Litecoin offers 12% gains to LTC holders, three reasons why the altcoin has bullish potential

- Litecoin price is on track to break outside the ascending channel after the 50-day Exponential Moving Average crossed below the 200-day EMA.

- LTC has yielded double-digit gains for holders over the past two weeks and the outlook on the altcoin remains bullish.

- Bulls are ready to push Litecoin to its $85.03 target, after breaking out of its ascending channel.

Litecoin, the decentralized peer-to-peer cryptocurrency, is on track to break out of its ascending channel. LTC has yielded 16% gains over the past two weeks and the outlook on the altcoin remains bullish.

Also read: Here’s why Ethereum Classic witnessed a massive rebound in its price with hashrate simulation

Litecoin price prepares for a bullish breakout

Litecoin, the payment cryptocurrency is on track to break out of its ascending channel. The peer-to-peer payment token is currently in an uptrend. LTC has posted consistent gains for its holders, two weeks in a row.

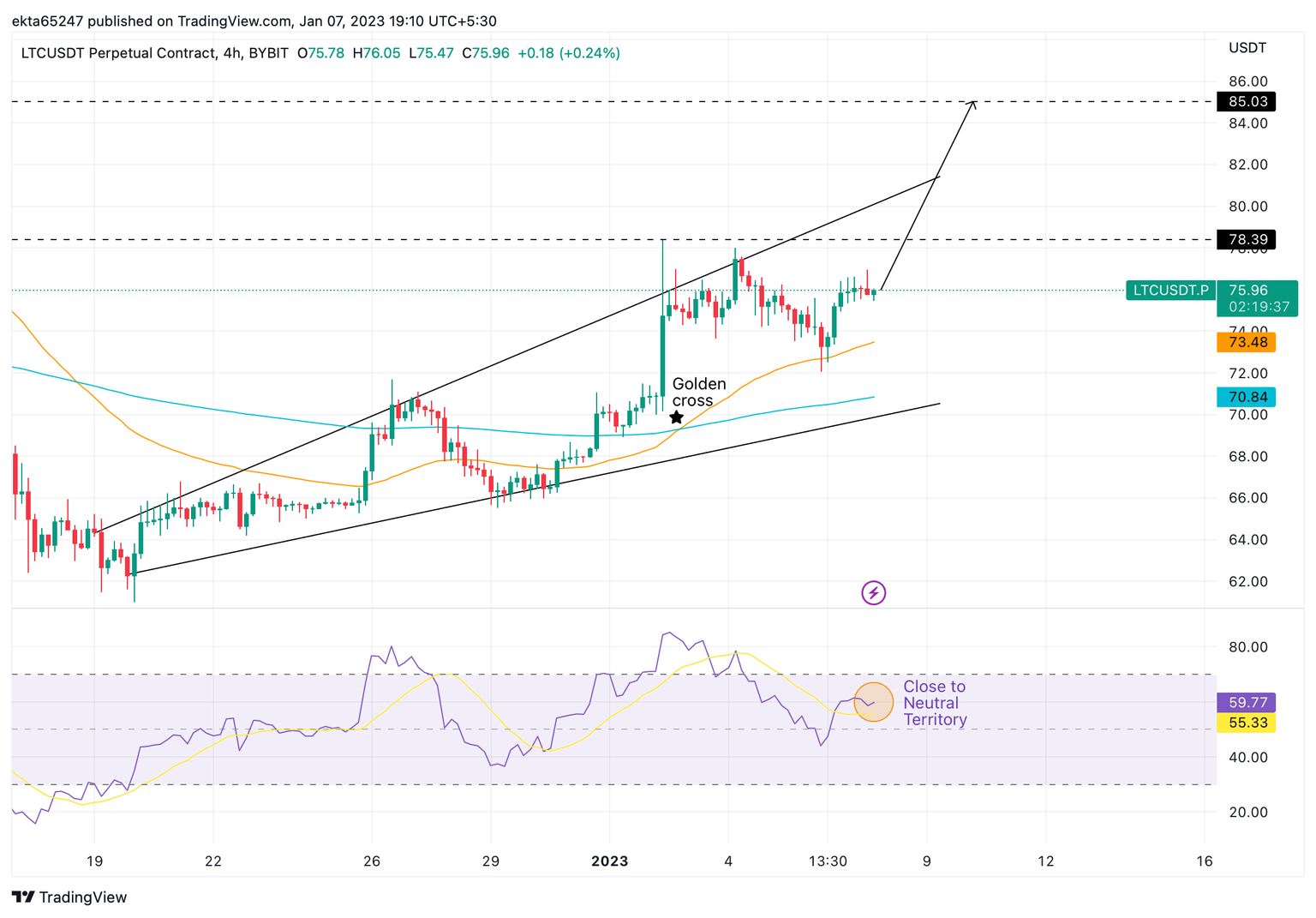

The Litecoin chart below shows LTC’s bullish potential. The target for the payment coin is $85.03. The 50-day Exponential Moving Average (EMA) recently crossed above the 200-day in a bullish indicator, the Golden Cross.

Relative Strength Index (RSI), a momentum indicator, is currently at 59.77, close to neutral territory. This signals there is bullish potential in Litecoin and holders can expect continuation of the uptrend. RSI signals a rising buying pressure in Litecoin.

LTC/USDT price chart

Michäel van de Poppe, crypto analyst and trader believes LTC is ready for a bullish breakout and it is open for a long with the target of $78.39 and $85.03. With sustained buying, Litecoin could continue to rise and break past the upper trendline, a close above the $80 level could validate the bullish thesis.

Litecoin is set to face resistances between $80 and $101. The asset could find support at the 50-day EMA at $73.48 and 200-day EMA at $70.84. Below the $70 level, the payment token could nosedive to support at $63.7.

The outlook on Litecoin is therefore bullish for the week and a decline below the $71, the lower trendline of the ascending channel would imply a bearish trend reversal in the token.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.