- Litecoin has been losing ground amid global cryptocurrency market correction.

- LTC/USD is vulnerable to further losses as the daily RSI points to the South.

Litecoin, the 7th largest digital coin with the current market value of $3.6 billion, lost over 6.5% in the recent 24 hours amid global correction on the cryptocurrency market. At the time of writing, LTC/USD is changing hands at $57.20, off the recent high registered at $63.17 on January 17.

Currently, the coin is moving sideways in sync with the market. As there are no clear fundamental factors that might have influenced Litecoin's price movements, the coin is affected mostly by speculative sentiments and technical factors. Namely, a retreat below the psychological $60.00 attracted new speculative sellers to the market and increased the short-term bearish pressure.

LTC/USD: technical picture

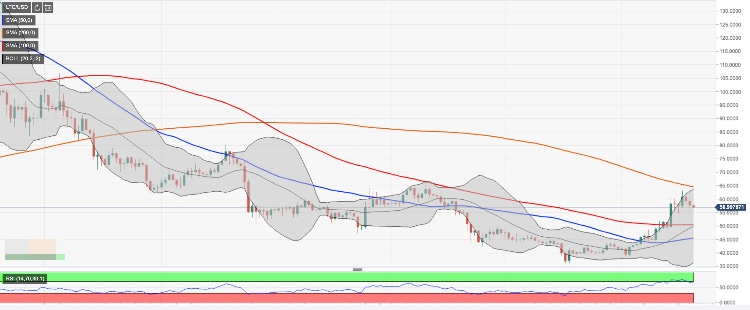

LTC/USD touched an area above $63.00, however, the upside momentum proved to be unsustainable at this stage. A wide-spread downside correction on the market pushed the coin towards $57.00 with the next local support created by SMA50 4-hour on approach to $56.00. Once it is broken, the sell-off may be extended towards $51.00 (SMA100 4-hour) and $50.50 (a combination of SMA100 daily and the middle line of the daily Bollinger Band.

This area is likely to slow down the correction and serve as a jumping-off ground for another recovery attempt; however, if it is out of the way, SMA50 daily a $5.50 will come into focus.

On the upside, the initial resistance is created by the middle line of the 4-hour Bollinger Band at $59.00. We will need to see a sustainable move above this level to retest $60.00 and the recent high of $63.17. The ultimate bulls' goal is created by SMA200 daily at $64.54.

Considering that the daily RSI points to the downside, LTC/USD may be well-positioned for an extended bearish correction before another bull's wave.

LTC/USD daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto Today: Traders discuss Solana futures and Ethereum Hoodi update as Bitcoin price stalls at $83,000

Amid a 2% decrease in market capitalization, crypto trading volume surges 42% to $87.2 billion in the last 24 hours, signalling active capital rotation. Bitcoin price stagnates below $85,000 as Gold enters a record rally to $3,000 ahead of the US Fed rate decision.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, XRP gain as MicroStrategy buys $10.7 million BTC

Bitcoin (BTC) daily price chart shows signs of recovery in the largest cryptocurrency. Strategy, one of the largest corporate holders of Bitcoin, acquired another 130 BTC last week, according to an announcement on Monday.

Top Formula 1 crypto sponsors rally, racing fans gain from Binance Coin, OKB, ApeCoin and Crypto.com

The 2025 Formula 1 season kicked off in Australia last week with a lineup of crypto sponsors for half of the teams. Racing giants are powered by sponsors like crypto exchanges Binance, OKX, ApeCoin, and Crypto.com, among other NFT and trading platforms.

SEC pumps brakes on altcoin ETFs, institutional interest remains

The US SEC postponed its decisions on several spot altcoin ETF applications this week, including those for Litecoin, XRP and Solana. A K33 Research report shows there is consensus but the agency is waiting the confirmation of Trump’s nominee for SEC Chair.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.