Litecoin Price Analysis: LTC/USD gains over 10% in just a few hours, stops short of $55.00

- Litecoin Foundation has a lot of ambitious development plans for 2020.

- LTC/USD broke free from the range and hit the highest level since November 2019.

Litecoin, the 7th largest digital coin with the current market value of $3.4 billion, gained over 7% in the recent 24 hours amid global recovery on the cryptocurrency market led by such coins as Bitcoin SV (+26%) and Dash (+23%). Notably, Bitcoin has lagged behind with only 5% of gains. LTC/USD retreated to the seventh position giving way to Bitcoin SV. At the time of writing, LTC/USD is changing hands at $53.8, off the intraday high registered at $54.78.

Litecoin Foundation has a lot of ambitious plans

The creator of Litecoin Charlie Lee spoke about the company’s vision for 2020 with Peter McCormack. Namely, he mentioned the intention to include extensions block to its blockchain to improve the network's infrastructure. He also added that the process may take some time. but the team would do its best to make sure everything is done in the right way.

When asked about LiteBank initiative, Lee said:

“Yes, the LiteBank is something of a prototype that we are working on. Last year we had purchased this bank who were working with crypto related progress. It is definitely a process that we plan to execute slowly as something of this sort has not been done before. We will see how we can play around with it and create cool stuff.”

However, the recent Litecoin's price developments have little to do with these announcements as the market is driven by speculative sentiments and technical factors.

LTC/USD: technical picture

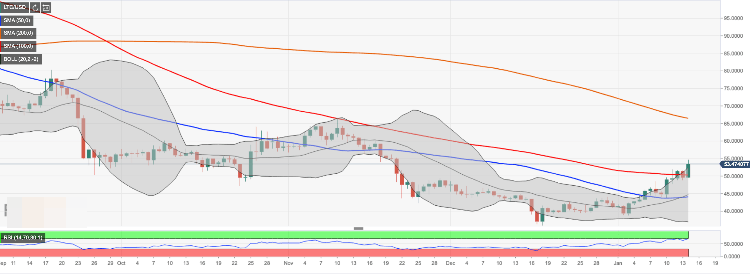

LTC/USD broke free from a tight range limited by psychological $50.00. The development increased the upside momentum and pushed the price above even more critical resistance created SMA100 daily at $51.30 and the upper line of the daily Bollinger Band at $52.53. LTC/USD hit the highest level since November 21, 2019 and surpassed SMA100 daily for the first time since July 31, 2019.

While the intraday high above $54.00 was not sustained, the coin retains the bullish bias as long as it stays above $50.00. If this support gives way, the sell-off may bbe extended towards $44.00 created by a combination of SMA50 daily and the middle line of the daily Bollinger Band.

Considering that the daily RSI has reversed to the upside, LTC/USD may be well-positioned for another recovery attempt. Once $55.00 resistance is cleared, the next psychological barrier of $60.00 will come into focus.

LTC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst