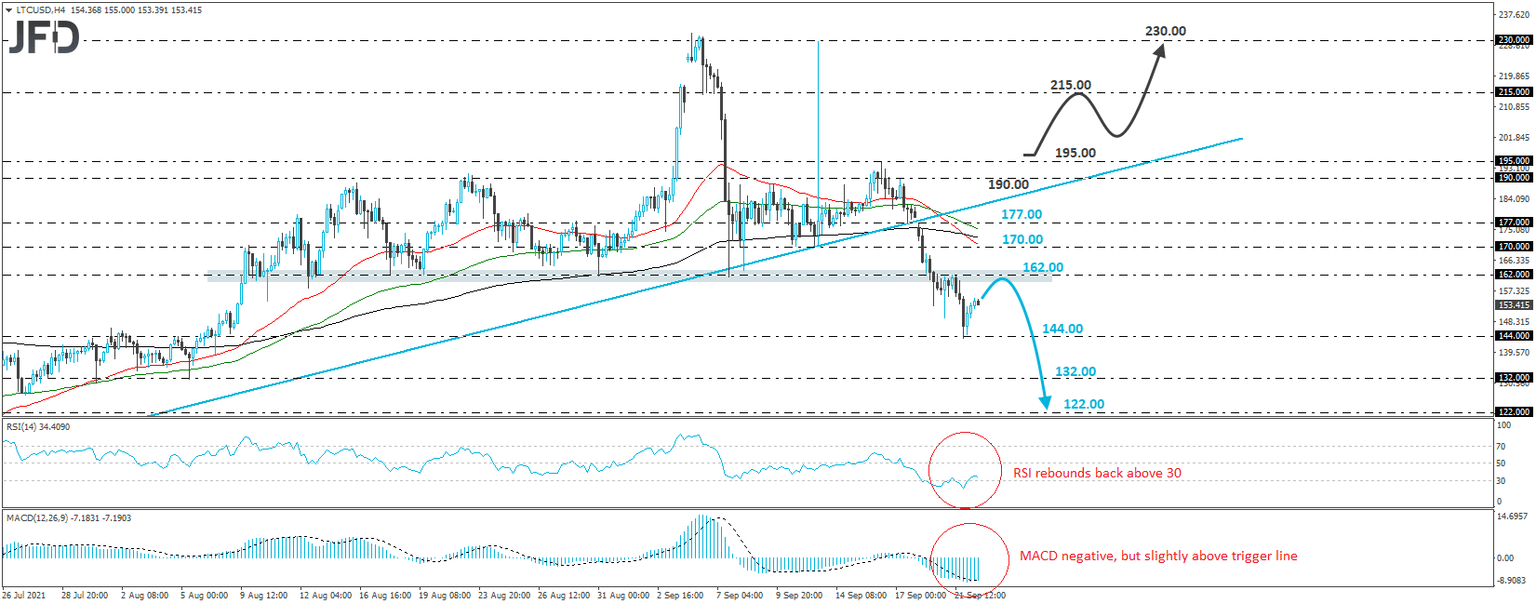

Litecoin breaks below key territory of 162.00

Litecoin entered a tumbling mode on September 16th, after it hit resistance at 195.00. Then, on September 19th, it broke below the upside support line taken from the low of July 20th, while the next day, it fell below the key support (now turned into resistance) zone of 162.00. That zone had been acting as a floor for the crypto since August 10th. With all these technical signs in mind, we would consider the short-term picture to be negative.

Yesterday, Litecoin hit support at 144.00 and then it rebounded somewhat. However, even if the rebound continues for a while more, we see decent chances for the bears to take charge again from near the 162.00 area. A forthcoming wave may result in another test at 144.00, the break of which could pave the way towards the 132.00 zone, marked by the low of August 5th. If that area is not able to hold either, then a break lower may set the stage for extensions towards the 122.00 territory, marked by the inside swing high of July 23rd.

Shifting attention to our short-term oscillators, we see that the RSI rebounded and exited its below-30 zone, while the MACD, although negative, has bottomed and just poked its nose above its trigger line. Both indicators detect slowing downside speed and support the notion for some further recovery before the next leg south.

On the upside, we would like to see a return back above 195.00, which is the high of September 16th, before we start examining whether the outlook has turned bullish again. The crypto will already be back above the aforementioned upside line and may climb towards the 215.00 area, marked by the inside swing low of September 6th. If that area surrenders as well, then the next hurdle to consider may be the spike high of September 13th, at 230.00.

Author

JFD Team

JFD