Litecoin ETF gets acknowledged by SEC, LTC could stretch its rally to $186

- Litecoin saw double-digit gains after the SEC acknowledged Canary Capital's Litecoin ETF filing.

- This puts it ahead of XRP and Solana ETF filings, which have yet to be acknowledged by the SEC.

- Litecoin could rally over 30% to $186 if it breaks the neckline resistance of an inverted Head-and-Shoulders pattern.

Litecoin (LTC) gained over 15% on Thursday following the United States (US) Securities and Exchange Commission's (SEC) acknowledgment of Canary Capital's Litecoin exchange-traded fund (ETF) 19b-4 filing.

Litecoin surges as Canary Capital ETF filing receives recognition from SEC

Litecoin, a cryptocurrency created from a fork of the Bitcoin blockchain, witnessed a 17% rise as investors expressed excitement towards the SEC's acknowledgment of Canary Capital's 19b-4 Litecoin ETF filing.

The surge reflects rising interest in the cryptocurrency as investors anticipate a smooth review process, ultimately setting the stage for SEC approval.

If the Litecoin ETF is approved, it could send the asset back into the limelight and ignite a wave of mainstream adoption.

The SEC's recognition of Canary Capital's Litecoin ETF filing places it ahead of other altcoin ETF filings, including Solana and XRP. These filings are also in the race for new crypto ETFs, but they have yet to receive an acknowledgment from the SEC.

"Throw in the comments from SEC on the S-1 and this filing is by far the furthest along checking all the boxes," said Bloomberg ETF analyst Eric Balchunas on X.

Other asset managers, including Grayscale, CoinShares and Monochrome, have also filed for Litecoin ETFs with the SEC.

Although the acknowledgment of Canary's filing may take a few months for regulators to review, investors believe there's strong potential for the SEC to green-light the ETF.

This is due to its similar fundamentals with Bitcoin — which already has an ETF — and the current SEC administration's shift toward a better regulatory environment for crypto, under acting Chair Mark Uyeda.

With the new approach to digital asset regulations, the crypto community is optimistic about the SEC’s quick approval. Such an outcome could instill confidence in investors and send LTC to price levels not seen since the 2021 bull run.

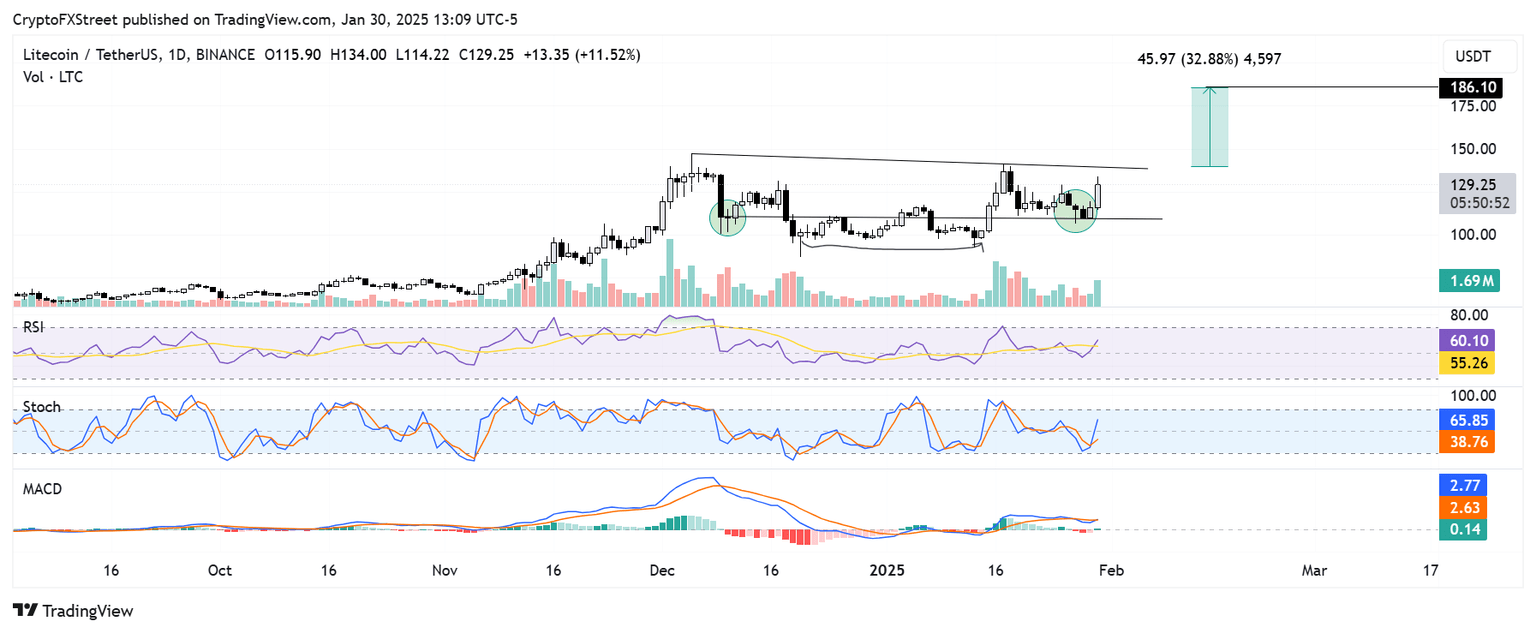

On the technical side, Litecoin is developing an inverted Head-and-Shoulders (H&S) pattern on the daily chart.

LTC/USDT daily chart

A move above the neckline resistance of the pattern — while establishing it as support — could see Litecoin rallying over 30% to a two-year high of $186. However, a breach of the support level near $108 will invalidate the thesis.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their neutral levels, indicating rising bullish momentum.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi