- Litecoin prepares for a gigantic upswing to its all-time highs at $420.

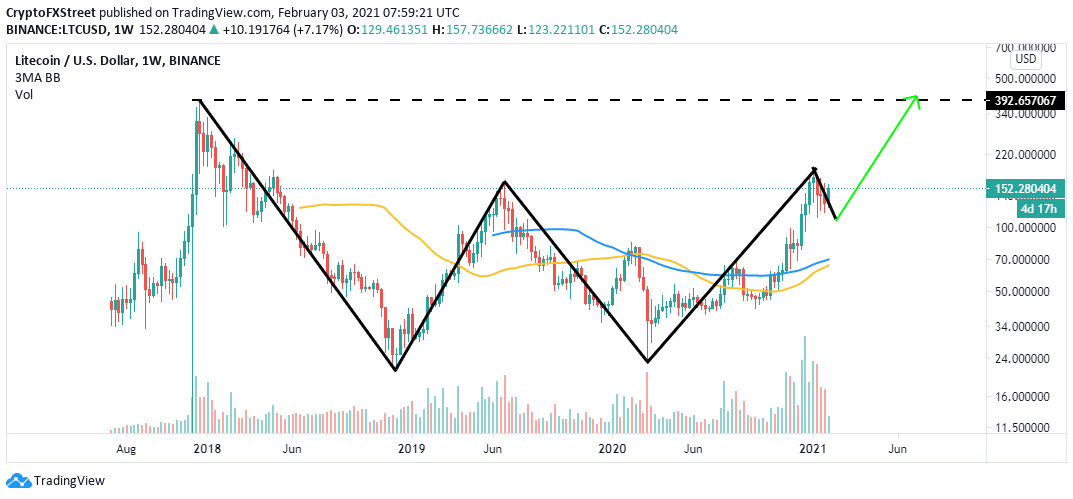

- LTC prints a similar long-term technical picture to Ethereum’s on the weekly chart.

- Holders remain on a buying spree as the MVRV suggests Litecoin is still in the ‘buy zone.’

- The majestic uptrend to $420 may fail to materialize if LTC dives under the IOMAP support at $420.

Litecoin recently rose above 2020’s high, drawing much closer to $200. However, a barrier at $190 put a halt to the massive upswing. After confirming support at $110, LTC has embarked on recovery, eyeing the all-time high at $420.

Litecoin could mimic Ethereum breaking out to all-time highs

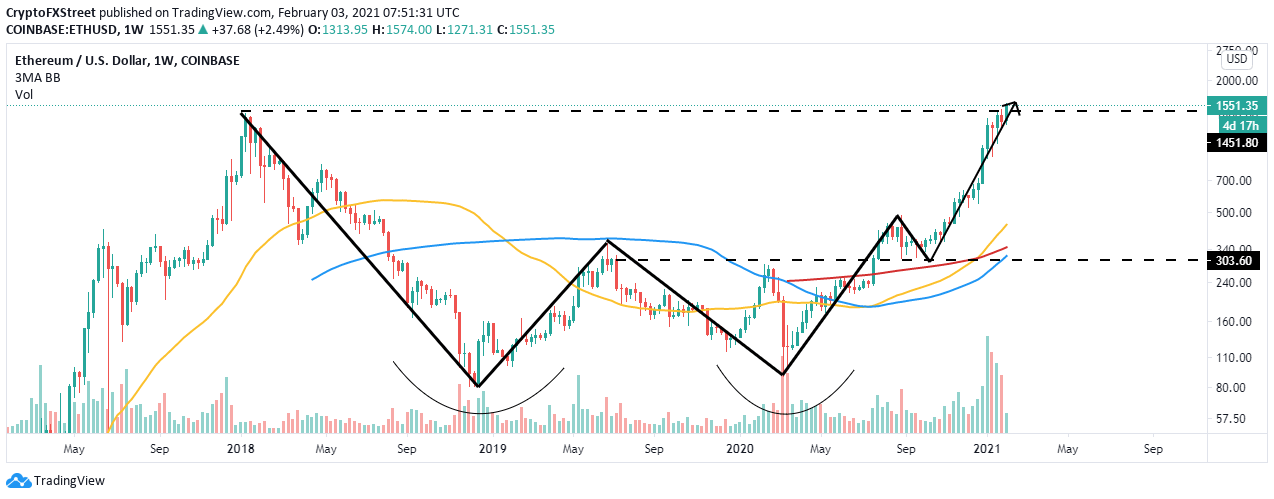

The weekly charts of Ethereum and Litecoin look quite similar, suggesting that Litecoin is on the verge of a massive breakout. From a comprehensive look at the ETH chart, we can see a ballistic rise to $492 in June 2020, followed by a correction to $300.

The pioneer cryptocurrency then embarked on an unending rally towards the end of the year. A rise in investor interest, backed by the crypto bull run, saw Ethereum step above $1,000 In January 2021. At the moment, Ethereum is trading at new record highs as bulls are eyeing $2,000.

ETH/USD weekly chart

Intriguingly, Litecoin is taking a similar pattern that could see it more than double in price, with gains eyeing $400 (record highs). The recent rebound at $110 is essential for sustaining the uptrend, and, therefore, such level must be guarded at all costs.

LTC/USD weekly chart

Litecoin’s large volume holders on a buying spree

The buying spree among the whales reinforces the bullish outlook. Santiment’s holder distribution brings to light the persistent rise in the number of addresses holding between 10,000 and 100,000 LTC.

LTC/USD holder distribution chart

The on-chain metric, calculated on a 30-day moving average, shows whales bottomed at roughly 400 on January 24.

Over the past couple of weeks, the addresses have increased to 420, representing a 4.8% growth. If the accumulation continues, buying pressure will intensify behind Litecoin, eventually pushing the price on an upward trajectory.

Litecoin still in the buy zone

According to the MVRV, an on-chain metric by Santiment, Litecoin recently returned into the buy zone. The MVRV measures the average profit or loss as per the current LTC holders in relation to the last time the tokens were transferred.

A higher MVRV figure suggests that most or all LTC holders are in profit. However, the chart shows a recent dip and an ongoing recovery of the MVRV. Thus, Litecoin offers entry positions within the “opportunity zone.”

Litecoin MVRV model

Simultaneously, the IOMAP model by IntoTheBlock reveals little resistance that could hinder Litecoin’s rally. However, it essential to keep in mind the subtle resistance between $169 and $174.

Here, roughly 34,000 addresses had formerly bought nearly 962,000 LTC in this zone. Breaking above this zone could catapult Litecoin above $200, perhaps jumpstarting the rally to the record highs.

On the downside, immense support has been established to ensure that declines are kept at bay, especially at $137 to $142. Here, approximately 113,000 addresses had previously purchased roughly 4.8 million LTC.

Litecoin IOMAP chart

Looking it at the other side of the fence

It is essential to realize that the resistance between $190 and $200 could continue to delay the expected breakout. Simultaneously, if Litecoin fails to hold above the IOMAP support at $140, a downswing could occur, forcing the coin to revisit the support at $110. Other support levels to keep in mind include $80, the 100 Simple Moving Average and the 50 SMA on the weekly chart.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top gainers Virtuals Protocol, Floki, Hyperliquid: Altcoins extend gains alongside Bitcoin

The cryptocurrency market sustains a market-wide bullish outlook at the time of writing on Tuesday, led by Bitcoin (BTC) and select altcoins, including Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE).

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[13.34.28,%2003%20Feb,%202021]-637479492176237481.png)

%20[13.34.28,%2003%20Feb,%202021]-637479479616922251.png)

-637479481680252977.png)