Litecoin price is breaking out to new yearly highs

- Litecoin price broke out of an ascending triangle pattern on the 4-hour chart.

- LTC faces only one significant resistance area on the way up.

- Litecoin bulls are eying up a price target of $265 in the long-term.

Litecoin has been trading in an uptrend for the past two weeks and has finally broken out of a key pattern on the 4-hour chart. LTC bulls face weak resistance ahead of a new 2021-high above $250.

Litecoin price on its way to new 2021 highs

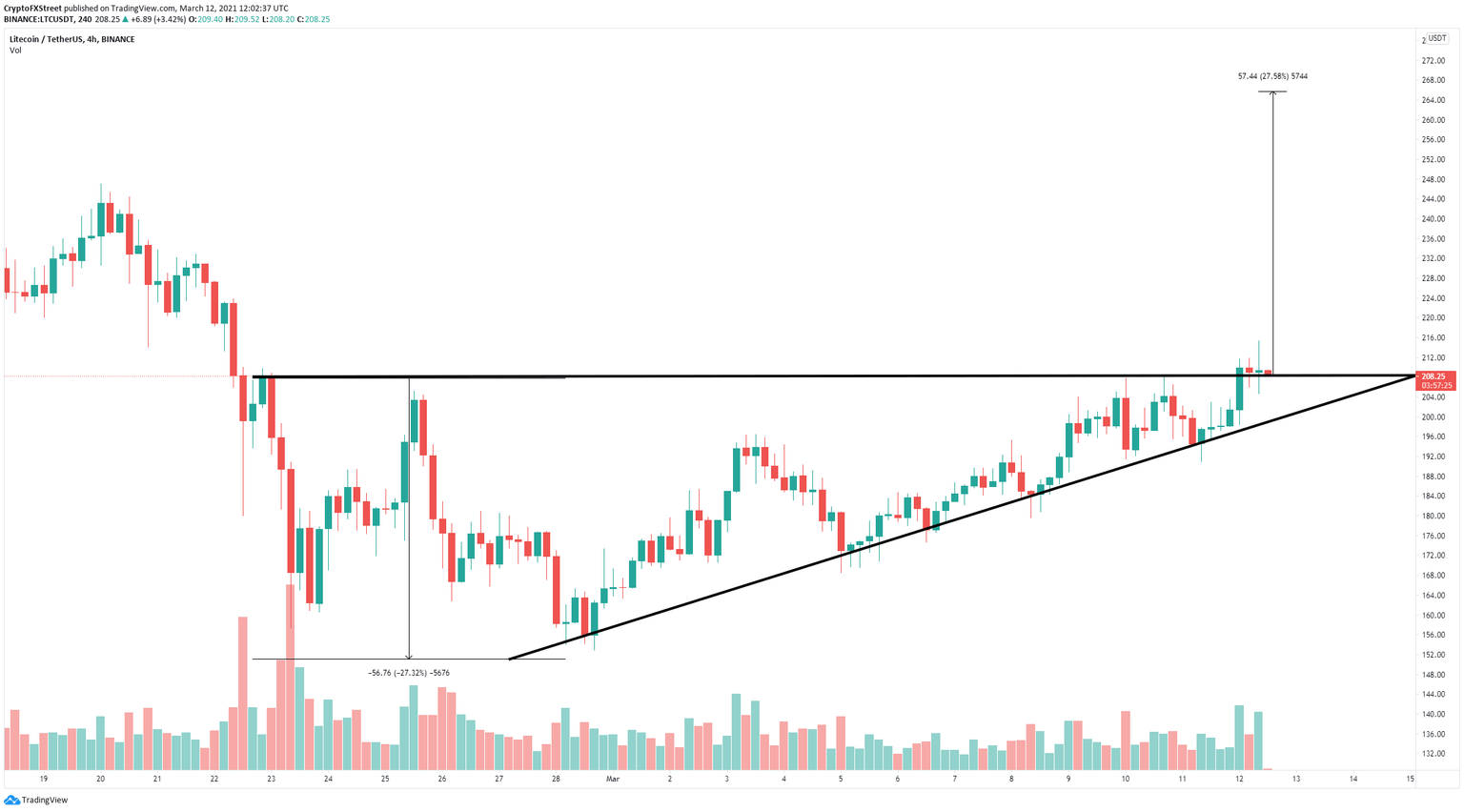

On the 4-hour chart, Litecoin has broken out of an ascending triangle pattern which has a long-term price target of $265, a 27% move calculated using the height of the pattern as a reference point.

LTC/USD 4-hour chart

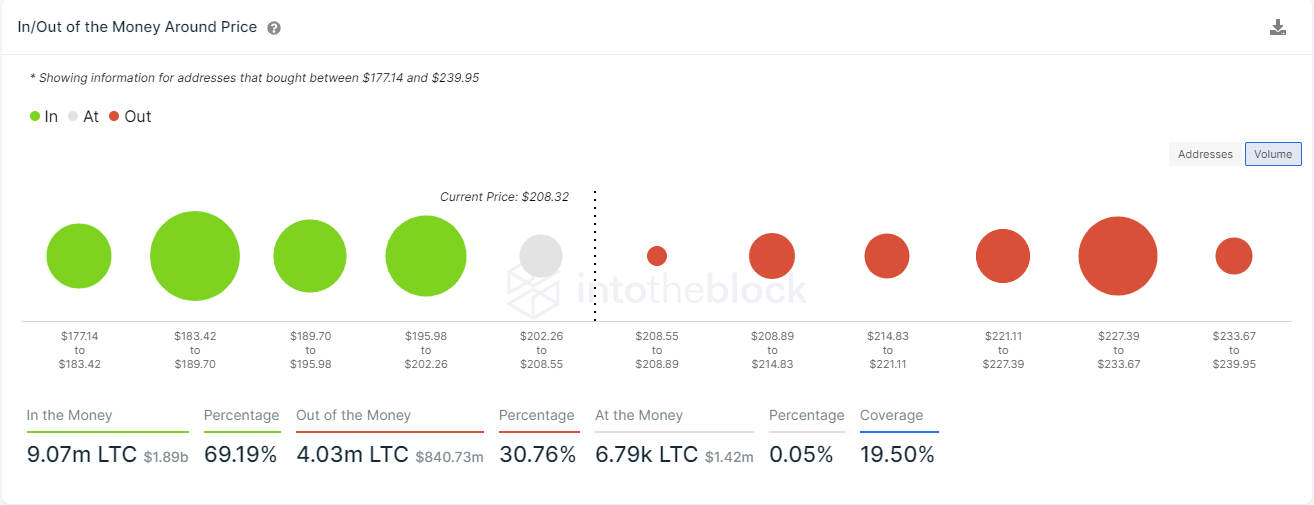

The In/Out of the Money Around Price (IOMAP) chart seems to add credence to this outlook as it shows only one crucial resistance area between $227 and $233, where 42,000 addresses produced 2.24 million LTC of volume. However, above this point, there are barely any other barriers.

LTC IOMAP chart

Similarly, the MVRV (30d) was in the buy zone for the past week and remains quite low, which indicates that Litecoin has a lot of room to rise in the short to mid-terms.

LTC MVRV (30d)

Nonetheless, Litecoin must hold the previous resistance trendline of the ascending triangle at $208. If the bears can crack this key level, they will invalidate the bullish outlook and push Litecoin price down to at least $198 in the short-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B13.05.04%2C%252012%2520Mar%2C%25202021%5D-637511476733475319.png&w=1536&q=95)