- LTC/USD dips below $90.00 amid strong selling pressure.

- The initial support is created by $87.50 handle.

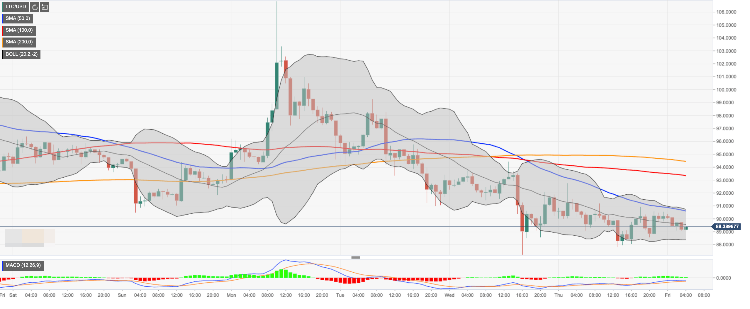

At the time of writing, LTC/USD is changing hands at $89.39. The coin slipped below critical $90.00 after a short-lived growth above $100.00 on August 5. The fifth-largest digital asset with the current market value of $5.6 billion has lost nearly 2% on a day-on-day basis and over 8 % on a weekly basis.

On the intraday charts, a sustainable move below psychological $90.00 bodes ill for the short-term momentum. The next support awaits us on approach to the recent low of $87.52. It is followed by $86.80 (the lower line of 4-hour Bollinger Band and the lower line of 1-day Bollinger Band). The next bearish target is created by SMA200 (Simple Moving Average) daily on approach to $81.00. Litecoin has been trading above this line since the end of February.

On the upside, the initial recovery is limited by $90.00, followed by with SMA50 (Simple Moving Average) and the middle line of 1-hour Bollinger Band 1-hour at $90.60. Once this area is cleared, the upside is likely to gain traction with the next focus on $93.50 ( the middle line of 1-day Bollinger Band).

LTC/USD, 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Is Altcoin Season here as Bitcoin reaches a new all-time high?

Bitcoin reaches a new all-time high of $98,384 on Thursday, with altcoins following the suit. Reports highlight that the recent surge in altcoins was fueled by the victory of crypto-friendly candidate Donal Trump in the US presidential election.

Shanghai court confirms legal recognition of crypto ownership

A Shanghai court has confirmed that owning digital assets, including Bitcoin, is legal under Chinese law. Judge Sun Jie of the Shanghai Songjiang People’s Court shared this opinion through the WeChat account of the Shanghai High People’s Court.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.