- Lido DAO token declined during the intra-day trading on May 18 following a 40% rally in the last three days.

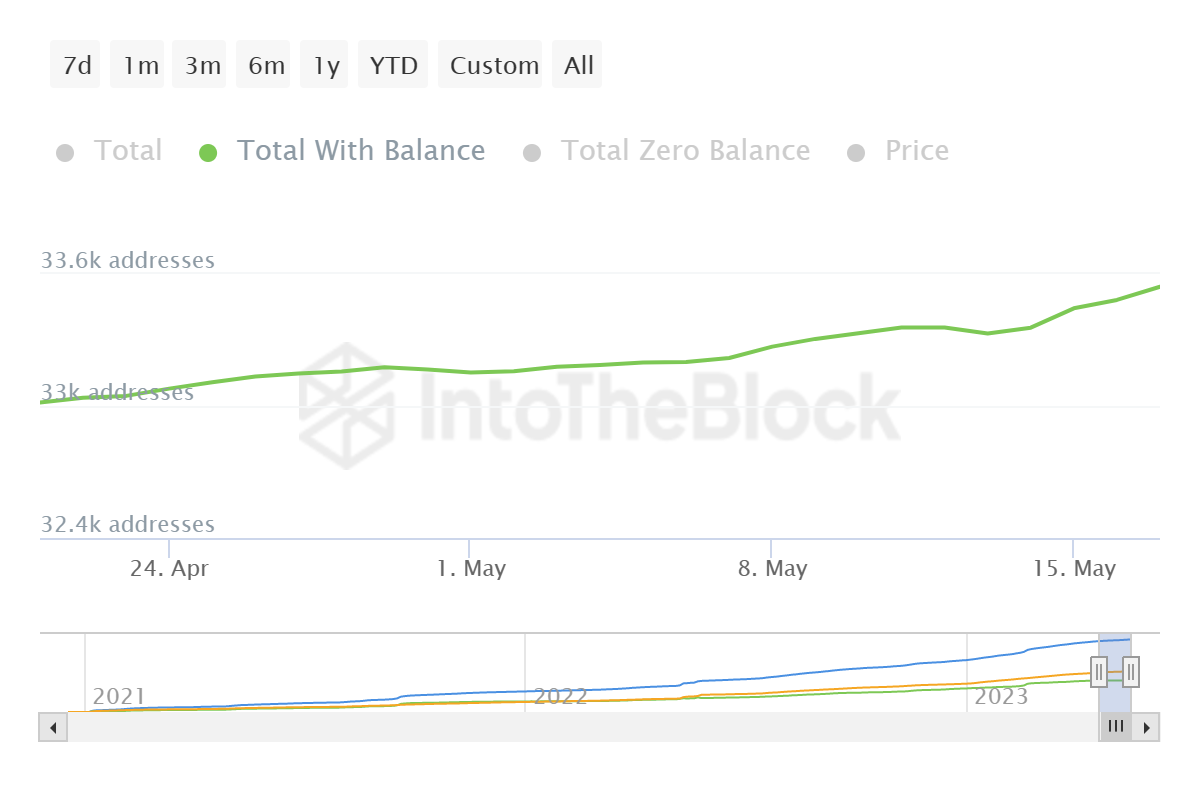

- The anticipation surrounding V2 triggered a rise in participation, effectively increasing the rate of new address formation by over 200% week-on-week.

- This also marked an uptick in the velocity, suggesting tokens are changing addresses which is generally a strong network growth indicator.

Bullishness from investors will likely counter any bearishness in price, preventing a steep drop.

Lido DAO price has been observing immense growth in the last few days owing to network development which spurred demand among investors. But even as the altcoin begins suggesting a potential drawdown, investors do not have much to worry about as they hold the key to preventing a decline.

Lido DAO price notes a dip

Lido DAO price, trading at $2.13 at the time of writing, fell by nearly 9% in the last few hours. The sudden red candlestick came after the altcoin registered a more than 43% rally over the last four days. Corrections were anticipated as the market would need to cool down at some point.

Usually, such a decline occurs after the token has been oversold and the market has been overheated, but in the case of LDO, the fall came earlier.

LDO/USD 1-day chart

Anyhow, investors who are planning on dumping their supply for profits before the cryptocurrency declines further would be better off not doing that. HODLing is the right choice for now since the V2 bullishness has not dissipated yet.

