LINK trading volume skyrockets 160%, price shoots 10% as Chainlink activates CCIP for DeFi-TradFi bridge

- LINK price is up 10% on the back of a 160% surge in 24-hour trading volume.

- The uptick follows Chainlink network activating its Cross Chain Interoperability Protocol on Ethereum, Optimism, Polygon, and Avalanche blockchains.

- As the biggest oracle provider in crypto, Chainlink founder and CEO Sergey Nazarov says the move will link DeFi with TradFi.

- Multiple banks have signed in to leverage CCIP’s complete token transfer capabilities while DeFi leaders look to unlock cross-chain economy.

-637336005550289133_XtraLarge.jpg)

Chainlink (LINK) price is bullish, defying current bearishness in the crypto market as Bitcoin (BTC) fails to provide direction. The token’s stats are flashing green on CoinMarketCap, suggesting optimism in the LINK market. It comes amid a new network development poised to meet users where Decentralized Finance (DeFi) and Traditional Finance (TradFi) intersect.

Also Read: Whales are secretly accumulating these two DeFi coins: LINK, UNI

LINK market shows optimism as Chainlink activates CCIP

LINK, the ticker token for the Chainlink ecosystem, is enjoying the rewards of a bullish market, rising almost 10% in market value alongside a 160% increase in 24-hour trading volume.

The bullishness rides on the back of a new Chainlink network news involving the integration of decentralized finance (DeFi) with traditional finance (TradFi) for user convenience.

1/ The Chainlink Cross-Chain Interoperability Protocol (CCIP) has officially launched on Avalanche, Ethereum, Optimism, and Polygon mainnets.#LinkTheWorld pic.twitter.com/SdLVyaapg3

— Chainlink (@chainlink) July 17, 2023

In a July 17 blog announcement, Chainlink founder and CEO Sergey Nazarov revealed the network’s plans to activate its Cross Chain Interoperability Protocol (CCIP), which will be available to developers beginning July 20.

Chainlink’s CCIP leverages Oracle network for a competitive advantage

Based on the announcement, CCIP will leverage Chainlink’s expansive Oracle network as a competitive edge while capitalizing on TradFi associations. The feature will run on the Ethereum, Optimism, Polygon, and Avalanche blockchains to provide a communication bridge between networks, including the safe transfer of data and assets.

5/ On July 20, CCIP will become available to all developers across five testnets:

— Chainlink (@chainlink) July 17, 2023

• Arbitrum Goerli

• Avalanche Fuji

• Ethereum Sepolia

• Optimism Goerli

• Polygon Mumbai

Sign up here to get notified as soon as it’s available on testnet: https://t.co/gdE5wd7W8L

Nazarov told Blockworks that:

One oracle network is responsible for channeling messages and value. The other one is responsible for monitoring and determining if the properties of the transactions going through the first one are risky or not.

Besides serving as a bridge, CCIP can also facilitate the full token transfer, with the press release highlighting the presence of a distinct Active Risk Management (ARM) network. This network like banks, prevents malicious cross-chain activities by halting services upon the slightest suspicion, thus protecting user funds.

LINK’s CCIP meets users at the DeFi-TradFi intersection

Chainlink’s Cross Chain Interoperability Protocol can link DeFi with TradFi, with up to nine banks already signed up for CCIP’s token transfer capabilities. Citing a press release, these banks include “Australia and New Zealand Banking Group (ANZ), BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange (SDX), and The Depository Trust and Clearing Corporation (DTCC).

One use case for the CCIP, as used by the Society for Worldwide Interbank Financial Telecommunication (Swift), is for global banks to bring industry-grade valuable asset tokens into the DeFi space. According to Nazarov, this will ultimately expand the blockchain industry while providing diversified collateral.

Chainlink price rises 10% on the news

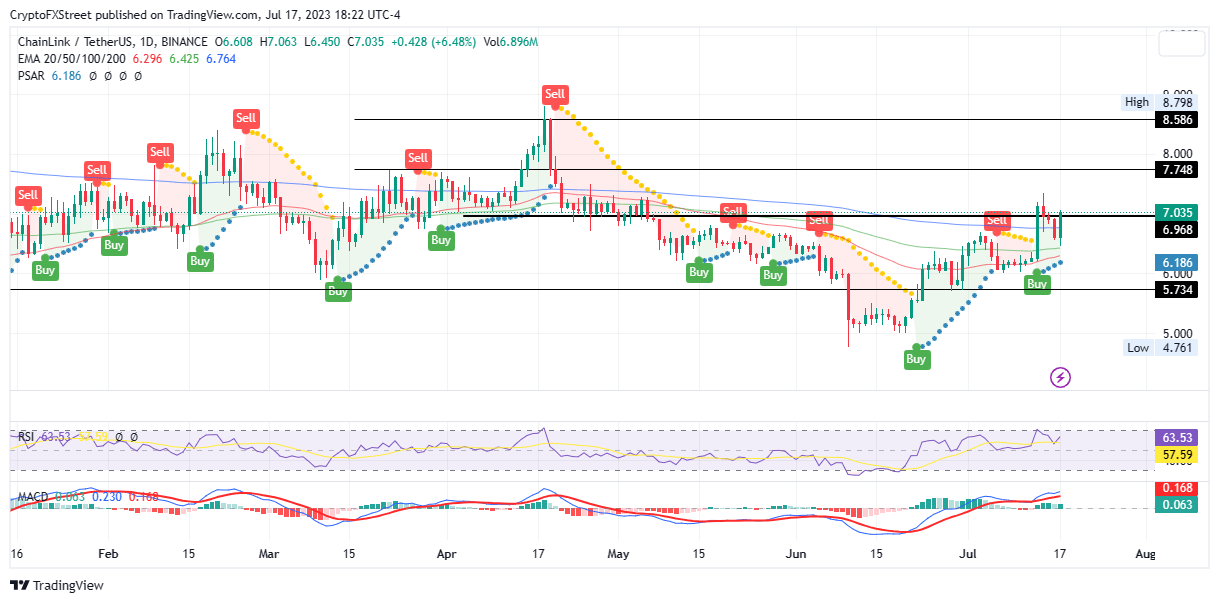

Chainlink (LINK) price is up almost10% on this news, extrapolating the bullishness that began around June 21. This is indicated by the Parabolic SAR indicator, which continues to track the asset’s price for a consecutive 30 days.

The Relative Strength Index (RSI) points north, suggesting rising momentum. This, coupled with the position of the Moving Average Convergence Divergence (MACD) indicator above the midline, shows that bulls are leading the market.

Accordingly, Chainlink price could extend north to tag the $7.7 resistance level or reclaim the April 18 highs around $8.5 in a highly bullish case. Such a move would constitute a 20% climb from the current levels.

LINK/USDT 1-Day Chart

Conversely, if profit-takers pull the trigger, Chainlink price could lose the support offered by the 200-, 50-, and 100-day Exponential Moving Averages (EMA) at $6.7, $6.4, and $6.2 levels, respectively, before a retest of the formidable support at $5.7.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.