Litecoin Price Forecast: Is third time the charm for LTC to trigger 20% breakout move?

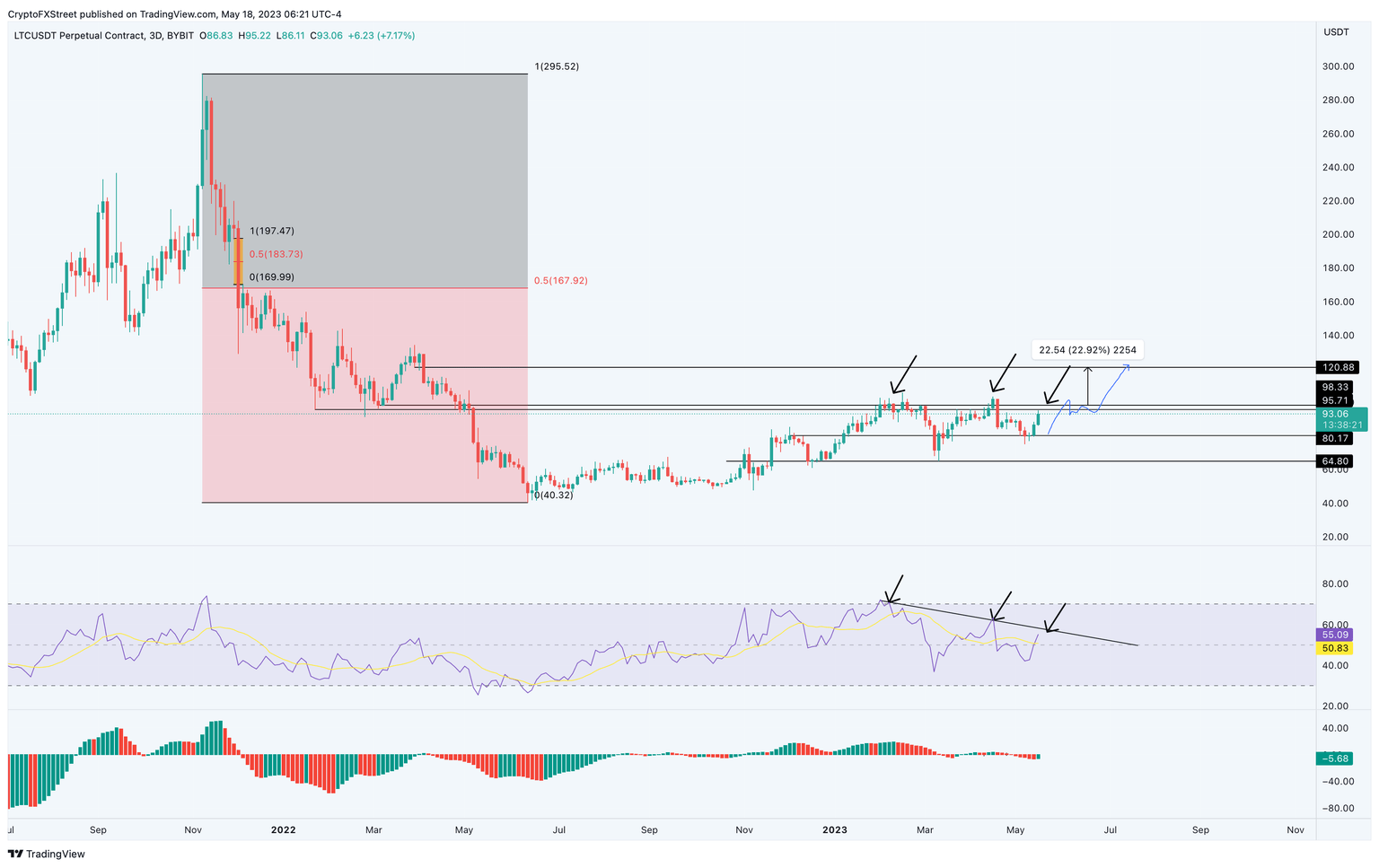

- Litecoin price shows a clear struggle to overcome the $98 hurdle.

- After two failed attempts in the last three months, LTC is at it again.

- A decisive flip of this hurdle into a support floor could trigger a swift 22% ascent to $120.

- Invalidation of the bullish outlook will occur if the altcoin slides below $80.

Litecoin price has been consolidating for quite some time as it faces a strong headwind. The lack of buying pressure or increased selling pressure has kept LTC stationary despite the visible struggle. But things could change as the altcoin is preparing for its third attempt to kickstart a rally.

Also read: Litecoin Price Forecast: LTC consolidates in a triangle as bulls anticipate a 45% breakout

Litecoin price in a tight spot

Litecoin price slipped below the $98 hurdle on May 7, 2022, and has been stuck trading under it ever since. Although there were plenty of three-day candlestick closes above this hurdle, none of them stuck and transitioned into a full-blown upswing.

In the last 105 days, Litecoin price has failed to overcome this hurdle twice. The pullback after the second failed attempt has given rise to another impulsive move that is edging close to retesting the $98 resistance level.

The Relative Strength Index (RSI) and the Awesome Oscillator (AO) add more nuance to the price action. During the first failed attempt by Litecoin price, the RSI was oversold, and the AO was slacking off, suggesting a decline in momentum.

The second attempt saw RSI overcome the mean, which was a good sign, but the AO revealed a lack of momentum. As the third attempt is underway, investors can note that the RSI has once again overcome the mean, but the AO is still negative. A decisive flip of the AO above the zero line with taller histogram bars would suggest the resurgence of bullish momentum.

Until that happens, investors’ hands should be tied. However, a successful flip of the $98 hurdle combined with bullish RSI and AO indicators will be the buy signal for patient investors. In such a case, Litecoin price could trigger a swift 22% rally to the next critical resistance level at $120.

In a highly bullish case supported by a Bitcoin rally, Litecoin price could see an extension of this move to tag the $167 hurdle. This move, however, would constitute a 70% gain when measured from the initial hurdle at $98.

LTC/USDT 1-day chart

Investors should note that the outlook detailed above for Litecoin price is heavily reliant on Bitcoin price moves due to the inherent correlation of altcoins with the BTC. A sudden spike in selling pressure that knocks the big crypto lower could translate into losses for altcoins as well.

In such a case, if Litecoin price flips the $80 support floor into a resistance level, it will invalidate the bullish thesis by creating a lower low. This development could see LTC trigger a 20% crash to the next stable support level at $64.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.