- Charlie Lee supports the idea of donating miners' rewards.

- LTC/USD recovery may be limited by SMA50 on 1-hour chart.

At the time of writing, LTC/USD is changing hands at $53.20, down nearly 2% since the beginning of the day. The seventh larges digital asset with the current market value of $4.3 billion has been moving within a short-term bearish trend amid low volatility.

Litecoin may follow the lead of Bitcoin Cash

While commending the initiative of the Bitcoin Cash community to force miners to transfer 12.5% of their revenues, the creator of Litecoin Charlie Lee suggested that miners should donate 1% of their block rewards (0.125 LTC) to the ecosystem development. He also added that the donations should be completely voluntary.

He wrote on Twitter:

I think a better way to fund development is mining pools voluntarily donate a portion of the block reward. How about Litecoin pools donate 1% (0.125 LTC) of block rewards to the @LTCFoundation? If every miner/pool does this, it amounts to about $1.5MM donation per year!

He also added that due to merged mining of Dogecoin and other coins based on Scrypt algorithm, miners are able to receive over 105% of block rewards. What's more pool of miners can decide on the target. of their donations, for example, Litecoin.com or The Lite School.

The community reaction was controversial. Someone supported the initiative, while others expressed doubts and suggested that Lee should have donated the proceeds from selling his coins in 2017.

LTC/USD: technical picture

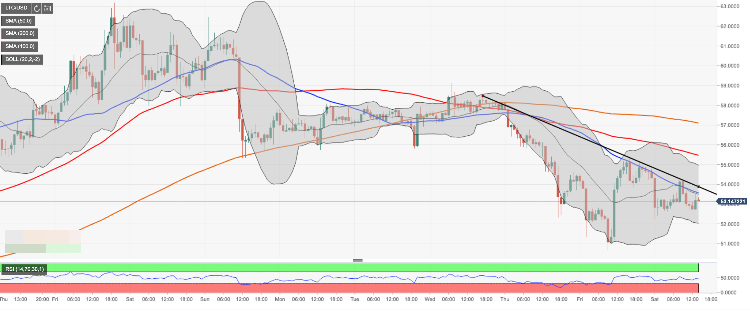

LTC/USD hit the bottom at $50.65 on January 24 and has been recovering ever since. However, the further upside may be limited by SMA50 1-hour at $53.60, which is closely followed by the short-term downside trend line. Once it is out of the way, the upside is likely to gain traction with the next focus on SMA100 at $55.50 and SMA200 1-hour at $57.00.

On the downside, the support comes at $52.00 ( the lower line of 1-hour Bollinger Band). A sustainable move below this area will take us towards the recent low of $50.65. If the price breaks below $50.00, SMA50 daily at $46.50 will come into focus.

LTC/USD 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP decline as President Trump’s team considers “broader and higher tariffs”

Bitcoin continues its decline, trading below $82,000 on Monday after falling 4.29% the previous week. Ethereum and Ripple followed BTC’s footsteps and declined by 9.88% and 12.40%, respectively.

XRP Price Forecast: Weak demand and rising supply could trigger a downtrend

Ripple's XRP is down 7% on Friday following bearish pressure from macroeconomic factors, including United States (US) President Donald Trump's tariff threats and rising US inflation.

Crypto Today: XRP, SOL and ETH prices tumble as South Carolina moves to buy up to 1 million BTC

Bitcoin price tumbled below the $85,000 support on Friday, plunging as low as $84,200 at press time. The losses sparked over $449 million in liquidations across the crypto derivatives markets.

Hackers accelerate ETH decline following $27 million dump, bearish macroeconomic factors

Ethereum (ETH) declined below $2,000 on Friday following a series of hacks traced to accounts of crypto exchange Coinbase users, which caused a loss of $36 million.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.