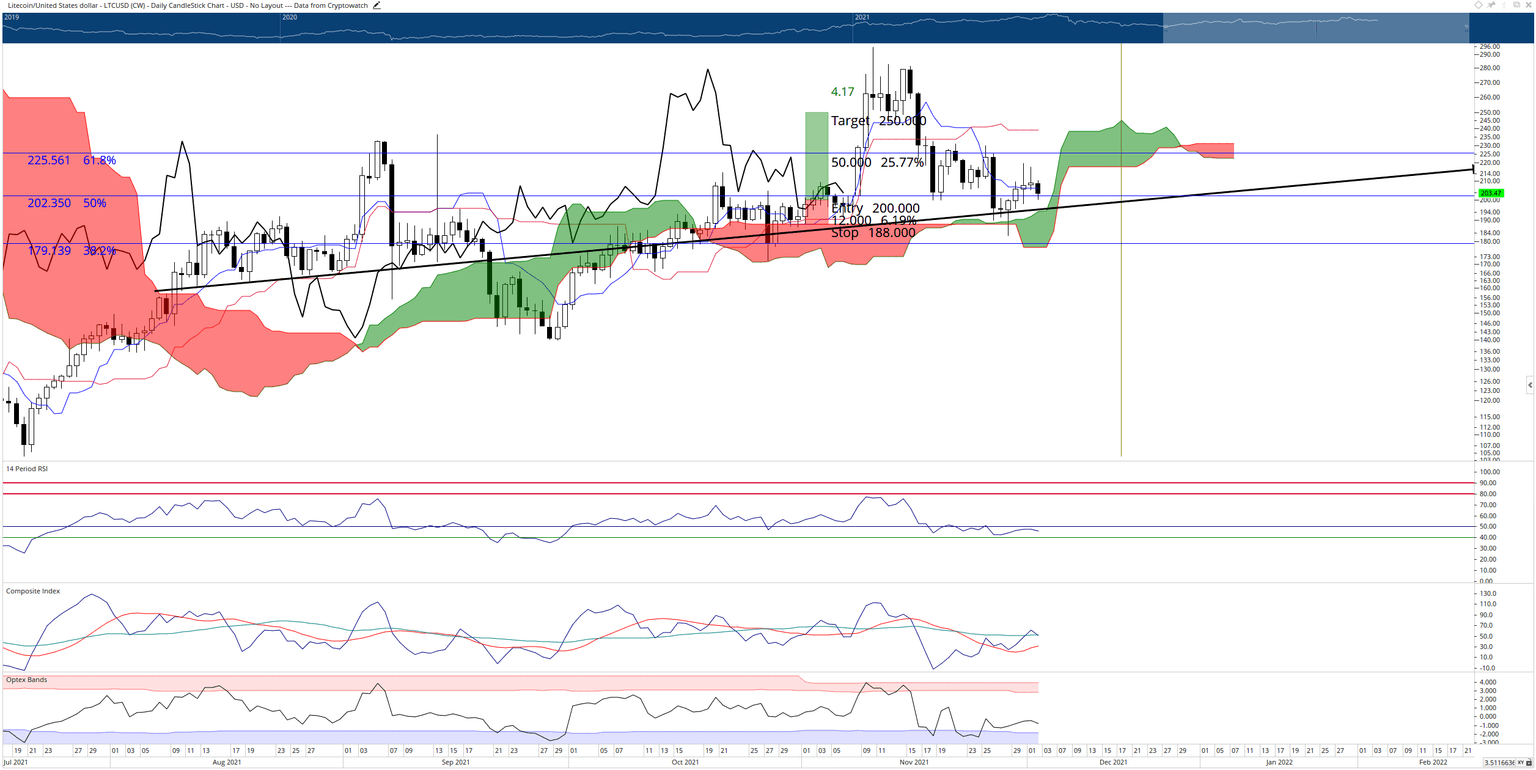

Litecoin price shows significant weakness on its daily chart, with the current support at $200 showing signs of failure.

Litecoin price could retest its final and most substantial level of support at $180

Litecoin price is currently trading against some strong support at the $200 level, though the support is unlikely to hold and more downside is expected. $200 is not just an important and natural psychological number, but it is also the 50% Fibonacci retracement. The daily Tenkan-Sen (blue moving average) is just above the $200 level at $205.

While those levels all indicate a collection of strong near-term support, the position of the Chikou Span and the Cloud warn that $200 may not hold. The Cloud up ahead shifts, abruptly, much higher over the next two trade days.

Additionally, by Sunday (December 5th), if Litecoin is still trading in the same value area, the Chikou Span will slide below the candlesticks, and Litecoin price will shift below the Cloud. Consolidation: here is not a supportive condition but rather a bearish warning sign.

$180 is the strongest and final support zone for Litecoin price. The 38.2% Fibonacci retracement and 2021 Volume Point Of Control all reside within the $180 level. Failure to hold $180 could trigger a move to retest the June 2021 lows at the $100 value area.

LTC/USD Daily Ichimoku Chart

Litecoin price must close above the daily Kijun-Sen and Cloud at the $240 value area to invalidate any near-term bearish expectations. Traders should look for any major bullish spike that would result from the daily candlesticks respecting Senkou Span A (top of the Cloud) as support. Sharp and fast moves higher on Saturday and Sunday would be expected in that event.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.