Litecoin could display strong performance ahead of its next halving event

- Litecoin halving event is scheduled for August 3, 2023, a little over 100 days from now.

- Litecoin price could display strong performance for the weeks to come, as the countdown to LTC halving continues.

- In 2019, LTC topped out 7 weeks prior to its halving, rising over +500% from the bear market bottom.

Litecoin is approaching its next halving, an event scheduled to occur every 840,000 blocks, according to the network’s predetermined halving schedule defined in its protocol. The first LTC halving date was in 2015 followed by the last one in 2019. Based on the prediction, the next occurence should be on August 3, 2023. Following the event, LTC mining rewards (LTC block) will be reduced from 12.5 LTC to 6.25 LTC.

Litecoin halving, what is it?

The Litecoin network issues new LTC tokens every 2.5 minutes (or thereabouts). Halving defines the day the amount is halved, with the number cut in half every four years. Putting it in perspective, the amount of new LTC issued in 2015 based on the aforementioned interval dropped from 50 to 25. Similarly, in 2019, the number dropped from 25 to 12.5. Accordingly, in the 2023 halving event, the number will drop from 12.5 to 6.25.

With this event, the amount of new Litecoin generated per block is reduced by 50%, thereby lowering the supply of new LTC. As is characteristic of a typical market, a reduced supply matched with a steady demand results in price hikes. Given that the halving lowers the supply of altcoin against a steady demand, experts expect Litecoin price to rally, as has been the case for the previous cycles.

Halving events often turn out to be bullish because the event sees new supply into the market being reduced by half. Based on reports by crypto analyst Rekt Capital, Litecoin usually rallies quite strongly in the weeks leading to its halving. For instance, LTC rose 820% after bottoming out 122 days ahead of its first-ever halving in 2015, before surging another 12,400% afterward.

2.

— Rekt Capital (@rektcapital) January 8, 2023

On the other hand, how much does $LTC rally AFTER its Halving?

After Halving 1, #LTC rallied +14200%

After Halving 2, LTC rallied +1574%

Therefore, a key historical tendency emerges:

• LTC tends to rally more post-Halving compared to pre-Halving#BTC #Crypto #Litecoin pic.twitter.com/3L1gycttS1

In 2019, it soared 550% after bottoming 243 days in the weeks leading to that year’s halving, before rising around 1,573% after the event.

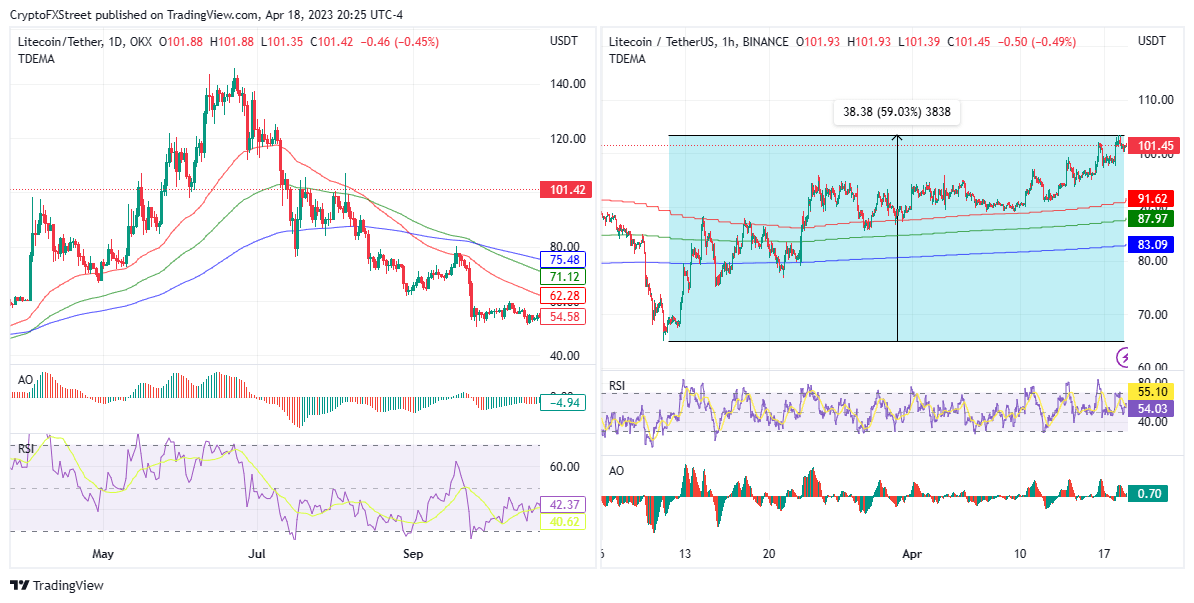

LTC/USDT 1-day chart 2019, LTC/USDT 1-day chart 2023

Based on the chart above, Litecoin price is up almost 60% since early March, with the potential of a continued uptrend as the countdown to the halving continues. In its astonishing price action, the altcoin managed to outperform its peers, including Avalanche (AVAX), Polkadot (DOT), and Tron (TRX), which recorded rallies below 40% during the same period.

AVAX/USDT 1-day chart, DOT/USDT 1-day chart, TRX/USDT 1-day chart

Not the end for Litecoin price

With around 15 weeks to the halving (based on the Litecoin clock), the rally for Litecoin price is still far from over, positioning LTC as the token most likely to benefit the most from the alt season. Moreover, as reported, LTC could also benefit from Bitcoin dominance, courtesy of the affiliation between the altcoin and the king crypto that has seen it christened “Silver to Bitcoin’s Gold.”

The halving could present investors with a much-needed breath of fresh air, most of whom have suffered the wake of tumultuous monetary policies. More specifically, some countries like Argentina, Turkey, and Lebanon, among others, have seen their fiat currencies become heavily devalued causing a diminishing purchasing power.

As was the case recently, the collapse of financial institutions revealed the need for an adhesive collaboration between traditional and contemporary finance, influencing decisions that for example, might be in the best interest of banks not to draw a line between themselves and crypto. Thanks to Bitcoin and Litecoin, investors can enjoy an open-source, transparent, and sturdy form of money, as halving events typically demonstrate that there is actually a way to have a consistent and transparent monetary policy.

Nevertheless, the only threat to an explosion in Litecoin price could be broader market fears amid rumors of an economic recession estimated to occur between now and early September.

The only threat to an explosion in Litecoin price could be broader market fears amid rumors of an economic recession estimated to occur between now and early September.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.