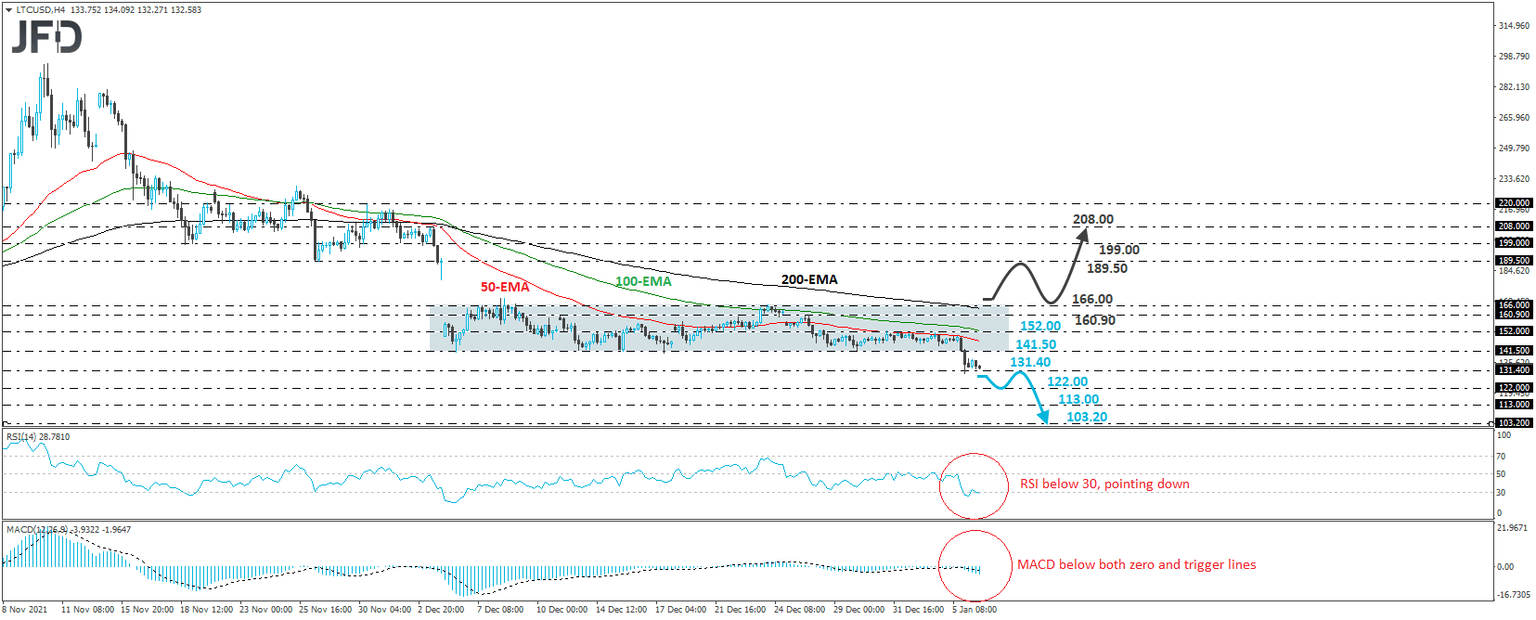

Litecoin breaks the lower end of a sideways range

LTC/USD traded lower yesterday, breaking below 141.50, which is the lower end of the sideways range that had been containing the price action since December 5th. Although the rate has paused for now near the 131.40 level, the dip below 141.50 has turned the outlook from neutral to bearish in our view.

A clear break below 131.40 could pave the way towards the 122.00 zone, marked by the inside swing high of July 23rd, the break of which could extend the fall towards the low of that day, at around 113.00. If the bears are not willing to stop there either, we could see them pushing the action towards the low of July 20th, at 103.20.

Taking a look at our short-term oscillators, we see that the RSI turned down and fell back below its 30 line, while the MACD lies below both its zero and trigger lines. Both indicators detect negative speed and support the notion for further declines in this cryptocurrency.

We will start examining the bullish case only upon a break above the 166.00 hurdle, which is the upper bound of the range. This will confirm a forthcoming higher high on the daily chart and may set the stage for extensions towards the 189.50 zone, marked by the inside swing low of November 26th, the break of which could extend the advance towards the 199.00 zone, which provides support on December 2nd and 3rd. Another break, above 199.00 may allow the bulls to test the high of December 3rd, at 208.00.

Author

JFD Team

JFD