Litecoin price into breakout zone as bulls flock in

- Litecoin price slipped yesterday after a perfect series of gains since February 3.

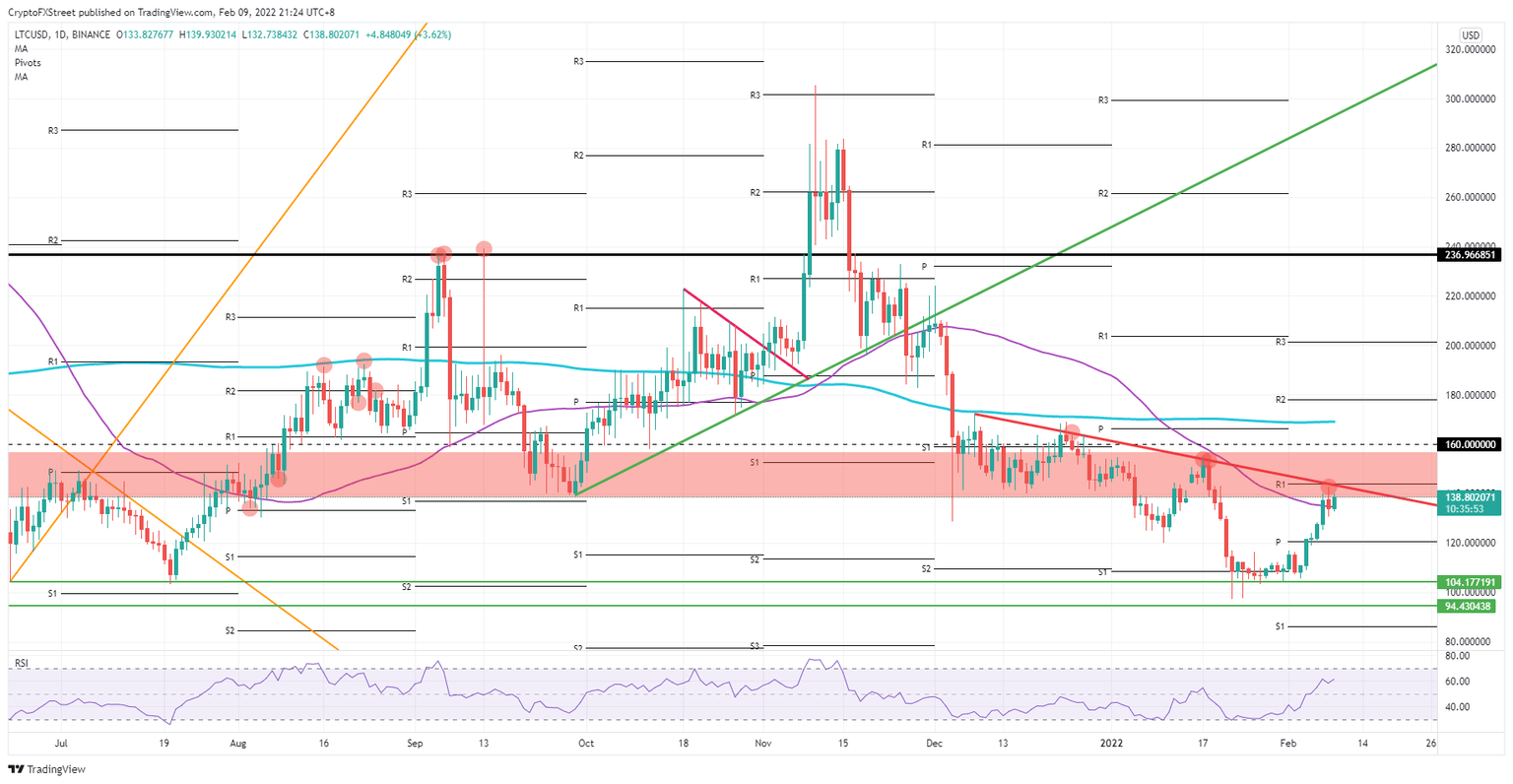

- The dip looks short-lived as bulls are trembling before the monthly R1 and red descending trend line, poised for a breakout.

- Expect a tiered rally with profit-taking at $160, $170 and $180 before thinking about $200.

Litecoin (LTC) price underwent a short correction yesterday after bulls faced a double hurdle with the intersection of the red descending trendline with the monthly R1 resistance level. Buyers got pushed out of the breakout zone but have made a comeback today with some global market tailwinds in their corner, and they are trying to break the downtrend since November. A breakthrough would see solid gains with some profit-taking around $160, $170 and $180, before targeting $200 in the medium term.

Bull run ready to start with ultimate gains of almost 48%

Litecoin price underwent a short correction as bulls were unfit to break above the double whammy of resistance at $144. After the rejection, price slipped below the 55-day Simple Moving Average, around $134. But bulls saw a solid opening this morning with a clear bounce off that 55-day SMA and are set to break $134 with some additional tailwinds coming from global markets.

LTC price action welcomes these new tailwinds as investors look beyond central banking and start to look for more investment opportunities, including cryptocurrencies. The additional interest, buy volume, and tailwinds set Litecoin up for a breakout trade with the monthly R1 resistance level as the critical level to close above this week. From there, the following level to sight is $160, as the cap of the distribution zone. Following that is $170 and the 200-day SMA, and after that $180, situated near the monthly R2 resistance level.

LTC/USD daily chart

As the hurdles at $140 already proved too big for bulls to get over, that could still be the case today. With the risk of price action being rejected again, expect a more extensive downward move, with the 55-day SMA not supportive enough and price probably falling back to $120. At that level, bulls have the monthly pivot for an entry to make another attempt at the red descending trend line in a few weeks time.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.