Lido DAO Price Prediction: LDO could fall 20% with the weekly supply zone holding as resistance

- Lido DAO price is trading horizontally, with bulls taking a breather after a 120% surge since September

- LDO could fall 20% to $2.638 giving bull a chance to regroup before the next leg up.

- The bearish thesis will be invalidated upon a weekly candlestick close above $3.500.

Lido DAO (LDO) price is trading with a bullish bias, boasting a series of higher highs and higher lows since October 2023. However, amid a choppy altcoin market, LDO could face a correction soon.

Also Read: Lido price sustains above $3 despite massive surge in profit-taking by LDO traders

Lido DAO likely to suffer a 20% correction

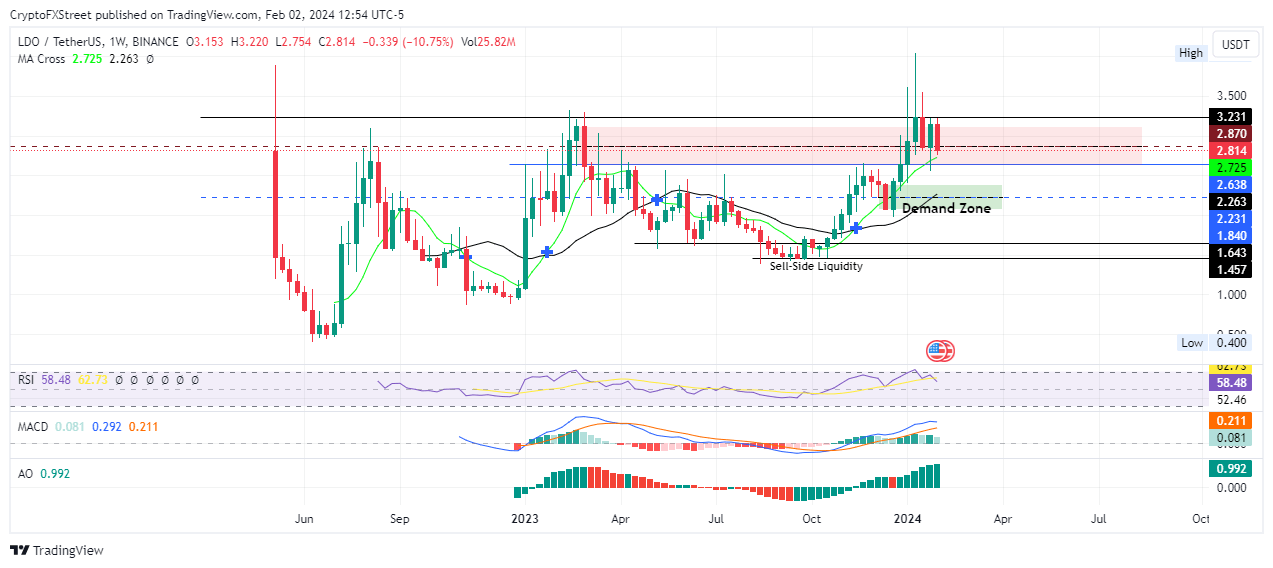

Lido DAO (LDO) price climbed 120% since October before a rejection from the $3.231 blockade. LDO is trading within a weekly supply zone, extending from $2.638 to $3.120.

With this order block holding as resistance, the staking token could fall 20% to find initial support at the midline (mean threshold) of the demand zone between $2.062 and $2.395, at $2.231. A candlestick close below $2.231 on the weekly timeframe would confirm the continuation of the downtrend.

The Relative Strength Index (RSI) is nose-diving, which points to falling momentum. This is after a bearish crossover on January 22 when it crossed below its signal line on the weekly timeframe.

Similarly, the histogram bars of the Moving Average Convergence Divergence (MACD) are losing the green feel, paling out to show the bulls giving out in favor of the bears.

LDO/USDT 1-week chart

On the flipside, a reentry by the bulls could see Lido DAO price push north, overcoming the supply zone and making it a bullish breaker. This move would be confirmed by a flip of the $3.231 barricade into a support floor.

Such a move would set the tone for LDO price to extend the climb to the $3.500 level, beyond which the bearish thesis would be invalidated.

In a highly bullish case, Lido DAO price could reclaim the range high at $4.038, last tested on Januar8. Such a move would constitute a 45% climb above current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.