Like DOGE, XRP going vertical is a good indicator of market froth, Bitcoin peaks

Crypto traders are used to seeing a price surge in non-serious cryptocurrencies such as dogecoin (DOGE) as a sign of market froth. Now it looks as though XRP, the payments-focused cryptocurrency, can also be used as an indicator for bull-market peaks in bitcoin (BTC).

Unlike meme tokens like DOGE and shiba inu (SHIB), XRP has utility. It is used by Ripple to facilitate cross-border transactions, which places it in a bucket different from the memecoins.

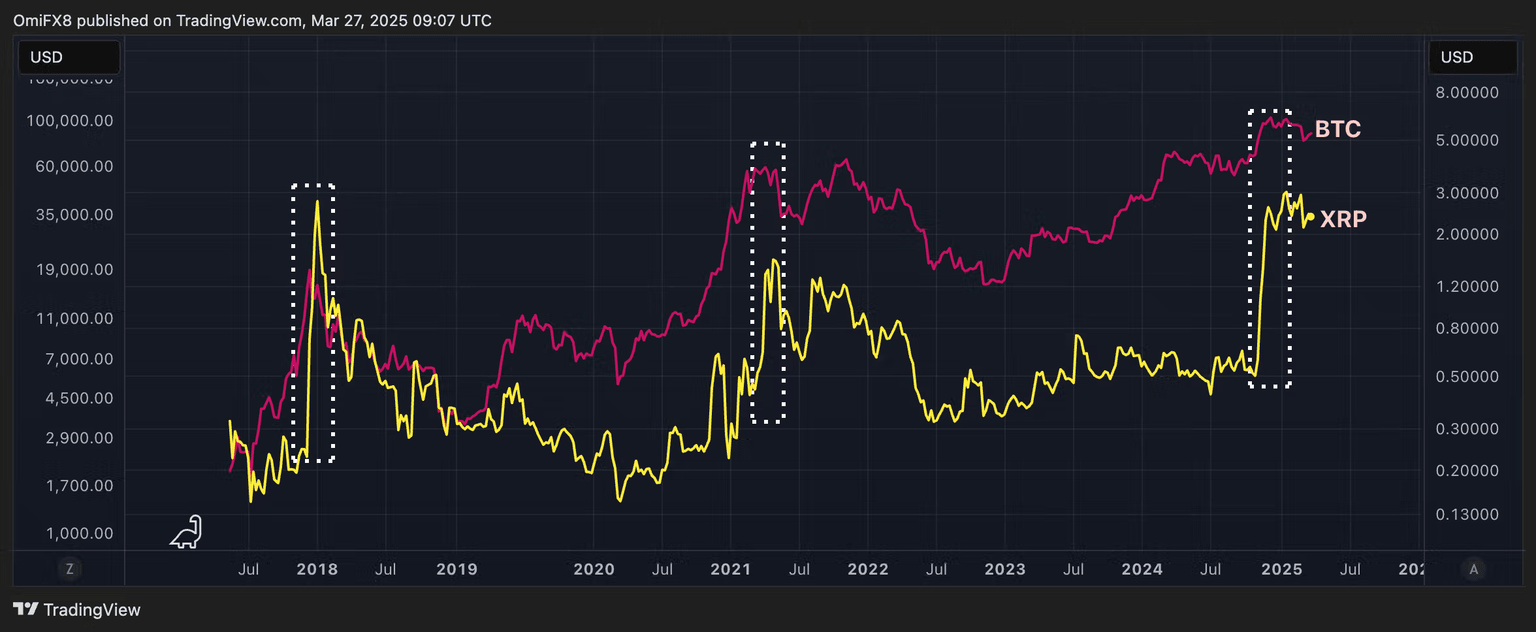

Even so, since 2017, XRP has been a contrary indicator for bitcoin bulls, tending to rally— often soaring several hundred percent in a short time — in the final stages of BTC bull runs, marking the point at which bitcoin ultimately peaked.

XRP experienced a remarkable 10-fold rally from December 2017 to early 2018, coinciding with bitcoin's peak at around $20,000, before entering a bear market that lasted almost a year.

A similar near-vertical spike in XRP occurred in early 2021, marking the peak of another bull market in bitcoin. And XRP's surge of approximately 240% in late 2024 foreshadowed bitcoin's bull market peak above $109,000, followed by a decline below $80,000.

As the saying goes: "Once is happenstance, twice is a coincidence, and three times is a trend."

The next time BTC is running hot, savvy traders may want to keep an eye on XRP for potential signals regarding the end of the bull run.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.