- Litecoin corrects lower 1.8% on the day as the crypto market stays in the red.

- A bullish trend could be brewing in the background.

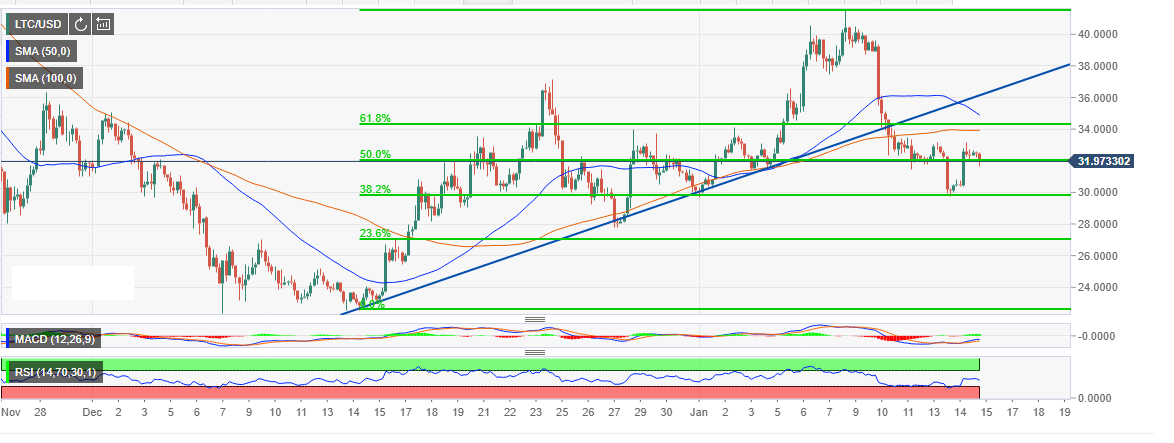

The market is in the red on Tuesday. However, there was a marginal recovery in the market yesterday. Litecoin price, for example, bounced from the support at the 38.2% Fibonacci retracement level taken between the highs of $41.59 and the lows of $22.62. The bullish correction managed to pull above the 50% Fib level but fizzled out short-of $34.00.

Litecoin started this year’s trading with a strong upside momentum. The bulls maintained its position above the trendline support while trading higher highs and higher lows. In fact, there was a break above the resistance at $40. Unfortunately, they could not sustain the momentum as the trend culminated in a lower correction forming lows towards $30.00.

Meanwhile, Litecoin is trading at $31.8 and is below the 1-hour Simple Moving Averages (SMA). The price is dancing with the 50 SMA while the immediate upside is limited by the 100-day SMA. LTC buyers must push the crypto above $34.00 in order for them to embark on a recovery journey towards the psychological $40.00.

On the flipside, if the current bearish trend progresses, LTC/USD is expected to find refuge at $30.00 (38.2% Fib level). Below this level, the buyers will take solace at recent lows around $22.5.

Taking a broader look at the chart, a bullish trend could be brewing in the background since the Moving Average Convergence Divergence (MACD) is trending to the upside from the dip at -1.57. Likewise, the Relative Strength Index (RSI) on the same chart, defended its position above the oversold region. Besides, it has recovered to the current position at 50.00.

LTC/USD 1-hour chart

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

Cardano stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by US Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2.

Solana signals bullish breakout as Huma Finance 2.0 launches on the network

Solana retests falling wedge pattern resistance as a 30% breakout looms. Huma Finance 2.0 joins the Solana DeFi ecosystem, allowing access to stable, real yield. A neutral RSI and macroeconomic uncertainty due to US President Donald Trump’s tariff policy could limit SOL’s rebound.

Bitcoin stabilizes around $82,000, Dead-Cat bounce or trendline breakout

Bitcoin (BTC) price stabilizes at around $82,000 on Thursday after recovering 8.25% the previous day. US President Donald Trump's announcement of a 90-day tariff pause on Wednesday triggered a sharp recovery in the crypto market.

Top 3 gainers Flare, Ondo and Bittensor: Will altcoins outperform Bitcoin after Trump's tariff pause?

Altcoins led by Flare, Ondo and Bittensor surge on Thursday as markets welcome President Trump's tariff pause. Bitcoin rally falters as traders quickly book profits amid Trump's constantly changing tariff policy.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.