Litecoin Price Forecast: LTC hits $130 for first time in almost three years as open interest soars

- Litecoin briefly touched the $130 mark on Monday, propelled by improved sentiment around privacy-focused coins after a US court reversed sanctions placed on Tornado Cash.

- Litecoin price has now increased 75% since Gary Gensler’s exit from the US SEC was confirmed on November 14.

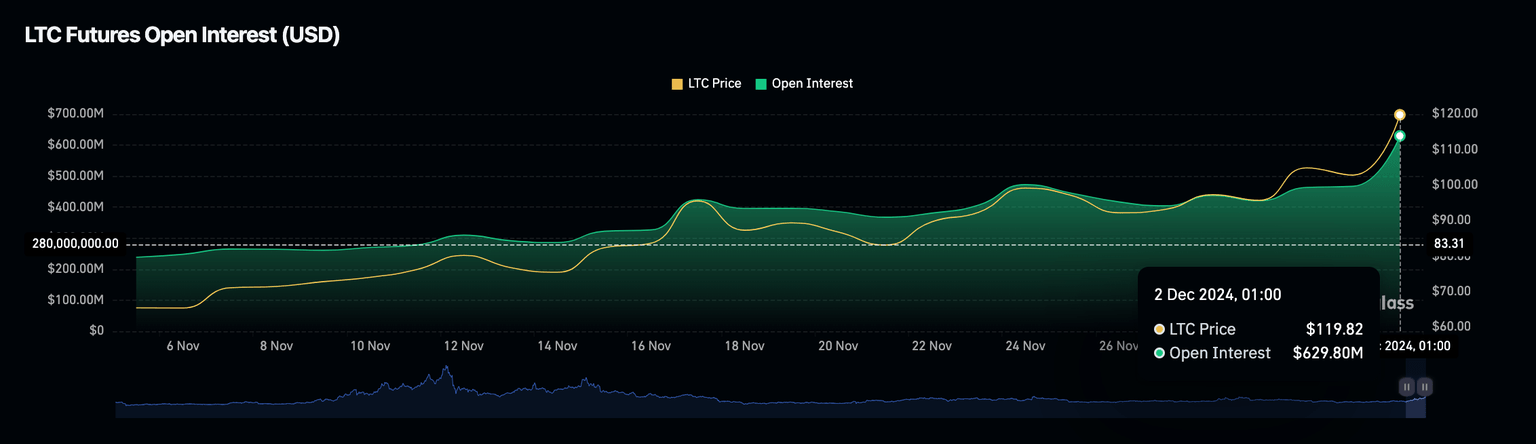

- Litecoin open interest crossed $620 million on December 2, reflecting a 56% spike in futures contracts within a week of the Tornado Cash ruling.

Litecoin price grazed the $130 mark on Monday, propelled by improved sentiment around privacy-focused coins after a United States (US) court reversed sanctions placed on Tornado Cash.

Will LTC price advance towards $150 in the week ahead?

Litecoin price hits 3-year peak as markets react to Tornado Cash ruling

On November 26, a US court overturned sanctions imposed on cryptocurrency transactions mixer Tornado Cash, sparking an instant bullish reaction for major privacy-focused assets, including Litecoin.

According to a Reuters report, the appeals court ruled that the US Treasury Department acted outside its authority when it sanctioned Tornado Cash in 2022 for allegedly facilitating cybercrime and laundering over $7 billion, particularly by malicious actors like North Korean hacker groups.

The court's decision to reverse the sanctions makes a significant mark in the legal interpretation of privacy-focused decentralized financial tools.

By recognizing Tornado Cash as a neutral technology rather than a culpable entity, the ruling effectively limits the extent of government oversight over blockchain protocols.

In an instant reaction, projects like Litecoin (LTC), Bitcoin Cash (BCH) and Monero (XMR) have all witnessed a considerable surge in demand.

Litecoin price action | LTCUSDT

The chart above shows how Litecoin’s price rally began around November 14, when the US Securities and Exchange Commission (SEC) chair Gary Gensler hinted at his imminent exit slated for January 2025.

After an initial consolidation around the $100 mark, Tornado Cash has triggered another leg-up, driving the LTC price toward $130 territory on Monday.

While LTC price has retraced towards the $122 level at the time of writing, other critical market signals suggest the rally may not be over yet.

Litecoin Open Interest spiked $225M in the last seven days

The LTCUSD daily chart shows that Litecoin price has increased 75% since November 14. However, a closer look at the derivatives market trends shows this rally was also accompanied by a considerable increase in speculative demand, which could potentially support further gains.

Coinglass’ Open Interest metric, which depicts the active capital stock invested in Litecoin futures contracts, helps track short-term traders’ sentiment around key market events.

Looking at the chart above, Litecoin's open interest dipped as low as $404 million on Wednesday.s markets digested the Tornado Cash ruling, investors began to place large bets on LTC.

After $225 million in capital inflows in seven days, Litecoin's open interestreached $629 million on Monday.

When an asset’s price rally is supported by a prolonged period of increase in derivatives market inflows, strategic investors interpret it as a bullish signal to support the ongoing rally for two reasons

First, rising open interest reflects heightened speculative activity and confidence in the current directional price trend.

Second, it signals increased liquidity, which helps sustain upward momentum by reducing volatility and reinforcing bullish support at key levels.

Litecoin price forecast: More gains ahead if $115 support holds

Litecoin's bullish momentum remains strong, with prices gaining 74.8% over 18 days as shown on the chart.

The Bollinger Bands indicate an extended upward trend, with the price trading above the upper band at $116.04.

If this key support holds, Litecoin could rally toward the next key resistance at $130, supported by $225 million in speculative demand observed in the past week.

More so, the Average Directional Index (ADX) reading of 43.95 signals a strong trend.

Such high ADX values validate the sustained upward momentum as strategic investors continue to back Litecoin.

If bullish sentiment persists, bulls could aim for a $150 target in the coming weeks.

However, a multi-day close below the $115 support could effectively negate the short-term bullish momentum.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.