Litecoin price might pullback to $94 before shooting higher, analyst says

- Litecoin price broke out of the continuation pattern earlier last month on the back of a 55% rally.

- A correction and retest of the upper limit of the wedge at $94 would provide a base for a bounce – and break above resistance at $122.

- LTC holders have been pulling back despite the price rise, with active addresses declining by 70% as they await the impact of the halving in August.

Litecoin price recorded significant gains in the second half of June, but more recently, the altcoin has been correcting. While LTC holders and investors might be looking at this negatively, the bigger picture makes it apparent that not only is the decline in price good for the altcoin but also necessary for further gains.

Litecoin price dip is healthy

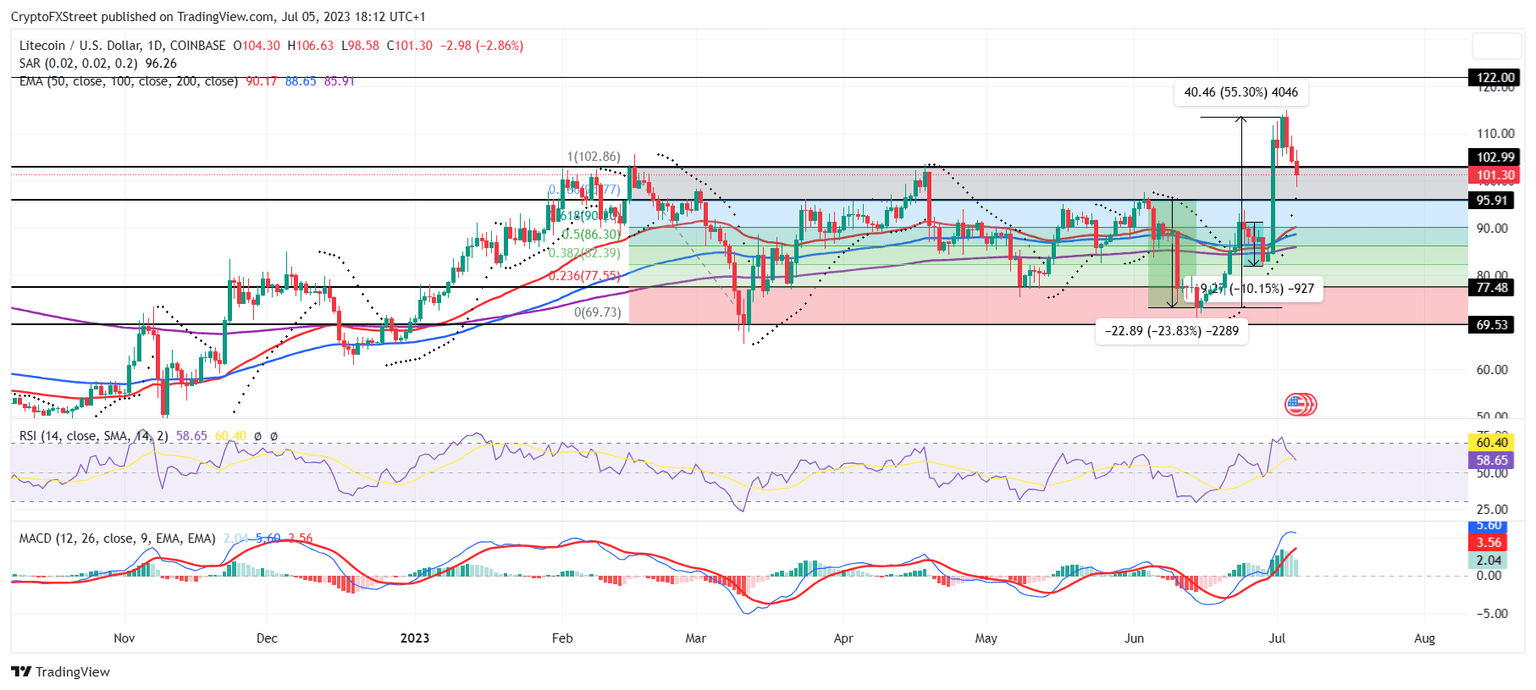

Litecoin price is trading at $101 after falling by nearly 11% since the beginning of this month. This drawdown was the result of the LTC market cooling down after observing a 55% rally in the last two weeks of June which pulled the altcoin up from $73 to $113. While investors were expecting a further incline, analyst Rekt Capital highlighted why a drawdown is important for a rally.

LTC/USD 1-day chart

The analyst noted that Litecoin price for the majority of 2023 was in a continuation pattern. Continuation patterns are generally considered to be an interruption of a larger trend, and price tends to go back to following the trend at the end of the pattern. In the case of LTC, the broader trend is bullish, so the price is set to rise again.

The recent rally acted as a breakout, and in order to reinitiate a rally, Litecoin price first needs to test the upper limit of the triangle pattern as support. According to Rekt Capital, this point coincides with the $94 mark and retesting it would result in a bullish outlook for Litecoin price.

