Litecoin trading volume rises 50% to $5 million in the final countdown to LTC halving

- Litecoin halving event is due on August 4, barely four days out, with investors monitoring the countdown.

- The event will drop mining rewards by 50%, from 12.5 to 6.25 LTC per block.

- The altcoin is up 5% with a 24-hour trading volume increase of 50% to almost $5 million.

- Historically, the BTC fork sees major moves around halving events on the back of the “buy the rumor, sell the news” case or a typical post-halving rally.

Litecoin price is trading with a bullish bias after taking off in style on July 25. The altcoin continues to rise on the back of a major event in the ecosystem, with investors anticipating a major move.

Also Read: Trading bots feted as UniBot on-chain volume nears 10 million in 24 hours

Litecoin price turns bullish ahead of the LTC halving

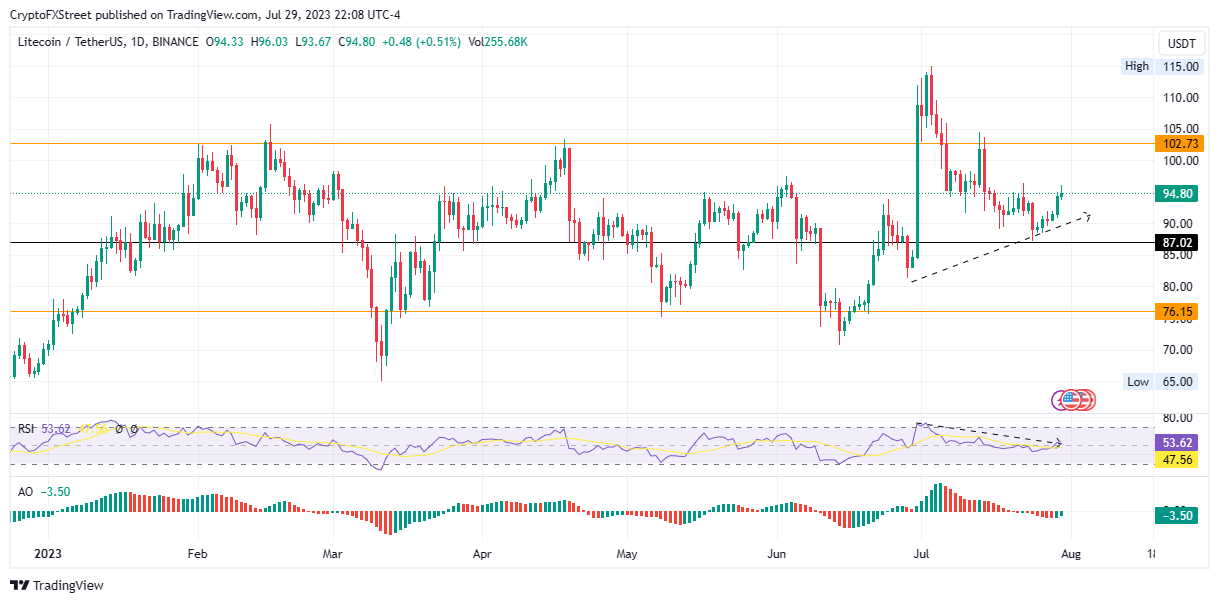

Litecoin (LTC) price is on a course north, moving along an uptrend line with prospects for more gains. This comes ahead of the LTC halving, slated for August 3. The event will reduce mining rewards from 12.5 LTC to 6.25 LTC per block. Notably, up to 2,227 blocks are left, meaning the halving events are still ongoing, with a project of the last one happening in the year 2142.

Litecoin Halving Countdown

Litecoin halving defines an event where rewards to miners will be cut in half. The process goes back to around eight years ago when the first halving of this crypto happened. It takes place every four years, as indicated in the schedule below.

Litecoin Halving Schedule

Litecoin price forecast

At the time of writing, Litecoin price is $94.66, recording a daily rise of almost 5%. This comes amid surging trading volume, up 50% in the last 24 hours to breach the $5 million mark. These points to increased interest in the altcoin that could bode well for its market value.

Historically a Bitcoin fork, LTC sees major moves around halving events on the back of the “buy the rumor, sell the news” case or a typical post-halving rally. As the price action moves along an uptrend line, Litecoin price could score more gains for investors.

Momentum indicators favor this outlook with the Relative Strength Index (RSI), indicating a bullish divergence against the Litecoin price. This happens when the price edges north against an overall foaling RSI. The result of such a technical formation is often a strong move north.

Similarly, the Awesome Oscillators (AO) histograms are soaked in green, suggesting bulls are leading the market. If buying momentum is sustained, LTC could breach the $100 level to tag the $102.73 resistance level. Such a move would constitute a 10% upswing.

Conversely, early profit takers could break the current uptrend, causing a pullback below the ascending trendline. A decisive break below the $87.02 support could invalidate the bullish thesis.

Litecoin halving FAQs

When is the next Litecoin halving?

Litecoin's third block halving event is scheduled at a block height of 2,520,000, estimated to happen around August 3. The current block height is 2,511,587. The first halving took place in 2015 after the block height was 840,000. The second Litecoin halving event occurred in 2019 when the total block height hit 1,680,000. This event takes place roughly once every four years.

What will be the new block reward after the third Litecoin halving?

Halving is an important event for both miners and investors. After halving, the block rewards are slashed in half, as the name suggests. The first halving event in 2015 reduced the block reward from 50 to 25, and the second in 2019 halved it to 12.5. The third halving, scheduled on August 3, will further reduce it to 6.25. This means miners will go from receiving 12.5 LTC for mining a block to 6.25 LTC after the third halving.

How will halving affect Litecoin price?

After a halving event, the emission of LTCs is cut in half, which effectively triggers a reduction in the Litecoin supply. If the demand remains more or less the same, it creates a negative supply shock. The same dynamics are seen if the demand for LTC increases. Due to the reduced supply and high demand, it would trigger a rally in Litecoin price. But traders often anticipate this trend and try to get exposure to LTC before the halving, causing a premature rally and a sell-the-news drop on the day of the event.

Why is Litecoin halving important to LTC holders?

Following a halving event, miners receive 50% fewer rewards for every block they mine, creating scarcity in the altcoin and reducing the circulating supply of the asset. The event's purpose is to control the inflation rate of Litecoin. Halving is a key event influencing the asset's price and market capitalization over time.

How different is Litecoin halving from Bitcoin halving?

From a technical perspective, it is not any different. But from an investor and miner perspective, there are a lot of differences. For example, the concept of halving remains the same for both assets. Still, due to a relatively lower total supply of 21 million and first-mover advantage, Bitcoin's network effect and large market capitalization, as a result, have a significant impact on the crypto ecosystem compared to Litecoin. Additionally, the effect of halving events is more pronounced for Bitcoin because of the asset's dominance. Hence, BTC halving receives more attention.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.