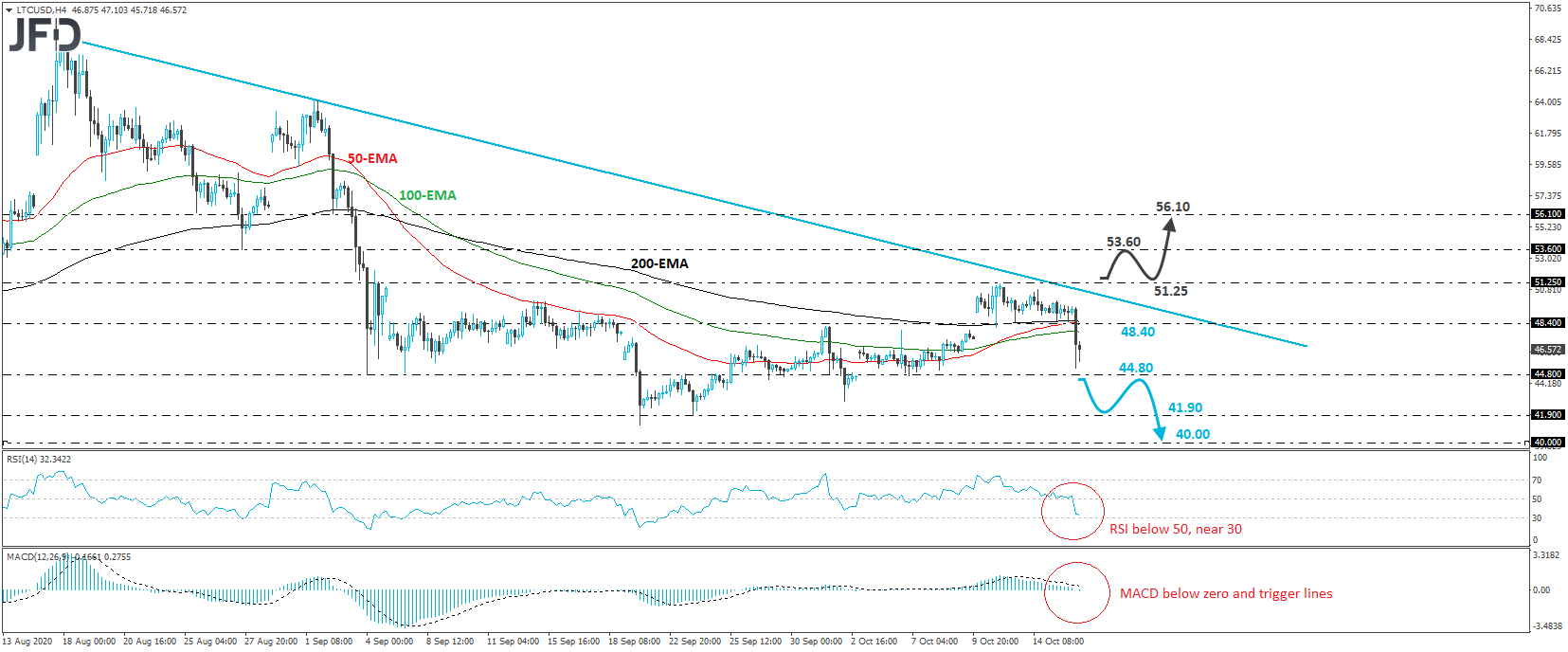

LTC/USD tumbled on Friday, falling below the 48.40 barrier, which supported the price action since Monday. Overall, the crypto continues to trade below a tentative downside resistance line drawn from the high of August 17th, and thus, we would consider the near-term outlook to be cautiously negative for now.

If the bears are willing to stay in the driver’s seat, we would see them challenging the 44.80 zone soon, which supported the price on October 7th. A clear dip below that zone may invite more sellers into the action, who could push for a test near the 41.90 barrier, marked by the low of September 23rd. Another break, below 41.90 may set the stage for declines towards the psychological round figure of 40.00, which prevented the crypto from drifting lower between June 28th and July 5th.

Shifting attention to our short-term oscillators, we see that the RSI lies below 50 and is now approaching its 30 line, while the MACD lies fractionally below both its zero and trigger lines, pointing down. Both indicators detect downside speed which supports the notion for further declines in this cryptocurrency.

In order to abandon the bearish case and start examining a bullish reversal, we would like to see a clear rebound above the peak of October 12th, at 51.25. The price would already be above the aforementioned downside line and thus, the bulls may decide to initially aim for the inside swing low of August 27th, at 53.60. If that level is not able to halt the advance, the next stop may be at 56.10, marked by the inside swing low of September 2nd.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.