Litecoin adoption bolsters with Visa as LTC dip triggers a 20% rally

- Litecoin price is likely to rally 20% after a dip into the $210 to $233 demand zone.

- LTC can be used anywhere Visa is used, according to a recent announcement.

- A lower low below $210 will invalidate the bullish thesis.

Litecoin price has seen a sharp decline over the past day and might continue to drop more before it sees an uptick in buying pressure. Investors can expect LTC to bounce off a crucial demand zone to restart an upswing.

Visa and LTC payments

Litecoin adoption seems to be taking a massive leap as the official Twitter account of the cryptocurrency revealed that ‘Litecoin Card’ can be used to convert LTC to fiat at the time of payment.

Litecoin is accepted anywhere VISA is.. the #Litecoin Card converts $LTC at the time of purchase. You can also connect the card with the @Litewallet_App #PaywithLitecoin #Hodl #SundayThoughtshttps://t.co/rOzz9zoXRD pic.twitter.com/AR4wXqCPg6

— Litecoin (@litecoin) November 14, 2021

Litecoin Card is a fintech platform powered by Unbanked and allows users to pay in real-time using cryptocurrencies. The Litecoin Twitter account stated.

Litecoin is accepted anywhere VISA is.

This adoption will allow users to actively use LTC for purchasing whatever they want, just as how a Visa debit/credit card would work. While this adoption increases the fundamental value of the altcoin, the development comes right after AMC Theatres’s announcement that they will accept Litecoin as a form of payment.

Together with the fundamentals of LTC seeing a massive boost, the overarching technicals also suggest that an uptrend is likely.

Litecoin price prepares for move higher

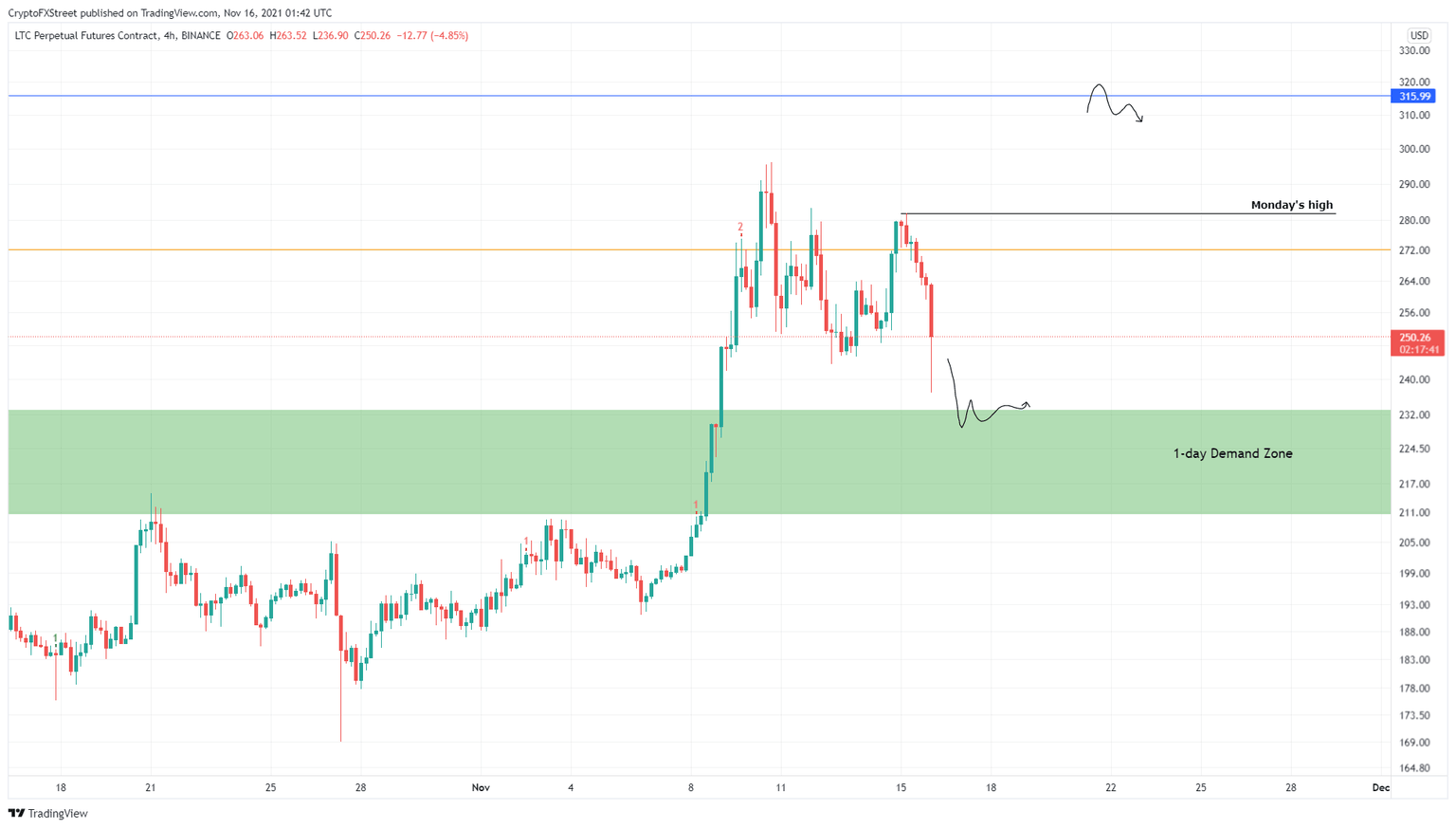

Litecoin price has been stuck consolidating above $210 to $233 demand zone and the $315 resistance barrier for roughly a week now. However, the recent 15% correction seems to have triggered a move lower.

Going forward, investors can expect Litecoin price to dip into the said demand zone. This move will allow LTC to recuperate and give the sidelined buyers an opportunity to buy the altcoin at a discounted price. Therefore, investors can expect Litecoin price to rally higher and encounter the 50% retracement level at $272.

While this barrier is significant, a sweep of Monday’s high at $281 would likely be the market makers’ target. This move would represent a 20% upswing from $233.

LTC/USDT 4-hour chart

On the other hand, if Litecoin price fails to bounce off the $210 to $233 demand zone but proceeds to remain inside it, things would start to turn awry. A breakdown of the $210 level and a daily close below it would invalidate the bullish thesis.

In such a scenario, Litecoin price could retest the November 6 swing low at $190.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.