- The 5th largest asset is rangebound on Thursday

- Litecoin core wallet is updated.

Litecoin (LTC) is changing hands at $75.24, off the intraday high of $76.27. The fifth largest digital asset with the current market value of $4.6 billion has gained over 1.5% in recent 24 hours moving in sync with the rest of the market.

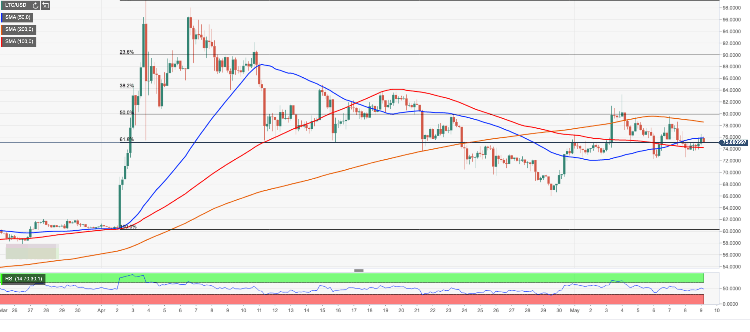

LTC/USD has been rangebound this week as the recovery from May 6 lows is limited by psychological $80.00 with 50% Fibo retracement located on approach. Once the barrier is taken out, the upside momentum is likely to gain traction with the next focus on $83.26 (May 4 high) and $84.34 (38.2% Fibo retracement).

On the downside, the initial support lies with $74.25 handle, strengthened by SMA100 (4-hour). It is followed by May 6 low at $72.28 and psychological $70.00

Litecoin Core update

The developers of the fifth largest digital asset released an update for the cryptocurrency wallet Litecoin Core v0.17.1. The release includes minor interface changes, extended privacy functionality and reduced transaction fees (0,0001 LTC). Thus, at the current exchange rate, users will pay on average $0.15 to have their transactions written in a block. However, in the periods of low demand the fee may be less than $0.01. The developers believe that new functionality will appeal to those who wants to launch their own Lightning Network.

LTC/USD, 4-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.