Lido DAO Price Prediction: LDO consolidation eyes retest of $4.56

- Lido DAO price is in a rangebound play between $2.55 and $4.04.

- After clearing weekly hurdles, LDO looks poised for an explosive rally to retest the range high at $4.04.

- In some cases, the altcoin could extend above $4.50 and form a local top there.

- A twelve-hour candlestick close below $2.93 will invalidate the bullish thesis.

Lido DAO (LDO) price has been trading sideways between the $2.55 and $4.04 range. But the recent bounce suggests LDO could be ready for a move to the upside.

Read more: UNI price jumps more than 50% after new Uniswap governance proposal update

Lido DAO price fundamentals likely to improve

The recent developments surrounding Uniswap’s fee switch proposal have stirred the crypto market sentiments. With fees being distributed to the holders of the underlying platform’s tokens, many investors are speculating if more decentralized exchanges (DEX) and automated market makers (AMM) will follow suit.

Many assume that if Lido DAO does a similar move, it could send LDO price shooting like a star, especially considering the size of LDO’s users.

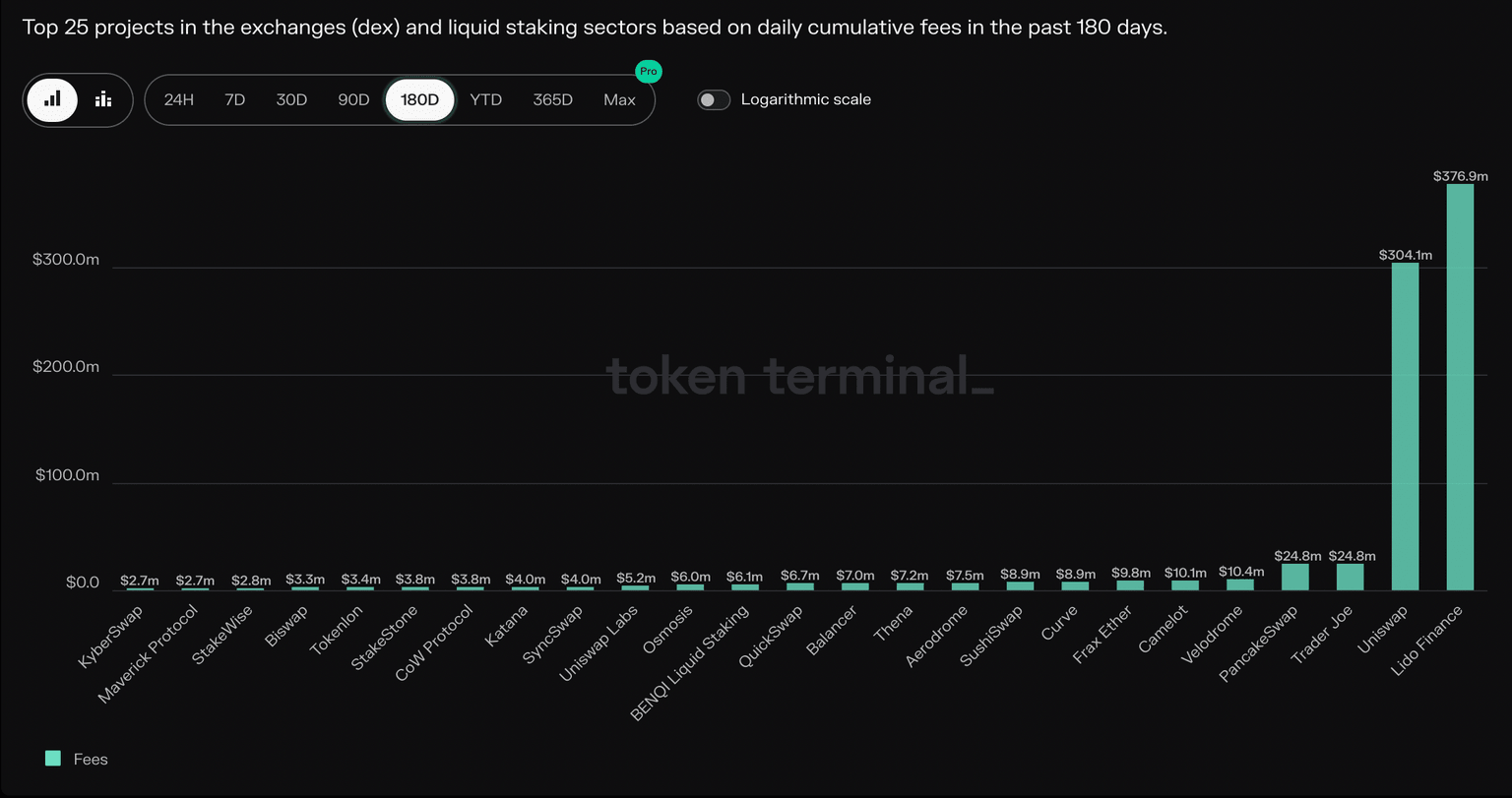

According to Token Terminal, the fees collected by Lido DAO platform in the last six months stands at $376 million, which is higher than Uniswap’s $304 million.

Uniswap vs. LDO Fees

With such strong fundamentals, it would be surprising if Lido DAO turned on the fee switch and the LDO price did not pump.

Also read: Ethereum price teases with a breakout, eyes $3,200 milestone as ETH bulls show resolve

LDO price eyes volatile move

Lido DAO price has reclaimed $3.29, which is the midpoint of the $2.55 to $4.04 range. In doing so, the Relative Strength Index (RSI) has flipped above the 50 mean level, suggesting a potential start to the bullish trend. The same can be seen with the Awesome Oscillator (AO), which has flipped the zero trend line, indicating a comeback of bullish momentum.

If Lido DAO puts a fee switch proposal forward or directly implements it, LDO price could rally 20% and tag the range high at $4.04. Based on the trend-based Fibonacci extension tool for the most recent trend between February 4 and February 23, the 161.8% level at $4.30 seems to be the target. Beyond this level, if buying pressure continues to pile up, the LDO price could retest the next target at $4.63, which is the 200% extension level.

Using the trend-based Fibonacci level for the larger trend between December 18, 2023, and January 23, 2024, reveals the $4.62 level as the next target. Since this level coincides with both the larger and smaller trends, investors can expect the potential fee switch scenario to propel LDO to $4.62.

LDO/USDT 12-hour chart

While the outlook for Lido DAO price from a technical perspective makes logical sense, investors need to be cautious of a potential Bitcoin price sell-off. This development could catch many investors off guard. In such a case, altcoins, including LDO, could slide lower.

A twelve-hour candlestick close below $2.93 will invalidate the bullish thesis for Lido DAO price by producing a lower low. If this development continues, LDO could crash 12% and revisit the range low at $2.55.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.