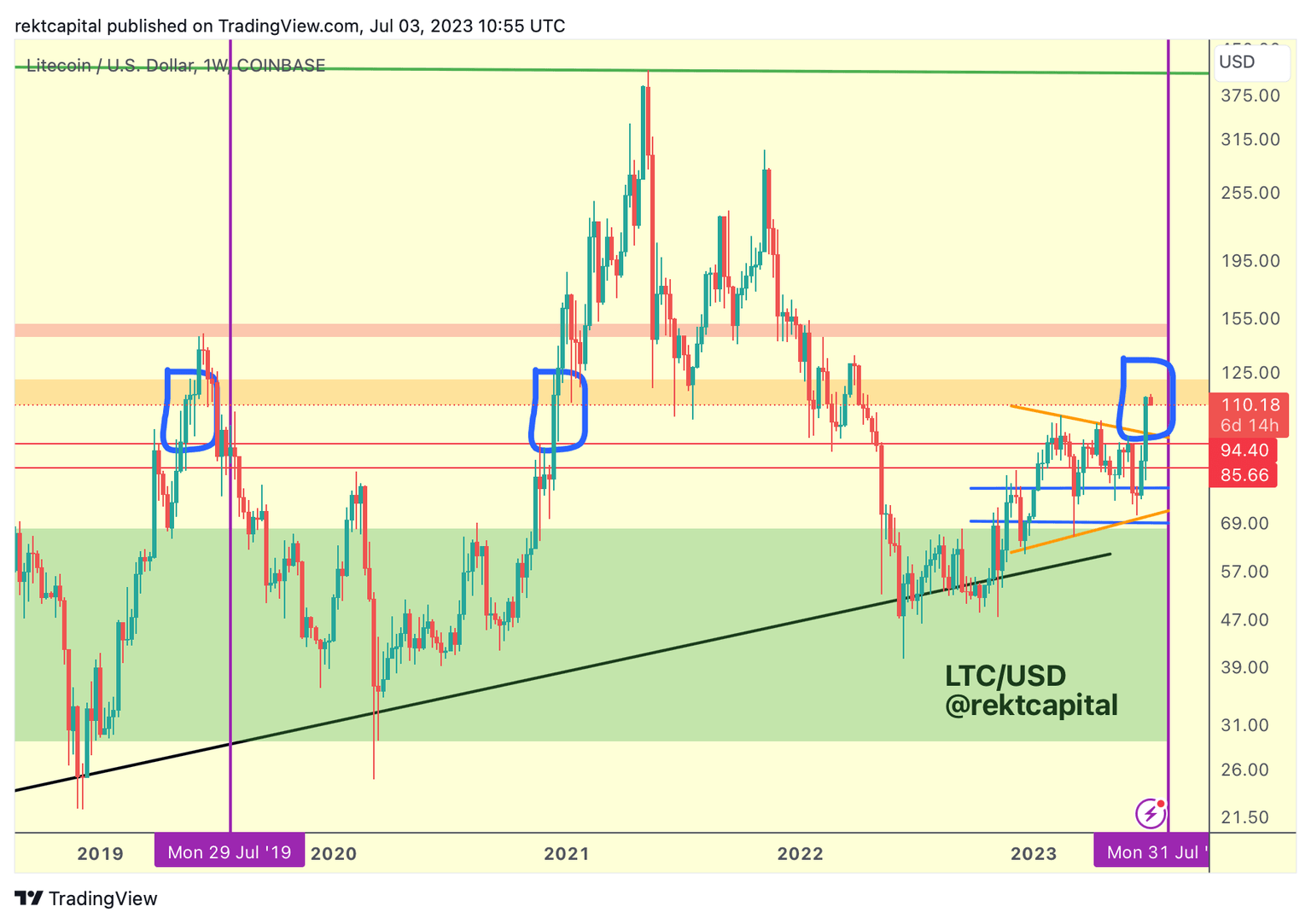

LTC/USD 1-week chart

This would potentially push the price back up toward the resistance box from $110 to $122. Once the box is breached, Litecoin price would have the opportunity to flip the $122 resistance line into a support floor, essentially repeating history. Back in 2021, a similar test resulted in LTC rallying for most of Q1 and Q2, correcting in May due to a broader market crash.

Thus a drawdown to $94 is currently necessary for a bounce back beyond $122. A recovery rally is also expected to revive investors' interest, who have been pulling back for a while now. Participation has declined by more than 70% in the last two months, with active addresses falling from 834k to 242k. No spike in activity was noted during the recent 55% rally either.

Litecoin active addresses

Thus, by the looks of it, LTC holders are likely waiting to observe the impact of the upcoming halving, which will cut down mining rewards by half. Set to take place in August, the halving is expected to be bullish for the price, but broader market conditions could alter the results. Hence, investors will also probably become active once the dust settles to see where they stand.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B19.48.53%2C%252005%2520Jul%2C%25202023%5D-638241799242458233.png&w=1536&q=95)