Litecoin Price Analysis: LTC/USD to continue hibernating in a range

- LTC/USD failed to ground above $42.00, settled below 1-hour SMA50.

- Only 21% of Litecoin wallets are in a green zone.

Litecoin is the seventh largest digital asset with the current market value of $2.7 billion and an average daily trading volume of $1.15 billion. The coin is locked in a tight range below $42.00. LTC/USD has barely changed both a day-to-day basis, though it is down over 1% since the beginning of Thursday.

At the time of writing, only 21% of all LTC addresses are in a green zone, while 75% are nursing losses. The average balance of LTC addresses is marginally above $1,000, while an average transaction size has increased to nearly $6,000 from $2,700 registered at the beginning of the week, according to Intotheblock data.

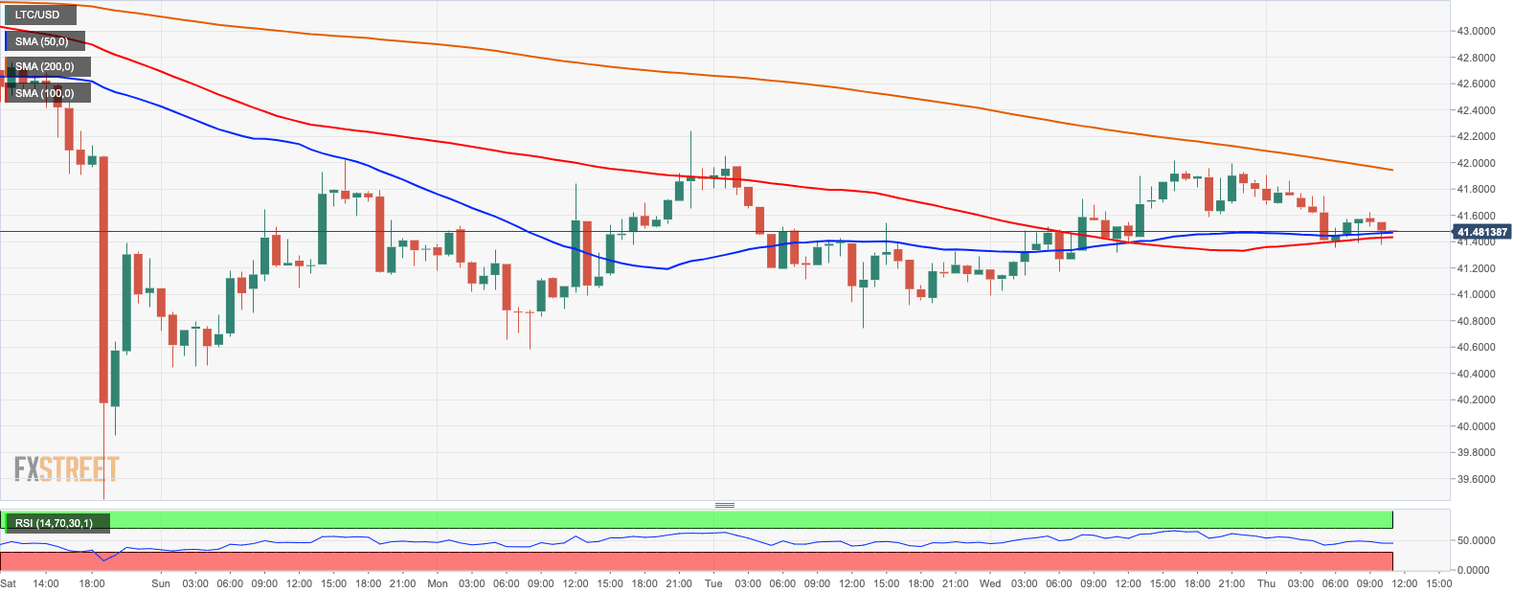

LTC/USD: Technical picture

On the intraday charts, LTC/USD is hovering around 1-hour SMA50 at $41.50. If the price extends the decline below this level, psychological $41.00. This barrier may slow down the short-term bears as it has served as a backstop since the beginning of the week. If the sell-off gains traction, LTC may retreat towards psychological $40.00. The next strong support comes at recent low of $39.44 and $38.00, which is the lowest level since April 16.

On the upside, we will need to see a sustainable move above $42.00 to improve the short-term technical picture. This barrier is reinforced by 1-hour SMA200. Once it is out of the way, the upside is likely to gain traction with the next focus on $43.00 and $43.30 (the resistance area that capped the recovery on June 26.)

The RSI on 1-hour chart is flat in the neutral position, which means that short-term range-bound trading may prevail at this stage.

LTC/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst