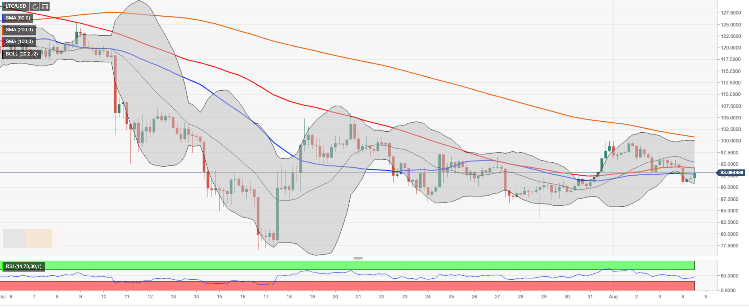

- LTC/USD is sitting in a tight range despite the upcoming halving.

- A sustainable move above $95.70 is needed for an extended recovery.

Litecoin (LTC) is oscillating in the range limited by $90.00 on the upside and $94.00 on the downside ahead of the major event. The fifth-largest cryptocurrency with the market value of $5.8 billion has lost about 3.5% of its value on a day-on-day basis and 1.1% since the beginning of Sunday.

Halving on the horizon

Litecoin's halving is supposed to happen on August 5, which means that there is less than one day before the event. Traditionally, the cryptocurrency price is growing ahead of the halving as it leads to the reduced miners' remuneration and thus enhances the deflationary effect.

However, Litecoin has lost nearly 25% of its value in the recent month after a strong growth during the first half of the year.

Litecoin's technical picture

On the intraday charts, LTC/USD is initially supported by psychological $90.00. This area is strengthened by the lower line of 4-hour Bollinger Band. Once it is out of the way, the sell-off is likely to gain traction with the next focus on $83.41 (the lowest level since July 27).

On the upside, we will need to see a sustainable move above $94.00 barrier to proceeding with the recovery. SMA100 (Simple Moving Average)on 4-hour chart located above this area may slow down the upside momentum. However, once int is broken, $95.40 (the middle line of 4-hour Bollinger Band) will come into focus.

The next strong resistance comes at $95.70 (confluence of SMA100 and the upper line of Bollinger Band on 1-hour chart).

LTC/USD, 4-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Dogecoin Price Forecast: Bulls deploy $355M in DOGE longs amid Gensler exit confirmation

Dogecoin price crossed $0.40 on Friday, after a weeklong consolidation that saw DOGE tumble 13% from last week’s peak. Derivative market reports link the DOGE rally to Gary Gensler’s imminent exit.

Crypto Today: XRP gains 10%, Cardano, XRP, and DOGE price rallies, delay Bitcoin’s $100K breakout

The global cryptocurrency sector pulled $230 million capital inflows on Friday, as markets reacted positively to news of SEC Chair Gary Gensler’s imminent exit.

Cardano Price Forecast: ADA could rally by another 30% as on-chain data signals bullish sentiment

Cardano (ADA) surged 24% to $0.98 on Friday following rising weekly active addresses, increased open interest and spot buying pressure.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.