- Litecoin traded below $88 on Tuesday, a steep 17% decline from the November 23 high of $106.

- Litecoin whales has recorded 73 consecutive days of positive net inflows.

- During this 73-day buying spree, whale wallets acquired 13.2 million LTC for $946.6 million.

Litecoin price hit $87.90 on Tuesday, down 17% from the recent high of $106 recorded on November 23. Despite the steep correction phase, on-chain data shows crypto whales have entered a 73-day buying spree.

Litecoin price loses $90 support amid cascading liquidations

After US Securities & Exchange Commission (SEC) Chair Gary Gensler’s announced exit, major altcoin markets received a boost.

Notably, crypto assets under litigation and those with ongoing ETF applications including Solana, LTC and XRP all recorded considerable gains last week.

However, as Bitcoin price stalled below $100,000, the ensuing sell-off sent bearish headwinds across the altcoin market.

Litecoin price action | LTCUSD

The chart above shows how Litecoin price gained 31% within 48 hours of Gensler’s exit announcement, moving from $81.50 on November 21 to a five-month peak of $106 on November 23.

However, as BTC price retraced below the $92,000 mark on Tuesday, Litecoin mirrored the market downtrend, reversing 17% of last week’s gains.

Whales invest $950 million in 73-day buying spree

At first glance, Litecoin’s 31% rally last week appears largely driven by speculative demand from traders betting on Gensler exit improving chances of an LTC ETF approval.

However, a closer look at the on-chain data trends shows a prolonged whale accumulation trend underpinning the recent Litecoin price breakout.

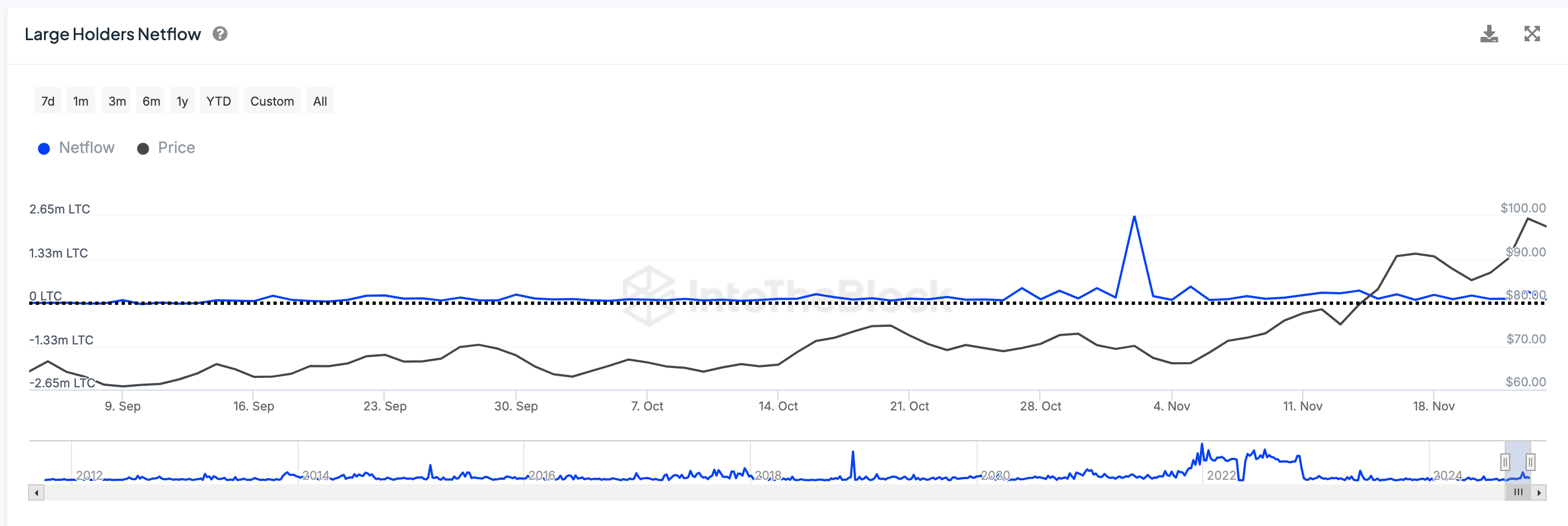

IntoTheBlock’s Large Holders’ netflow data tracks the daily deposits and withdrawals from wallets holding at least 0.1% of Litecoin circulation supply.

Litecoin Large Holders’ Netflow | LTCUSD

Litecoin Large Holders’ Netflow | LTCUSD

As depicted above, the Litecoin whales have recorded positive net flows in 73 consecutive days, dating back to September 14, acquiring 13.2 million LTC, at the average price of $946.6 million.

When whales acquire such a large amount of coins, it triggers positive sentiment for two key reasons.

First, it signals that Litecoin’s largest stakeholders maintain a bullish outlook for LTC’s long-term potential.

With the LTC ETF approval in sight, this trend could linger, potentially driving Litecoin price above $100 when market demand returns.

Additionally, large-scale whale purchases reduce the circulating supply of Litecoin on exchanges, creating potential scarcity.

This supply-demand imbalance can increase the likelihood of upward price movements, enhancing Litecoin's appeal to new market entrants.

LTC Price Forecast: All eyes on $85 support

Litecoin (LTC) is showing signs of cautious consolidation following a sharp 15% decline from its recent peak of $106.

LTC price has retraced to the $90 level, with immediate support identified near the lower Bollinger Band at $85. This level is critical as it coincides with a confluence of previous demand zones and the 20-day Simple Moving Average (SMA).

Litecoin price forecast | LTCUSD

On the upside, resistance lies at $101, the upper Bollinger Band, which LTC failed to sustain during its recent rally.

The Average Daily Range (ADR) suggests declining volatility, which could signal consolidation before the next significant move.

A breach below $85 could expose LTC to further downside toward $68, while a rebound might target $96 and $101 as potential recovery zones.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP show signs of bullish momentum

Bitcoin’s price is approaching its key psychological level of $100,000; a firm close above would signal the continuation of the ongoing rally. Ethereum price closes above its upper consolidation level of $3,522, suggesting bullish momentum.

Crypto Today: PEPE, Solana, BTC in early lead as Elon Musk, Michael Saylor spark 2025 market rebound

The cryptocurrency sector valuation crossed $3.4 trillion on Friday, having increased by $253 billion within the first 3 days of 2025. The crypto market rebound has been linked to positive speculations on Trump's upcoming inauguration.

XRP Price Prediction: XRP overtakes USDT after Ripple unlocks 500M ahead of Trump inauguration

Ripple price reached a 14-day peak of $2.5 on Friday, as the mega-cap altcoins make a positive start to 2025. With market sentiment still trending cautious, on-chain data suggests XRP price could potentially score larger gains.

Bitcoin, Ethereum options worth $2.6 billion expire with correction as a major theme this week

Bitcoin and Ethereum options that expired on Friday have a combined notional value of over $2.6 billion. BTC and ETH prices are hovering around key support levels, recovering from the holiday dip in the last week of 2024.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.