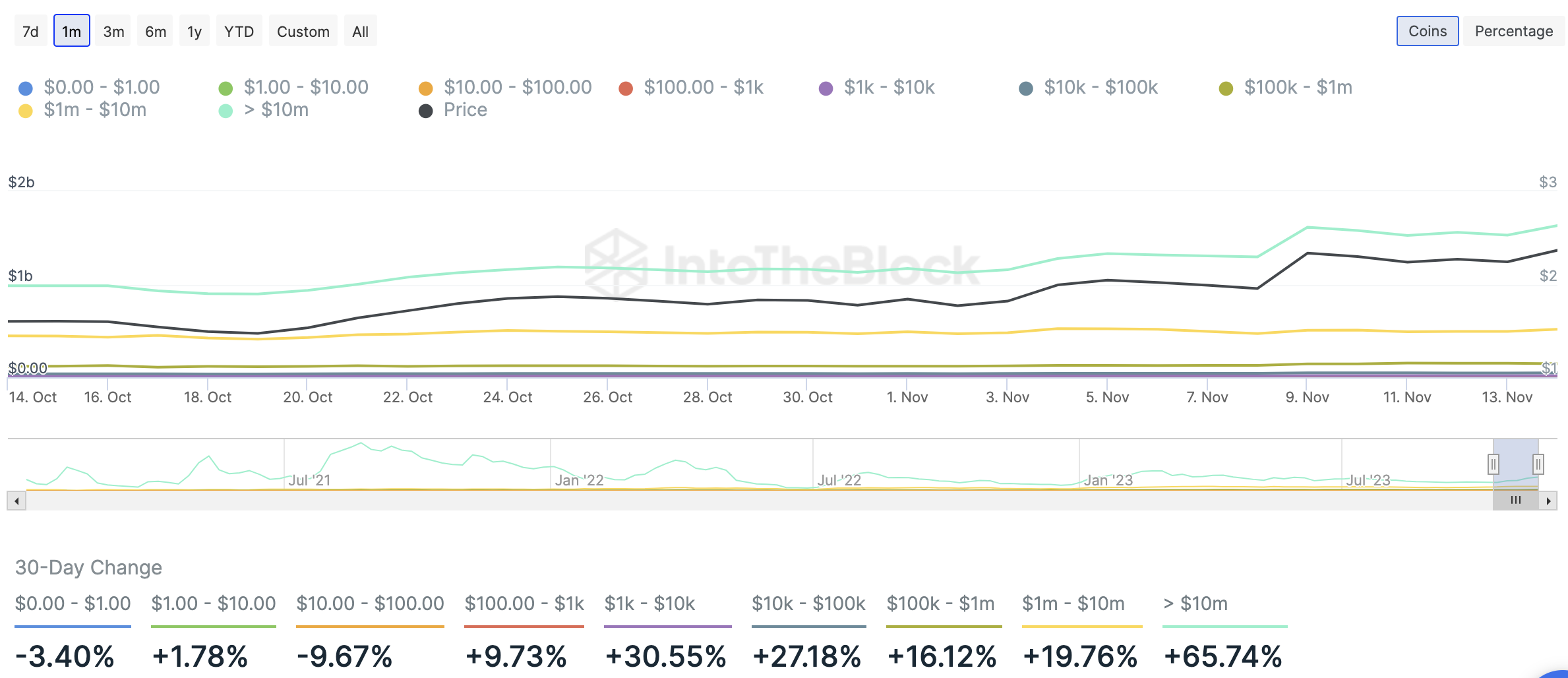

- Lido wallet addresses with LDO tokens worth $10 million and higher have increased by 65.74% in the past month.

- The rising count of whales is accompanied by declining selling pressure on the asset – ideal for LDO price to extend its gains.

- LDO price yielded 22% gains for holders over the past week.

Lido DAO’s governance token LDO noted accumulation by large wallet investors over the past month. LDO price rallied 51% in 30 days, yielding massive gains to the token’s holders. Two bullish catalysts, the declining supply of LDO tokens on exchanges and the rising count of whales, could drive Lido DAO’s price even higher.

Also read: Polygon powers Layer 2 network, aims to connect 50 million users to Ethereum

These bullish catalysts support LDO price gains

Based on data from crypto intelligence tracker, the governance token’s recent gains are likely here to stay. The supply of LDO on exchanges plummeted from 7% of the token’s total supply on October 8 to 5.52% on November 15.

Another on-chain metric that adds credence to the bullish thesis is exchange netflow. There has been a consistent outflow of LDO tokens from exchange platforms, supporting the asset’s price gains.

LDO Supply on Exchanges and Exchange Flow Balance

The token’s Active Addresses (over 24hrs), Volume and Network Growth imply LDO price gains are sustainable. Alongside LDO price rally, active addresses and volume increased, supporting LDO’s gains and signaling a rise in LDO token holders’ activity.

Active Addresses 24hr, Volume and price

Network Growth and price

A key metric that measures addresses with large LDO balances is supportive of the bullish thesis. In the past 30 days, LDO addresses with tokens equivalent to $1 million to $10 million and higher, climbed by 19.76% and 65.74% respectively. A rising count of large wallet addresses is typically a bullish sign for an asset.

LDO addresses by USD balance and price

At the time of writing, LDO price is $2.459. Lido DAO’s governance token is likely to extend its gains in the short-term, supported by bullish on-chain metrics.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP chart signals 27% jump after SEC-Ripple appeals pause and $50 million settlement

Ripple (XRP) stabilized above $2.00 exemplifying a similar pattern to the largest cryptocurrency by market capitalization, Bitcoin (BTC), which holds firmly above $84,000 at the time of writing on Thursday.

Bitwise lists four crypto ETPs on London Stock Exchange

Bitwise announced on Wednesday that it had listed four of its Germany-issued crypto Exchange-Traded products (ETPs) on the London Stock Exchange. It aims to expand access to its products for Bitcoin (BTC) and Ethereum (ETH) investors and widen its footprint across European markets.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[12.03.51,%2015%20Nov,%202023]-638356318420858695.png)

%20[12.05.00,%2015%20Nov,%202023]-638356318698605780.png)

%20[12.05.06,%2015%20Nov,%202023]-638356318971744087.png)