LINK, PYTH rally as top Chainlink oracles secure over $50 billion in value

- Chainlink and its oracles Pyth Network, WINKLink, Chronicle, RedStone, and Switchboard secure over $50 billion in assets.

- The oracles support multiple blockchain networks and DeFi projects in the ecosystem.

- LINK and PYTH gain nearly 3% on Tuesday, WIN adds nearly 1% and XNL falls 7%.

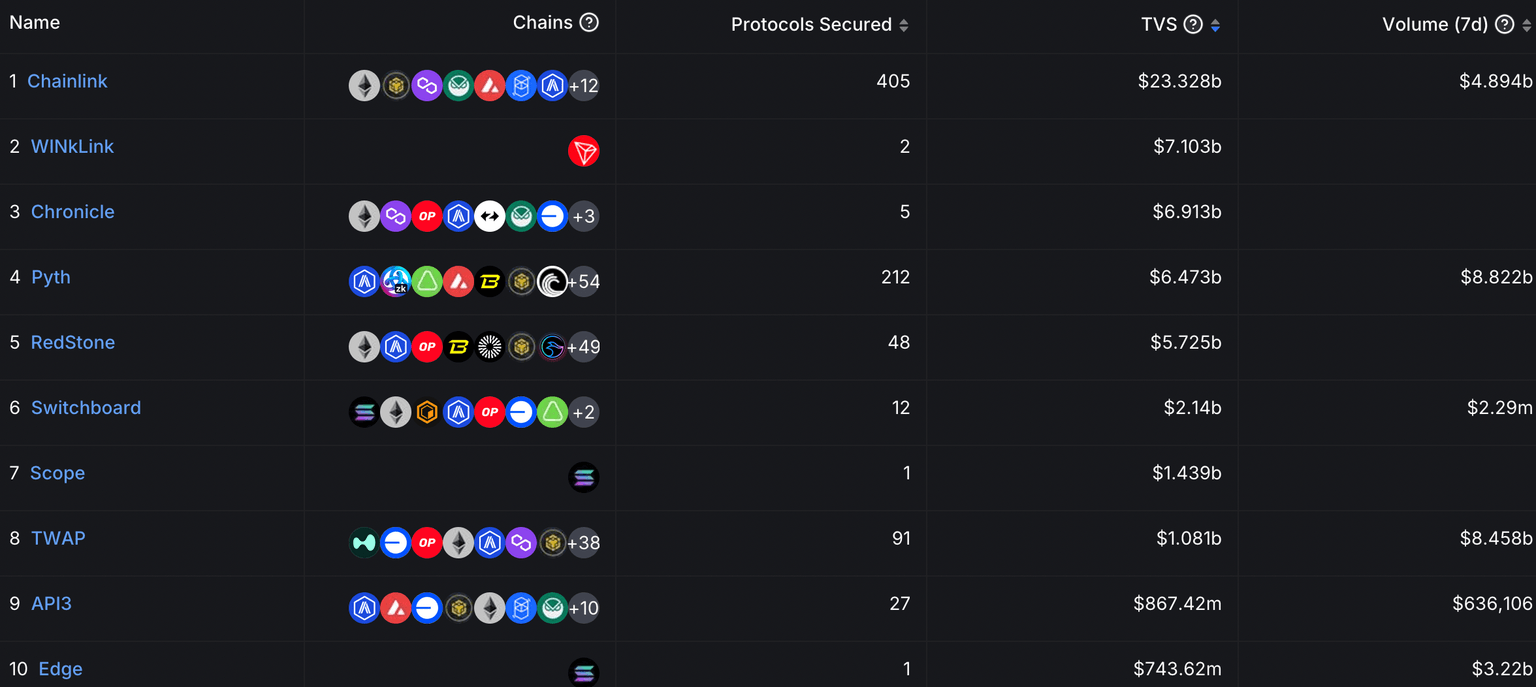

Chainlink (LINK) and its oracles Pyth Network (PYTH), WINKLink (WIN), Chronicle (XNL), RedStone and Switchboard have secured over $50 billion in crypto assets across blockchains, according to data from DeFiLlama. Most of the tokens linked to these oracles, which provide world data and price feeds to smart contracts and blockchains, are posting gains on Tuesday

LINK and Chainlink-based oracle projects gain

LINK gained 2.36% on Tuesday, with its network securing $23.33 billion across 405 blockchains, according to DeFiLlama. The oracles based on the Chainlink ecosystem include PYTH, WIN, XNL, Redstone and Switchboard, as seen in the chart below:

Chainlink, WINKLink, Chronicle, Pyth, Redstone and Switchboard secure over $50 billion in assets

Chainlink powers several DeFi projects by providing price and data feeds and secures value for applications across the crypto ecosystem. Chainlink ecosystem’s LINK and PYTH gain between 2% and 3% on Tuesday, WIN adds 1% while XNL loses 7%.

RedStone and Switchboard secure $5.72 billion and $2.14 billion in value across over 50 blockchains. Crypto market participants await RedStone’s token launch, although there is no official announcement for the expected launch date.

Chainlink announces RWA partnership

Chainlink recently partnered with Australian bank ANZ in the Monetary Authority of Singapore’s (MAS) project Guardian. T. LINK’s Cross-chain Interoperability Protocol (CCIP) technology will help secure the cross-chain exchange of real world assets tokenized on the network.

.@ChainlinkLabs is officially partnering with ANZ—a leading Australian bank with over A$1 trillion in AUM—in the Monetary Authority of Singapore's Project Guardian.#Chainlink CCIP will help enable the secure cross-chain exchange of tokenized RWAs. https://t.co/nlXJPJKjDv

— Chainlink (@chainlink) September 30, 2024

The development implies higher utility and adoption of LINK token.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.