Like Terra’s UST, this algorithmic stablecoin lost peg and crashed to $0.54

- Deus Finance’s DEI, an algorithmic stablecoin, lost its peg and nosedived to $0.54 recently.

- The stablecoin is backed by nearly 20% of DEUS tokens and other stablecoins like USDC, unlike TerraUSD.

- Deus Finance announced that the team is working around the clock to re-peg DEI.

After Terraform Lab’s TerraUSD (UST) nosedived and suffered a de-peg, the number of stablecoins losing their $1 peg has increased. Deus Finance’s DEI recently plummeted from its peg and hit $0.54.

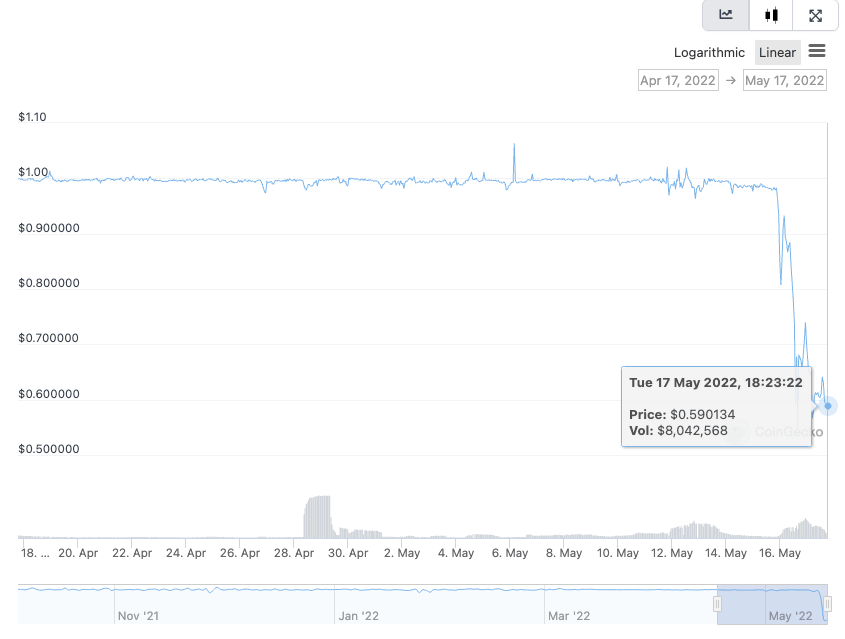

DEI collapsed after losing its peg, hits $0.54

A stablecoin on the Fantom network, DEI, by Dues Finance, became the latest stablecoin to lose its peg. DEI nosedived to a $0.54 low after losing its $1 peg. Unlike TerraUSD (UST), DEI is backed by 20% of DEUS tokens and by other stablecoins.

DEI price chart

DEI is considered a low-risk stablecoin, compared to alternatives like Tether USD (USDT) and USD Coin (USDC) since it is a fractional reserve stablecoin. DEI does not require over-collateralization; however, the majority of its collateral is stablecoins like USDC.

The composition is free-flowing, and currently, nearly 20% of DEI’s reserves are DEUS tokens. The collateral ratio of the stablecoin DEI is dynamic and determined via arbitrage bots.

DEI followed the trend of stablecoins losing their peg, like Terra’s UST and Tether’s USDT.

Proponents have identified two critical reasons for DEI losing its peg and plummeting to a low of $0.54 level. In March 2022, nearly $13 million worth of DAI and ETH was stolen from Deus Finance. This was a key reason for the platform closing its DEI lending contract. Deus Finance’s developers paused DEI redemptions, further fueling a bearish sentiment among investors.

The Deus Finance team has allayed holders’ fears by announcing that they are working around the clock to restore the DEI peg. The team has implemented mitigation measures for long-term stability and reestablishing DEI’s peg at $1.

Our team is working around the clock to restore the DEI peg. Mitigation measures were implemented immediately and solutions are being developed for long-term stability.

— DEUS Finance DAO (@DeusDao) May 16, 2022

DEI peg mechanism: https://t.co/KKt3Tsam6F

Bond program: https://t.co/UBhE3XAY7K

Further updates to follow.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.