- This week’s trading has seen LTC/USD cancel the gains and sliding into a resistance range.

- Litecoin value could increase significantly as the buyers are encouraged to increase their activity.

The weekly timeframe chart shows how Litecoin has been correcting lower since the bull rally at the end of last year. Litecoin recorded all-time highs above $300. However, the downtrend in 2018 has seen Litecoin explore and refresh new lows to the extent it formed a support close to $21.9.

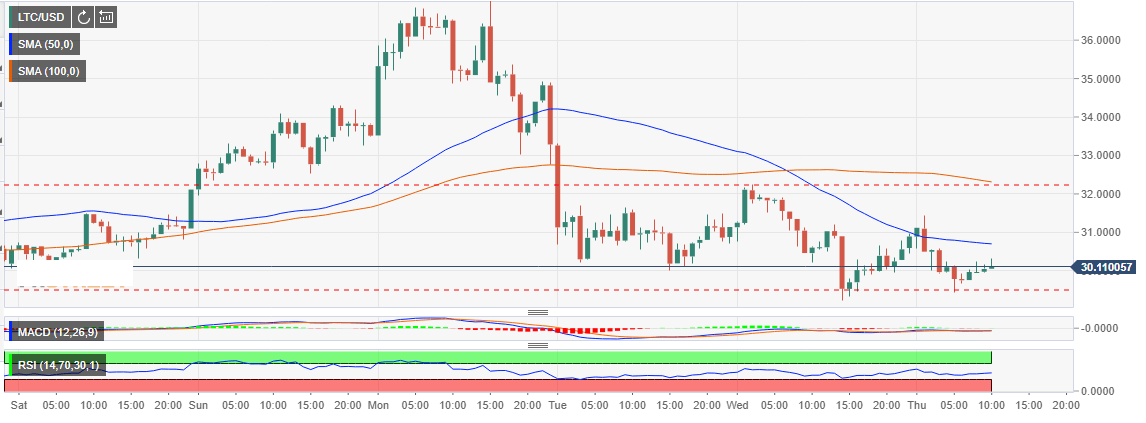

The Declines this December marked the beginning of a reversal that could also be mistaken for a new year rally. The reversal pushed Litecoin price above $36.00 before the bullish momentum came to halt short of $37.00. This week’s trading has seen LTC/USD cancel the gains and sliding into a resistance range. A support has been formed slightly above $29.00 while the range limit stands at $32.26 (coincides with the 100 SMA in the hourly range).

The above mentioned support has paved the way for an ongoing reversal above $30.00. The bulls must however pull the price above the 50 Simple Moving Average which likely to market the beginning of the new year rally. Further correction from the bear range will see growth which will battle the medium-term resistance zone at $37.00.

Another look at the chart, we see the MACD signal stuck slightly below the mean level. If the signal line can cross into the positive region, then we will be able to see Litecoin value increase significantly as the buyers are encouraged to increase their activity. In addition to that, the RSI on the hourly chart is has not sunk into the oversold despite the recent downward correction. In fact, it is in a slightly upward slant. This shows that the buyers have the influence at the moment and the situation is likely to continued towards the end of the year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.