Litecoin holders countdown 11 days to LTC halving, traders expect bullish price action

- Litecoin halving is 11 days away, analysts observe renewed enthusiasm among LTC traders.

- In the past six months, 1,185 new addresses have added more than 100 LTC to their holdings.

- LTC halving event is likely to catalyze a massive price rally in the altcoin.

Litecoin is less than two weeks away from its halving event when block reward for mining LTC will be slashed in half. LTC holders have displayed enthusiasm as the Litecoin halving event draws close.

LTC price on Binance is $92.58, the altcoin continues to sustain above the key psychological barrier at $90.

Also read: Alt season likely in Q3 with declining Bitcoin dominance, July emerges as altcoin month

Litecoin price sustains above $90 closer to LTC halving

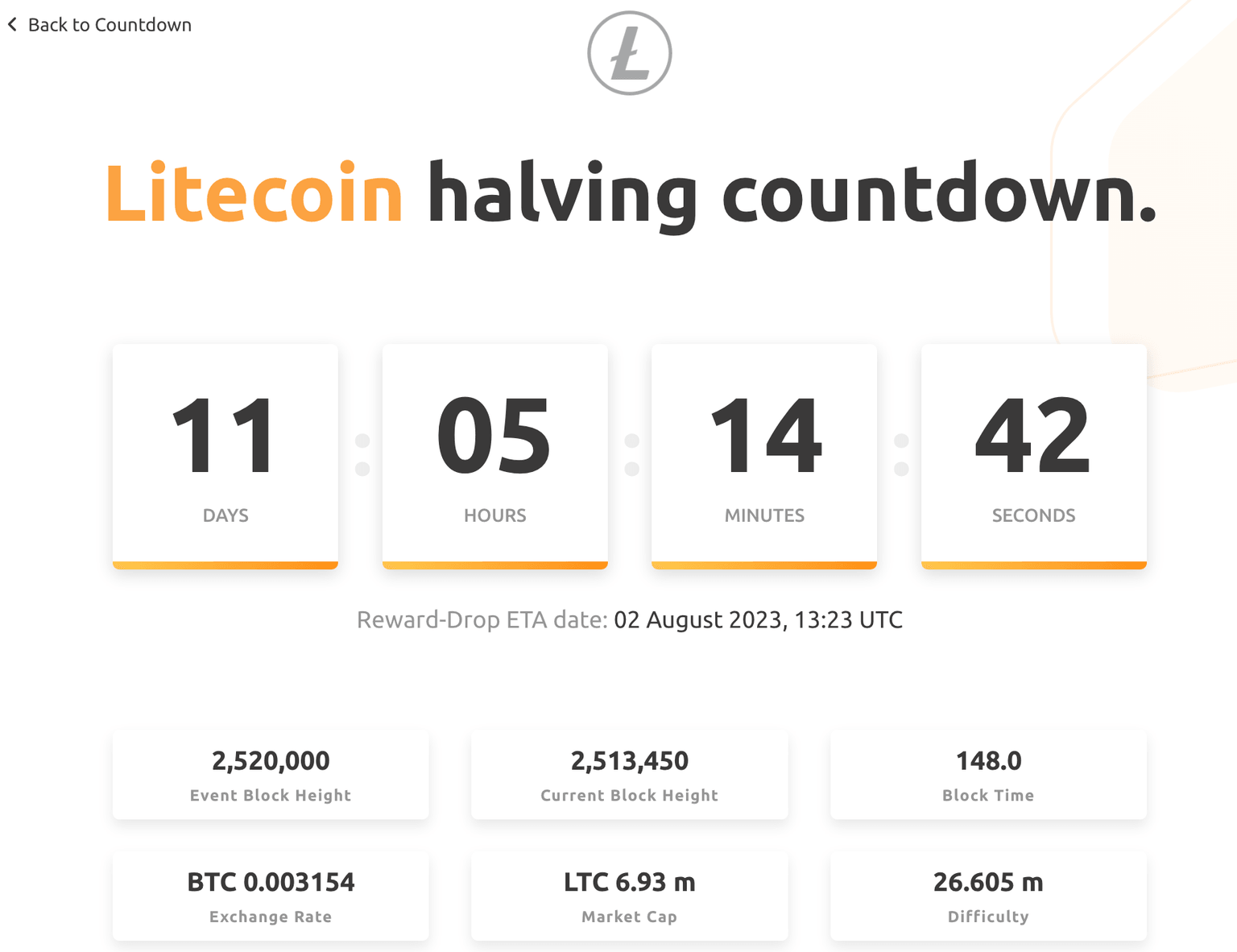

According to the Litecoin halving countdown tracker on Nicehash.com, LTC is 11 days away from its halving. The halving event marks a key milestone for Litecoin holders for two reasons. First it reduces the circulating supply of the asset, as block reward for mining LTC is slashed in half, therefore decreasing the selling pressure on the asset.

Litecoin halving countdown tracker on Nicehash.com

The second reason is that LTC halving events catalyze a rally in the altcoin’s price. Traders are enthusiastic that the scarcity will be enough to sustain the altcoin’s price above $90.

In the months leading up to the altcoin, 1,185 wallet addresses have joined the Litecoin network, holding upwards of 100 LTC each. These entities are bullish on LTC price rally with the upcoming halving event.

Based on data from Santiment, less than 12 days away from the halving, 36,800 wallets have at least 100 LTC each in their wallets. The rise in wallets holding large volume of LTC token is a sign of accumulation, typical of a bullish thesis for the altcoin.

Litecoin entities scoop up more LTC tokens closer to the halving

The alt season narrative has gathered steam in July 2023, after Blockchaincenter.net tracker identified it as altcoin month. Altcoins, including LTC have consistently outperformed Bitcoin throughout the past thirty days, increasing the likelihood of an alt season in Q3 2023. Find out more about it here.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.