Litecoin price action hints at volatile and explosive move ahead

- Litecoin price has been hovering below the $98 hurdle for nearly four months.

- Recent developments have suggested that LTC could trigger a 30% move to $120.

- A three-day candlestick close below $80 would create a lower low and invalidate the bullish thesis.

Litecoin price has failed all its attempts to trigger a bull rally ahead of its third halving. This important event is set to slash the block rewards by half from 12.5 LTC to 6.25 LTC and will take place in the first week of August.

Although Litecoin rallied along with Bitcoin in early 2023, its upswing has remained capped so far, struggling to overcome key hurdles. But enough time has elapsed for LTC bulls to make a comeback.

Also read: Three reasons why Litecoin whales could push LTC price to $100 before third halving

Litecoin price ready to explode

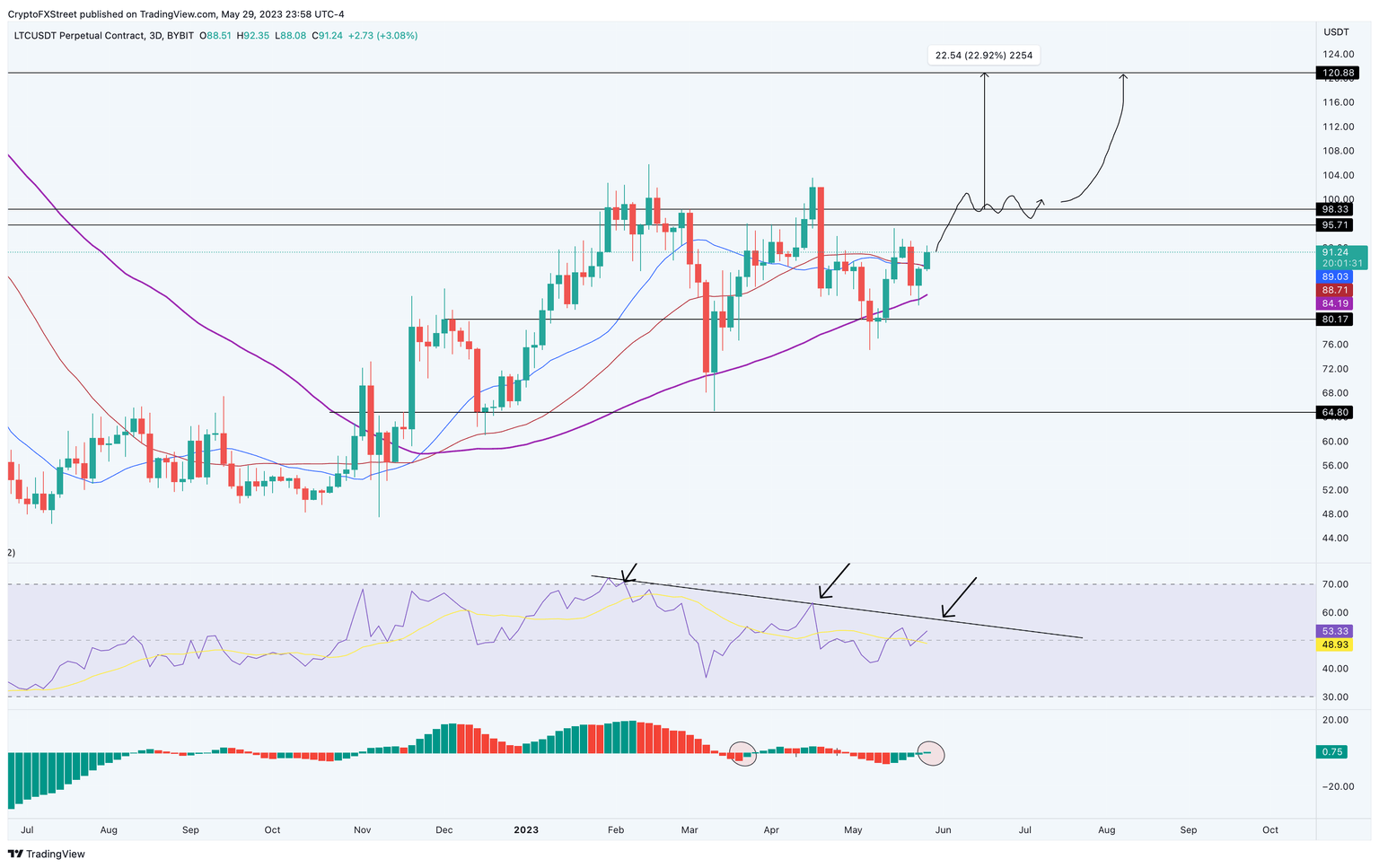

Litecoin price has been struggling to overcome the $98 hurdle for four months. Although there were brief breakouts, none failed to sustain, leading to steep corrections. The latest pullback pushed LTC down to sweep the $80 support floor and set up a low of $75.

So far, Litecoin price has bounced nearly 22% and is currently trading at $91.

The key changes can be seen in the Relative Strength Index (RSI) and the Awesome Oscillator (AO) momentum indicators. The AO shows a clean flip above the zero level, suggesting a rising bullish presence. Furthermore, the RSI shows a recovery above the mean level as it approaches a declining resistance level.

Interested investors can start to accumulate LTC at the current levels. The confirmation of an upswing will arrive when the RSI breaches the declining trend line. In such a case, Litecoin price could kickstart its ascent and flip the $98 hurdle into a support floor. This development will open the path for the altcoin to revisit the $120 resistance level.

In total, this move would constitute a 32% gain for LTC holders from the current position.

LTC/USDT 3-day chart

While the outlook for Litecoin price is plausible, it is too soon to predict if buyers will come through. On the other hand, Bitcoin price looks ready to collect the sell-stop liquidity below last week’s low at $25,764.

If the bears take control and push LTC to produce a three-day candlestick close below $80, it would create a lower low and invalidate the bullish thesis. After the breakdown of the aforementioned support floor, Litecoin price could trigger a nearly 20% crash to $64.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.