The anticipation surrounding the launch of V2 was the reason behind the rally, and it also triggered interest from investors. As a result, following the launch, the network began observing higher participation and also attracted investors in a much larger quantity.

On average Lido DAO network has been observed to add about 60 new addresses, whereas, in just the last four days, over 200 new addresses have been formed. This is a 230% week-on-week increase, bringing the total addresses to 33,540.

Lido DAO total addresses

But it's not just the addition of LDO holders but also their increased participation that suggests that investors are not done with the Lido DAO token yet. The active addresses, which have been rising since the beginning of the month, are still at a monthly high of 510.

Furthermore, at the time of writing, the velocity also stands at a 30-day high. The indicator depicts the rate at which a token changes addresses, and a high velocity suggests the network growth is rather strong.

Lido DAO velocity

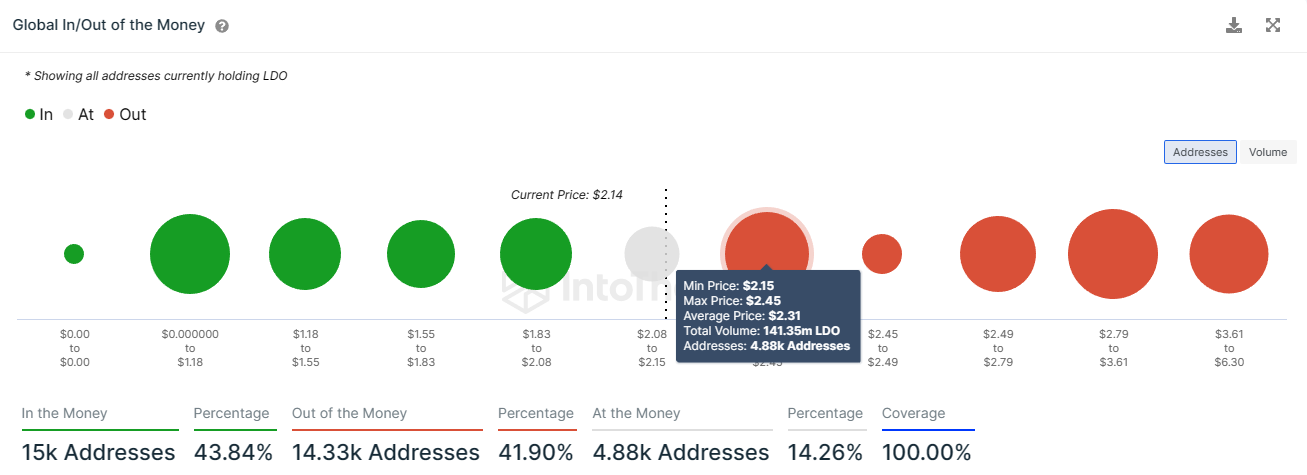

This means that LDO holders are active in conducting transactions on the network which will keep Lido DAO price from noting a steep drop-off anytime soon. The observed slowdown would serve as a momentary break to keep the market from overheating before the altcoin begins climbing back up. The next target for the cryptocurrency is $2.31, which is the average price at which nearly 141 million LDO tokens were purchased by 4,800 investors.

Lido DAO GIOM

Once this demand wall is breached and this supply worth over $280 million becomes profitable, some profit-taking could be observed; until then, investors will refrain from selling to support Lido DAO price to rise to $2.31.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Axiom’s volume surpasses $100M as meme trading platform war escalates on Solana

Axiom meme coin trading volume hit $101 million for the first time, surpassing other platforms on Solana. Axiom accounts for 30% of the ecosystem’s trading users, followed by Photon and Bullx at 24% each.

Bitcoin aiming for $95,000 as Global M2 money supply surges

Bitcoin (BTC) price edges higher and trades slightly above $85,500 at the time of writing on Tuesday after recovering nearly 7% the previous week. The rising Global M2 money supply could be a favorable signal for both Gold and Bitcoin.

Top 3 gainers Brett, Story and Virtuals Protocol sparkle as Bitcoin eyes $90,000

Cryptocurrencies have sustained a buoyant outlook since last week as US President Donald Trump’s tariff war was paused for 90 days, except for China, propping global markets for lifeline relief rallies.

Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[00.21.25,%2019%20May,%202023]-638200379131033162.png)