Litecoin price holds above $100 even as on-chain metrics suggest downturn ahead

- Litecoin price could face a correction despite being less than a month away from its third halving event.

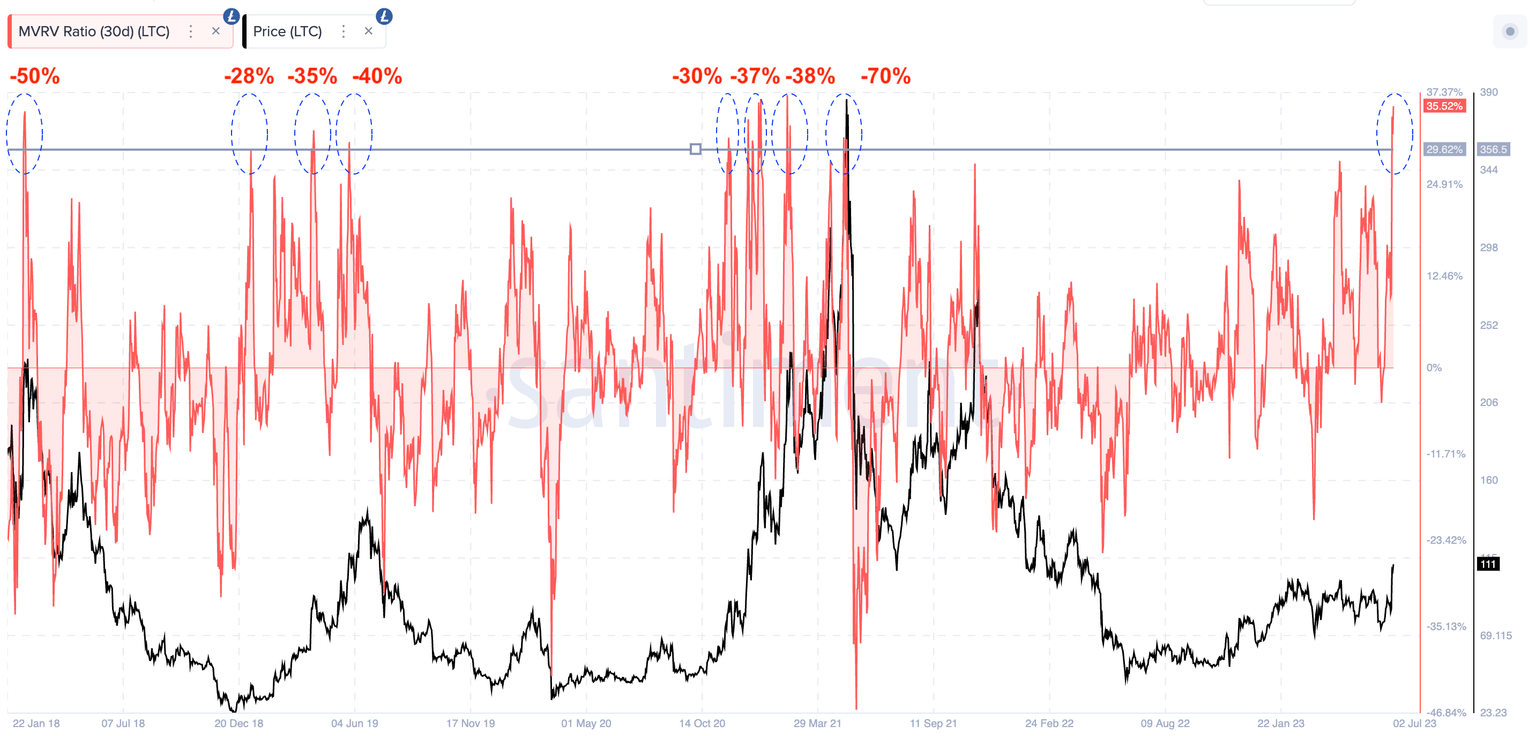

- MVRV, an on-chain indicator, has historically predicted a correction in Litecoin price, typically signaling a 30% to 40% pullback.

- LTC price hit a peak of $114.95 on Monday.

Litecoin network’s on-chain metrics signaled a bullish turn in LTC price last week, pushing its price up to a monthly high of $114.95 on Monday, but the altcoin might be on the cusp of a correction as some indicators have flipped bearish over the weekend.

Also read: Litecoin breaks past $100 on Binance after processing a million transactions in a week

On-chain metrics signal trend change

The Market Value to Realized Value (MVRV) is an on-chain indicator used to determine whether an asset is above or below its perceived value. In other words, the MVRV ratio signals when a cryptocurrency is undervalued or overpriced.

In the case of Litecoin, since 2018, every time that the metric exceeded the 30% threshold, a sharp price correction followed. Currently Litecoin’s 30-day MVRV is hovering around 35%. If history repeats itself, there is a likelihood that LTC price registers a pullback of between 30% to 40%.

MVRV ratio 30-day for Litecoin

However, there is a differential factor this time that could benefit Litecoin price despite bearish on-chain indicators. It is likely that the upcoming halving event, which will happen in around 30 days, supports LTC’s continued upward trend.

Halving events are typically considered bullish for cryptocurrencies like Litecoin and Bitcoin.

Other on-chain metrics support bears

The volume of active addresses on the Litecoin blockchain is consistently declining, according to data from Santiment. While the daily active address count on a 24-hour timeframe was relatively high in May and June, the metric has since declined and the level of activity matches the levels seen in March, when LTC price fell sharply.

%2520%5B13.46.12%2C%252003%2520Jul%2C%25202023%5D-638239720332629824.png&w=1536&q=95)

Litecoin network’s active addresses vs. price

The decline in daily active addresses supports a bearish thesis for LTC price in the short term.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.