- Litecoin brilliant performance elevates to the 4th position on the market.

- The cryptocurrency market seems to be waking up from the slumber mode.

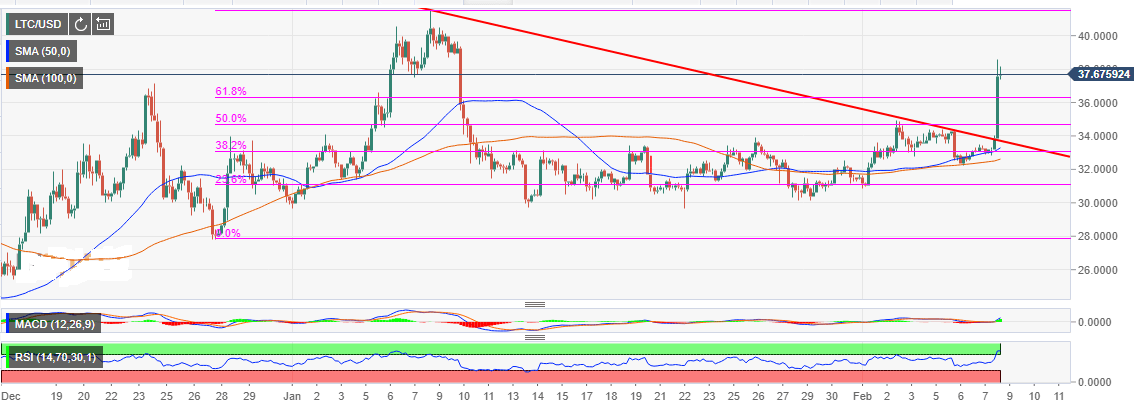

- This higher correction is likely to continue and a step above $40.00 is imminent.

Litecoin performance today has left many in surprise. The digital asset surged over 14% in less than three hours. The rise from a low of $33.00 stepped above $38.00 before starting to slow down. In addition to that, the ballistic rise has pushed LTC up in terms of market capitalization. At the moment, Litecoin is sitting comfortably in the fourth position behind Bitcoin (BTC), Ripple (XRP) and Ethereum (ETH).

The brilliant performance is believed to be caused by positive sentiments towards the crypto following the announcement that the network next goal is to add privacy and fungibility features. As reported by FXStreet yesterday, developers at Litecoin are currently working in collaboration with Mimblewimble to enable direction conversion of LTC and MW assets.

After an elongated period of declines, the cryptocurrency market seems to be waking up. Litecoin has for the past six weeks stayed above the support at $30.00. However, the crypto has not been able to overcome the selling pressure at $40.00 since the lower correction in the first week of January.

At present Litecoin is trading at $37.71 after correcting higher more than 14% on the day. The bulls pulled above the descending trendline resistance. This ignited more gains above the 61.8% Fib retracement level with the last swing high of $41.53 and a low of $27.85. All the indicators are in the green with the Relative Strength Index (RSI) buried in the overbought region while the Moving Average Convergence Divergence (MACD) heading north above the mean line (0.0). This higher correction is likely to continue and a step above $40.00 is imminent in the short-term.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Bitcoin Weekly Forecast: Will the “Uptober” rally reach a fresh all-time high?

Bitcoin continues to climb this week after breaking its resistance barrier, aiming for a new all-time high. US spot Bitcoin ETFs posted $1.86 billion in inflows until Thursday, the largest streak of inflows since mid-July.

Crypto Today: Main tokens gain as Bitcoin is less than 10% away from all-time high

Bitcoin climbs above $68,000 and pulls back as market participants turn greedy, according to the indicator that checks trader sentiment. Ethereum holds gains above $2,600 and XRP hovers around $0.55 on Friday.

Solana Price Forecast: SOL gains 2% as community discusses Firedancer validator for better performance

Solana gains 2% as its community discusses performance improvements through its new validator, Firedancer. Bitcoin’s Layer 2 project Solv Protocol launched BTC staking token on the Solana blockchain.

Bitcoin: Will the “Uptober” rally reach a fresh all-time high?

Bitcoin (BTC) rallied nearly 8% so far this week until Friday after breaking its resistance barrier, aiming for a fresh all-time high (ATH). This rise in Bitcoin’s price is supported by an increase in institutional demand, which showcased a $1.86 billion inflows this week, the largest streak of inflows since mid-July. Rising apparent demand and institutional reports suggest that the current BTC cycle resembles the third halving, when prices increased sharply.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.